In the years ahead, the banking sector is waiting for a growing fintech impact on the banking industry. "Uberization" may reduce the number of staff in the industry to 50%. Profitability in some areas of banking services will fall to more than 60%. It was stated by the former head of one of the largest banks in the UK, Barclays Anthony Jenkins,...

“Ignoring technological change in a financial system based upon technology is like a mouse starving to death because someone moved their cheese.” – Chris Skinner, fintech expert and author of Digital Bank and its sequel, ValueWeb.

It’s no secret that fintech is a pioneer in adopting innovative technologies. While artificial intelligence is something alien for many industries, the market for AI in fintech is expected to grow at a 23.17 percent compound annual growth rate (CAGR) from 2020 to 2025 (Mordor Intelligence).

Also, let’s not forget that the COVID-19 pandemiс has had the strongest effect on fintech and its customers, who are now using mobile apps more actively. This is a golden opportunity for businesses to get more meaningful insights on users, improve their experience, and, as a result, strengthen their market position.

But the stereotype that only big enterprises can provide AI and machine learning (ML) solutions is still alive. We’re here to dispel the myths and shed some light on artificial intelligence in fintech.

Here you’ll find the latest market trends, use cases, benefits, and challenges of AI in fintech based on our insights and expertise.

How AI Impacts Fintech: Market Trends for 2021

Artificial intelligence is not just a fast fashion in the fintech world. On the contrary, this technology is here to stay. According to research conducted by the Cambridge Centre for Alternative Finance, 90 percent of fintech firms are already using AI in some form.

Artificial intelligence plays a crucial role right now, and it seems this role will become even more important shortly. The technology that has long been a subject for science fiction is now a working tool to cover business needs.

A report from Tribe contains an interview with the world’s leaders in the AI field, and one of them is Daragh Morrisey, director of AI for Microsoft Worldwide Financial Services. Here are the key takeaways from this interview that portray the niche of AI and ML in fintech:

- The real pain point of all financial companies, including fintechs, is compliance regulation. Financial services providers should act with regulations in mind — and not only existing ones but also considering what’s coming ahead.

- It’s not the right time to experiment with AI innovation. Rather, companies should focus on what they need right now and start the execution phase.

- The competition for the right AI specialists is high, and it’s becoming more severe. The thing is, artificial intelligence is far from what any developer can do. Someone has to define algorithms and train them — but it’s impossible without a solid background.

- Big fintech providers, more than smaller ones, are now dealing with legacy technology, which creates an awkward discrepancy between existing software and innovative technologies. However, AI development is still possible for such businesses if you build the infrastructure in the cloud.

- Interestingly, artificial intelligence can reflect human biases. If you think that technologies make solely objective decisions, you’ll probably be disappointed. Development teams should keep it in mind from the project start — addressing it later will create unnecessary challenges. (You’ll find the list of tools further in this article.)

- AI may seem new now, but it won’t be for long. Soon, AI-based fintech will become a common practice, so active AI implementation is the key. Those companies that make the most of it now will gain more advantages in the near term.

The Difference Between AI and Machine Learning for Fintech

“Artificial intelligence and machine learning” — how many times have you seen these two concepts used together or interchangeably in the text? Are they synonyms or similar terms? Yes and no.

Artificial intelligence is a broader term that has machine learning under its umbrella. It helps machines to imitate human-like behavior and, therefore, make intelligent decisions.

As the name suggests, machine learning provides machines with the ability to learn new information and patterns independently, without the developer’s guidance.

Also, you might have seen deep learning mentioned here and there. This concept is an ML subset based on artificial neural networks. It means it enables machines to structure information in a human-like way (for example, process visual data). Machine learning can work independently, but still, it’s a machine, while deep learning makes it more “humanish.” Deep learning in fintech is used for financial forecasting and modeling.

All three concepts can be used in fintech solutions depending on the goals you set for AI implementation.

AI in Fintech: The Main Benefits for the Industry

Now, let’s get into the reasons why more and more fintechs opt for artificial intelligence and machine learning. What’s in it for you and them? These benefits will give you an idea.

Read also: Is there any chance that AI will replace content creators?

