Project background

For one of our recent software development projects, the client started out knowing that they had a winning idea: their experience in finance had shown them that offering comprehensive financial planning would help customers achieve economic security and independence. The challenge was that many users still saw the process as too difficult, boring, or inaccessible. Existing fintech solutions at the time also lacked essential features. Our client needed just the right tech solution that would bring their idea to life.

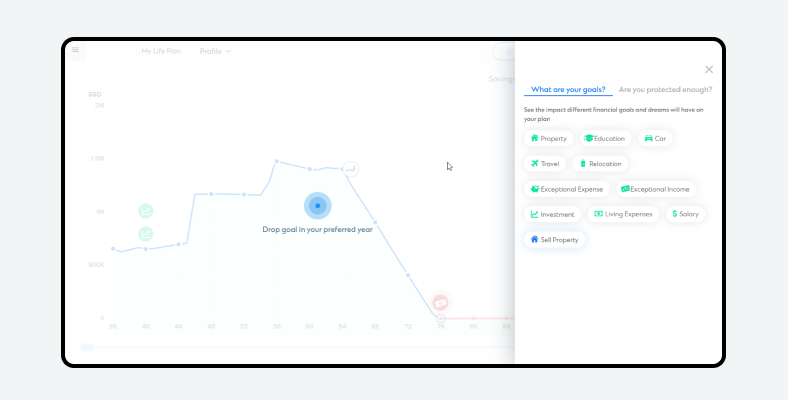

The goal was to develop a financial planning platform people would enjoy using because it’s easy, interactive, and fun. It needed to show customers everything they should know about the prospects of their household’s financial well-being, taking into account costly life plans and “what if” scenarios.

To bring this ambitious project to life while solving a number of technical challenges along the way, the company decided to hire the CHI Software team. Our experts partnered with them throughout the active development stage, helped to release the project, and continued assisting with maintenance for years after the product launched.

- Duration: 6 years

- Location: Singapore

- Industry: Fintech

- Services:

- Full-stack web development, including backend APIs, database scripts and front-end development

Business needs

01

High User Engagement:The primary goal was to create financial planning software that people actually wanted to use, making a positive impact on their lives. This would also make the platform attractive for financial institutions and advisers aiming to boost client engagement.

02

Customer Satisfaction:The simple-to-use, interactive, visual-driven solution offering extensive insights about the users’ financial status and prospects would provide the benefits of financial planning without the usual headaches, making customers happy and increasing sales.

03

Scalability:Our client needed their fintech solution to smoothly scale up, as they expected the number of users to grow quickly. They also planned to offer this tool to banks, insurance companies, and other financial institutions – for whom scalability is crucial.

04

Top-Notch Security:Security was absolutely the top priority of the project, as it would deal with highly sensitive data concerning clients’ personal and financial details. That meant the most stringent security measures would be needed to make sure all data would be properly protected.

05

Competitive Advantage:Our client wanted to create a one-of-a-kind fintech solution that offered unique benefits such as enhanced interactiveness, visualization, and an all-encompassing approach to financial planning, with the aim of becoming a leader in their market.

Product features

– Graphical representation of the users’ financial status for each year of their life expectancy, based on advanced data analytics.

– Assessing diverse financial parameters, such as savings, net wealth, and cash flow, to show the complete picture.

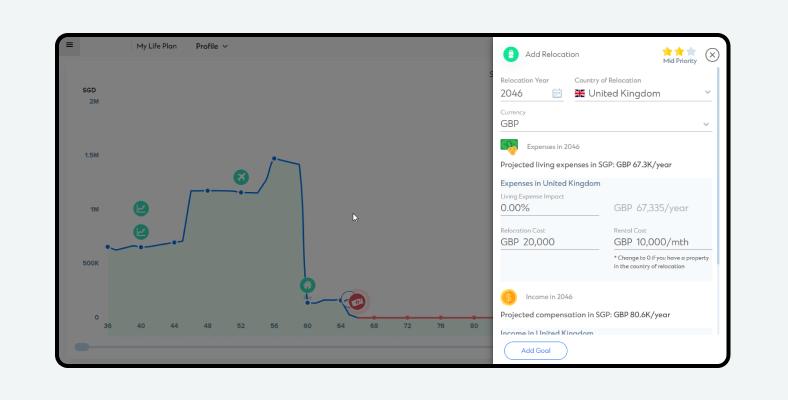

– Ability to add future goals like property purchases, education, or planning a trip or relocating abroad to the user’s financial plan.

