These days, it’s hard to imagine someone collecting their receipts to control daily spending. Saving money is an investment into a better future, but who wants to make much effort? Money-saving apps can balance it out.

Mobile solutions are always at hand to help manage spending and illustrate it with graphs and reports. On the one hand, it’s a no-brainer for users; on the other, it’s an attractive niche for business investments. COVID-19 made the market of finance apps flourish, with 4.6 billion app downloads and 16.3 billion in-app hours in 2020. It looks like apps for personal finance have become a customer habit.

It’s probably the best timing to develop your own money-saving app. And while you’re considering options, we’ll share what we know on this subject.

Market insights, general information, basic features, tech stack, and more — this article uncovers money-saving app development piece by piece.

Brief Overview of the Money-Saving App Market

The COVID-19 pandemic has shaken and transformed the whole digital world, and finance apps are a part of it. The pandemic also affected millions of people who had to stay at home and change their spending habits because of the crisis. Indeed, the year 2020 was a game-changer in many aspects.

Read also: Software industry trends in 2022

Read more

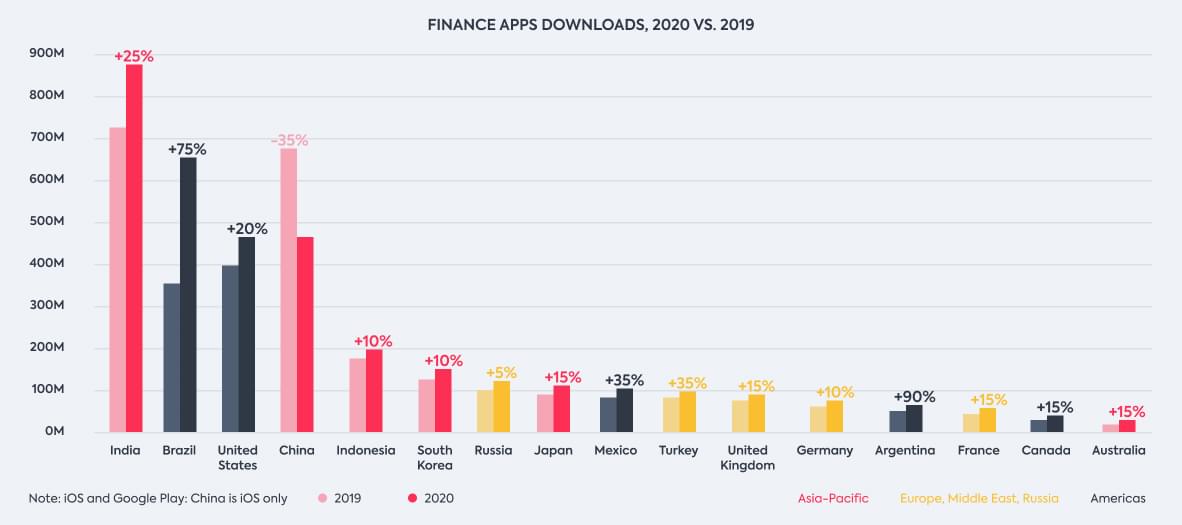

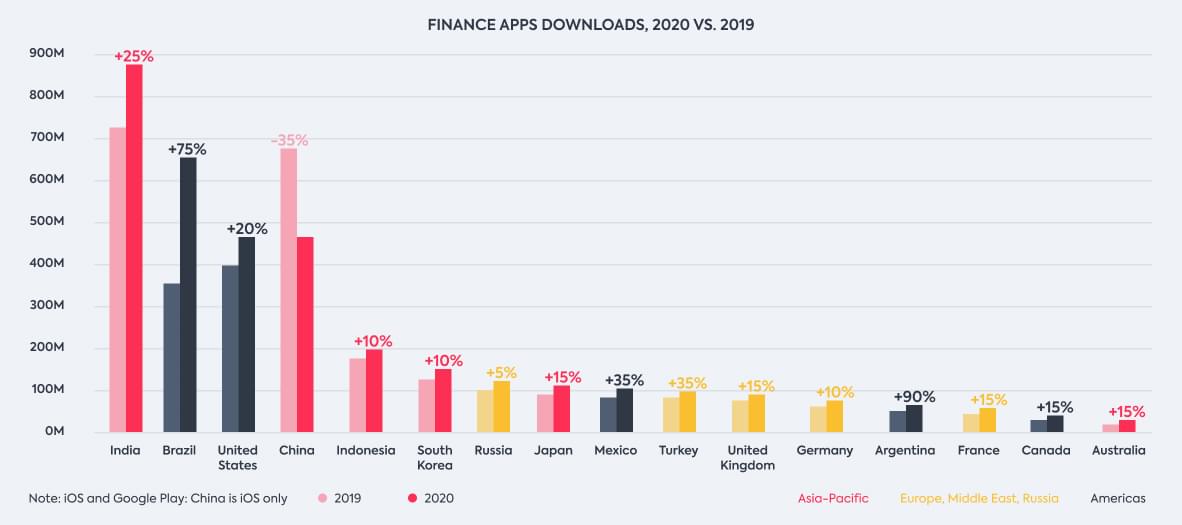

A lot of economies, except China, eventually saw the growth of finance app downloads. The number was the highest in India, reaching almost 900 million downloads — a 25 percent increase compared to 2019. The U.S. had a 20 percent increase, approaching the number of 500 million downloads a year.