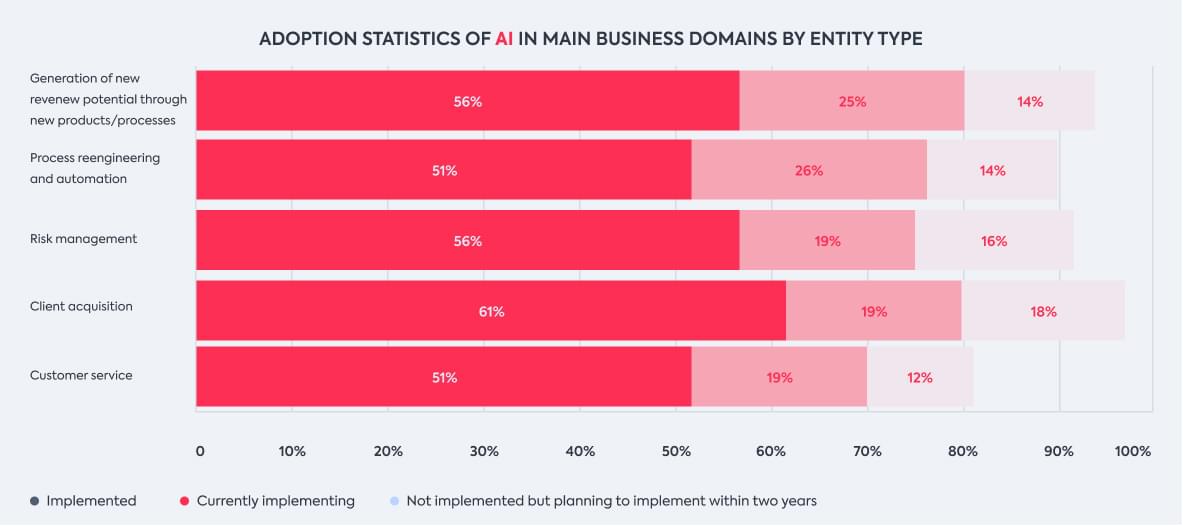

Before we start, here’s some statistical data on the main incentives for fintechs to use artificial intelligence, according to the Cambridge Centre for Alternative Finance. Spoiler alert: the customer is still king.

- Higher user engagement.AI solutions keep an eye on app users,answer their questions immediately (chatbots), or gather analytics on user preferences and behavior patterns. No company manager will know your clients better than a powerful AI engine. By knowing what people want, your business will always keep up with the competition.

- Optimized workload.AI solutions assist fintech employees with routine tasks such as answering typical questions, classifying clients,and monitoring transactions and emerging regulations. While technologies manage the smallest changes in the system and can react to them, you can use the human mind’s power for more creative tasks.

- Reduced user support cost.AI and machine learning in fintech are available 24/7 to answer people’s questions, and they become smarter with time by learning typical patterns and requests. It eliminates the risk of human error and saves on your user support spending over the long haul.

- Secure payments.Fintech and AI together ensure constant payment monitoring and user verification, covering numerous security gaps invisible to humans. Artificial intelligence is like a protective barrier that no one sees, but it’s always there.

- Data-driven decision-making.It’s no secret that every decision should be based on relevant data, just like we know how challenging it is to gather this data and not to miss a spot. AI peers into every shadowy corner to help you with that: it collects documentation, forms reports, and makes predictions. You get a forceful tool to build actionable business strategies.

- Attention to detail.With AI, you will always be aware of what’s going on in your organization. What can be overlooked by managers will never pass undetected by tech tools— this rule applies to any data management task.

How Is AI Used in Fintech? The Top 6 Use Cases

Even though artificial intelligence benefits for fintech do sound great, you might need some more clarification. How exactly do AI and ML work, and what use cases do they have in fintech? You’ll find it all here.

-

Chatbots as digital financial advisors

Yes, we don’t mean humans in this context. Chatbots are an extremely popular AI use case in numerous industries, and they can be implemented as user advisors in fintech.

The core of this use case is Natural Language Processing (NLP), one of the machine learning fields. It enables technologies to better understand and analyze natural (human) language. Such a feature allows users to “consult” a chatbot regarding financial services, plans, spending, and deposits.

Erica, in the Bank of America app, is one of the most successful chatbot examples. With access to the user’s balance and transactions, it offers transaction search and overview, bill reminders, and notifications about duplicate charges, and gives users hints on their financial health.