– Financial analysis for the whole household, including family members such as children and spouses.

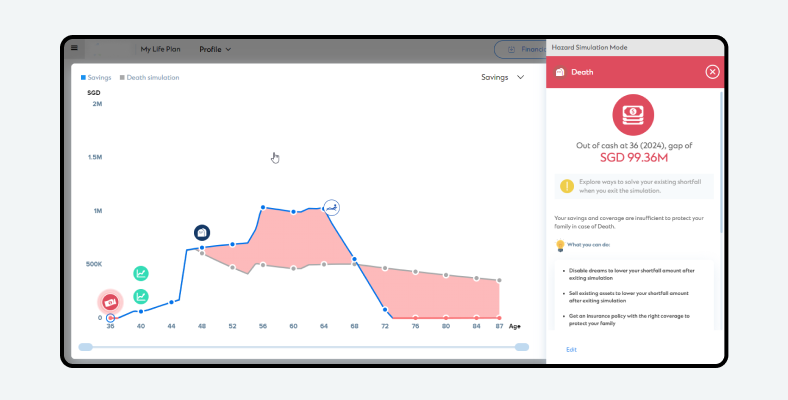

– Feature to add sudden adversities, like unemployment, illness, or death, so users can plan to mitigate their financial upsets.

– A simple drag-and-drop approach to adding events to the financial planning platform’s graphs for maximum user convenience.

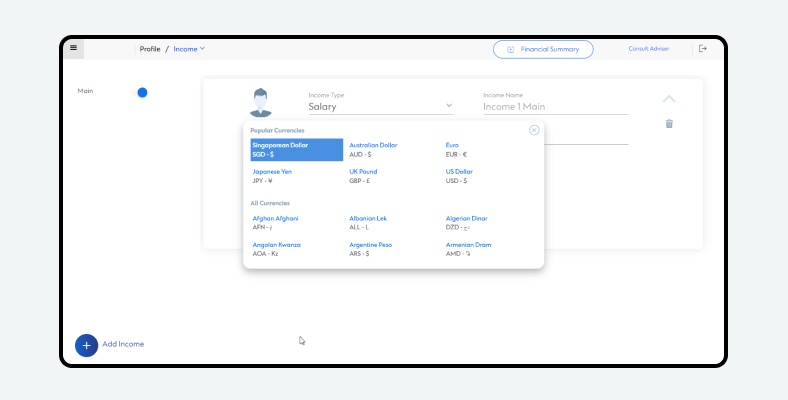

– Multi-currency support, letting users choose the main currency for the account and dedicated ones for different items.

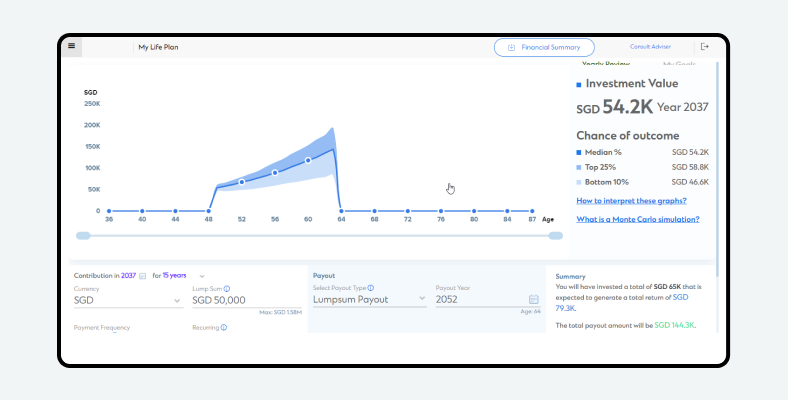

– Simulated investment scenarios that show users what they can expect from projected values and payouts.

– Recommendations for users on ways to improve their economic situation through personalized financial product offerings.