-

Credit history assessment

Another way to use machine learning in fintech is to allow it to assess credit history. It’s great if you can gather all the necessary information from documented sources, but what if you can’t? Often, people in developing countries don’t have a previous credit history, and banks have to explore advanced tools for this issue.

The best way to approach it is to use NLP and text mining (a way to transform unstructured data into structured data to identify meaningful content). This combination of tools fetches data from the client’s digital footprint (like browsing history or social media presence) and builds up a credit history with no human involvement.

-

Risk score profiling

Categorizing clients based on their risk score is a vital part of the manager’s routine. Or not. From now on, this task can be passed to AI algorithms.

Using Artificial Neural Networks (ANNs), developers can train technologies on the user’s historical data and then classify their profile from low to high risk level. Above that, technologies also can provide clients with service recommendations based on their risk score.

-

Financial trends prediction

What business owner doesn’t want to know the future? ML-based predictive analytics is another cross-industry instrument that works way better than a crystal ball. It gathers and processes vast amounts of data to make insightful predictions about market trends and client behavior.

Predictive analytics processes not only structured data sets but also identifies changes in common patterns. It is by far the most workable solution for marketers to develop efficient marketing strategies and assess upcoming risks.

-

RegTech

This innovation appeared not so long ago (in 2008) but has already become a separate niche. Even though now RegTech is used by companies from various domains, it originated in the financial sector.

RegTech (Regulatory Technology) is a way to manage regulatory compliance with the help of AI algorithms. It is a complex term that includes client identification, transaction monitoring, regulatory analysis, and reporting.

This solution covers two of fintech essential needs at the same time: regulatory compliance and fraud detection. As technologies are on duty day and night, they can create the safest environment for every business and its clients.

-

Algorithmic trading

Fast data-driven decisions — this is what trading is all about. And no other solution can analyze data better than machine learning technology. Can we consider it as a small revolution in trading? Probably, yes.

Algorithmic trading is an ML-based trading method that assists decision-making on the financial market. Technologies spot patterns that can pass unnoticed by human eyes; they react instantly and manage trading automatically. This process takes way more time and effort from human traders.

For the system to function properly, it requires as much market data as possible, which is not a problem for financial organizations. Algorithmic trading becomes essential if a trader operates in a market with rapid price changes.

Should You Use AI for Your Fintech Project?

Artificial intelligence and machine learning are beneficial for the fintech domain, but it doesn’t mean that your business needs it right this minute. Ask yourself these questions before making the final decision.

- Is there any specific problem you want to solve?AI vendors should know exactly why you need them and if they can help, so your goals should be well-defined.

- What AI use case are you most interested in?Pick one or two of the use cases we’ve already mentioned and explain to yourself why this solution can help you achieve the goal. It specifies your aspiration even better.

- Do you need a temporary or permanent solution?The work of artificial intelligence and machine learning never ends. Algorithms should be trained continuously, examining the growing amount of data in the organization. Consider this if you need something quick and temporary.

- Is there enough data for AI training?Don’t start now if your data is not fully prepared or you simply don’t have enough of it. AI is an engine that functions only with documentation fuel.

- Do you have enough resources to start? By this, we mean people and finance. What budget exactly do you have for tech innovation? Who of your employees will be responsible for smooth AI integration? Even if you outsource AI development, your organization should have a tech-savvy mediator for negotiations.

- Does AI implementation coincide with the overall business strategy?Artificial intelligence doesn’t exist in a vacuum— it is an essential part of other business processes. Stakeholders and employees from all departments should be well aware of that and ready for change.

- How exactly will workers be affected?List all the departments and define employees that will be most and least affected by the innovation. What exactlywill they do, how will it impact their daily tasks, and who of them will need additional training?

- How will you measure the project’s success?You should know if the AI trend has a positive effect on your business. Innovation itself doesn’t mean a thing— it should exist in conjunction with your business and marketing metrics.

If you’re not ready to answer at least one of these questions, slow down a little. You can consult with other decision-makers or learn the data infrastructure of your business more deeply. Don’t guess at answering these questions — look to the facts for guidance.

Challenges of Integrating Artificial Intelligence in Fintech

Of course, it’s not all sunshine and roses — combining artificial intelligence and fintech imposes challenges as well. Consider these points before AI integration starts.

-

Poor data quality

When we say that data is important for AI solutions, we don’t mean just any data you have — only quality data sets play a crucial role. Here, we stumble upon huge piles of uncleaned and unstructured data.

Read also: AI in mobile app development: What features to consider

Remember that fintech and machine learning work the best when documentation follows a certain order. It should be stored in spreadsheets or databases for the maximum positive impact, so getting into unstructured data management right now is the best way to overcome this challenge.

-

AI bias

Not only humans do it — even technology makes decisions based on bias. That can be very painful for your customer who, for example, is turned down for a loan for no objective reason. To avoid this issue, companies should detect bias before they do any harm, using special AI frameworks and toolkits and providing policies.

Examples of instruments you need to remove AI bias:

-

Need for human-to-human interaction

No matter how cool ML and AI are in coping with business tasks, they can’t replace heartwarming human interaction. Chatbots do provide insights and improve personalization, but there is a point when people take their place in communication.

You should decide what you need chatbots for, and accurately delineate AI and human tasks. Only a smart combination of both will have the biggest influence on the company.

CHI Software Experience with ML and AI in Fintech

AI capabilities in fintech are versatile and often depend on specific organizational needs. We at CHI Software developed an AI-based fintech app with a unique set of features. The product’s target audience includes two segments: kids and their parents. That’s how it works.

Our client: A company focused on the innovative approach to a daily financial routine. It is the first provider in the Middle East that started to facilitate digital financial operations.

Business needs: To develop a payment solution for school students. It needed to provide cash-free payments at the school canteen, considering the student’s individual diet.

Solution: Our team developed an app with Face ID integration tied up with a wide range of banks and financial institutions. AI features allow for an individual approach to every user.

Read also: CHI Software has been recognized as one of Top 30 Artificial Intelligence Agencies by DesignRush

App characteristics also include:

- Access to the balance with face ID,

- Integration with school POS systems,

- Integration with the government credit line in case of insufficient funds,

- Several payment options,

- Diet and nutrition database for every user, and

- Storage of the user’s allergy records.

How it works in practice: students open the app to pay for the food with Face ID, and they won’t be able to buy items that don’t match their nutrition restrictions.

Result: We’ve developed an AI-based fintech app with a healthcare element. It allows parents to control their child’s diet, while students enjoy cash-free payments at school. Later on, the app was supplemented by a cashback feature.

Our advice on how to maximize AI benefits for your fintech business in the deployment stage

We’ve made a list of practices to maximize business benefits while working with AI-based solutions, particularly in fintech. They include the following:

- Documented data architecture determines your data quality and how it will be stored and collected. It’s a strategic document that defines a big portion of the project’s workflow and infrastructure.

- Well-developed app infrastructure that includes all vital components to guarantee smooth app development, deployment, and management. In the case of AI, this infrastructure must ensure the app’s scalability and security with the growing amount of data.

- MLOps (a new term from 2018) is a combination of DevOps practices to provide successful ML deployment. When an algorithm is prepared by ML developers, they collaborate with data scientists and DevOps engineers to prepare the algorithm for usage.

- Smart hybrid cloud strategy is important, as many financial companies store data in cloud and on-premises infrastructures at the same time. DevOps engineers should ensure easy app deployment, regardless of its location (in the cloud or on a local server).

Conclusion

In today’s day and age, information is a valuable business asset. The more you know about your company, the better you can predict its future. AI and ML in fintech make it possible:

- Fintech executives consider AI as the most impactful technology in the long run.

- AI and ML benefits for fintech include both internal workflow optimization and external communication with clients.

- The most popular use cases of AI in fintech are client verification, regulatory compliance, trends predictions, and algorithmic trading.

- The AI boom doesn’t mean you have to go for it right away. Rather, you should ask yourself several questions to decide if your company is ready.

- No matter what, you should focus on high-quality data for a successful AI integration.

- Deployment on the AI projects is as crucial as the development itself and has its peculiarities (for example, MLOps).

Polina is a curious writer who strongly believes in the power of quality content. She loves telling stories about trending innovations and making them understandable for the reader. Her favorite subjects include AI, AR, VR, IoT, design, and management.