Source: App Annie & Liftoff

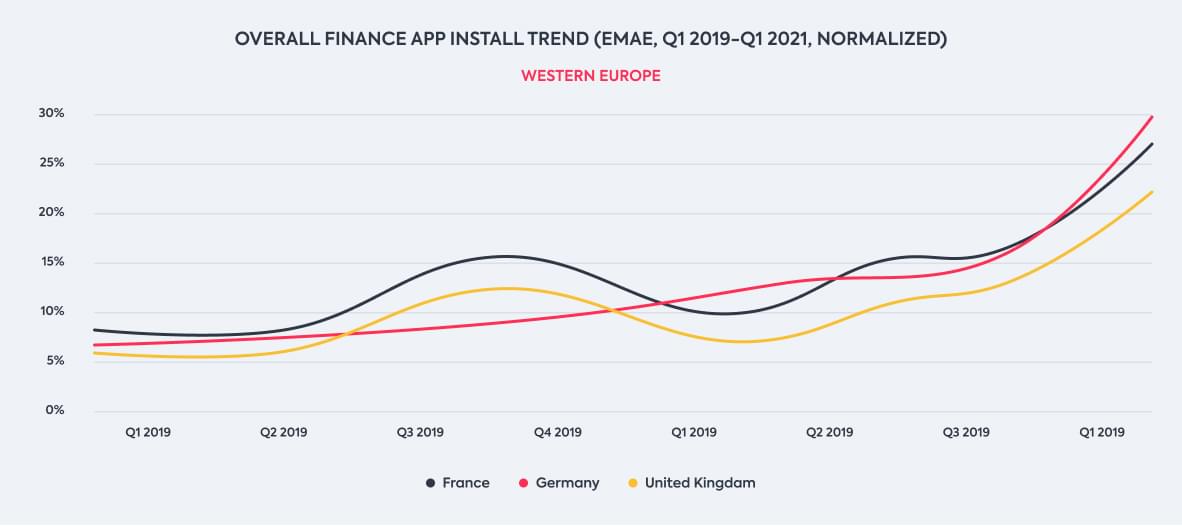

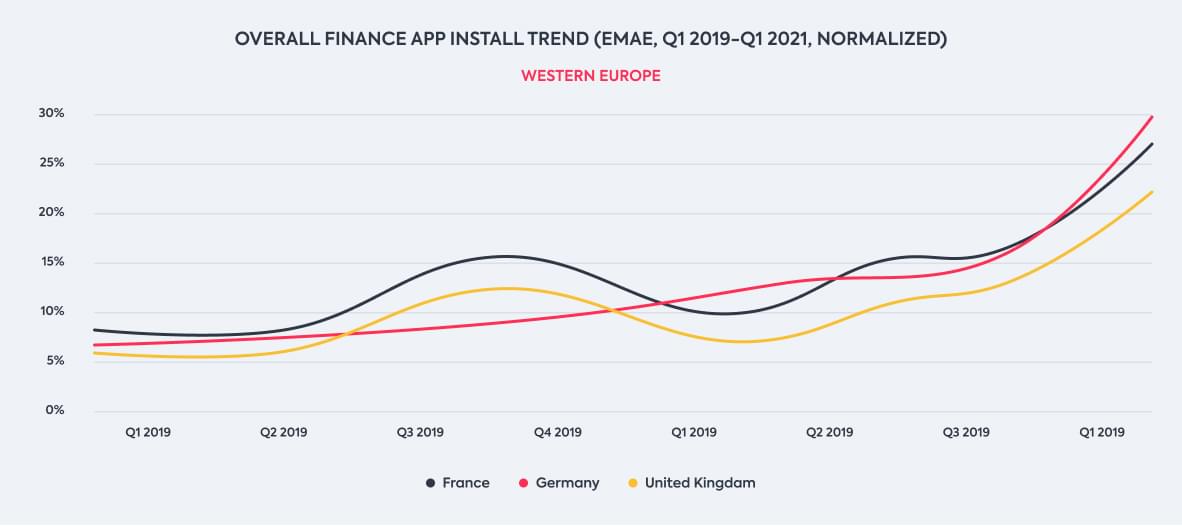

How about something more impressive? The average demand for finance apps in Western Europe grew by 85 percent between the first quarters of 2020 and 2021. Even more impressive, in Germany, it grew by 161 percent, and in the UK, by 129 percent. It seems that COVID-19 has had a long-lasting effect on customer preferences.

Source: AppsFlyer

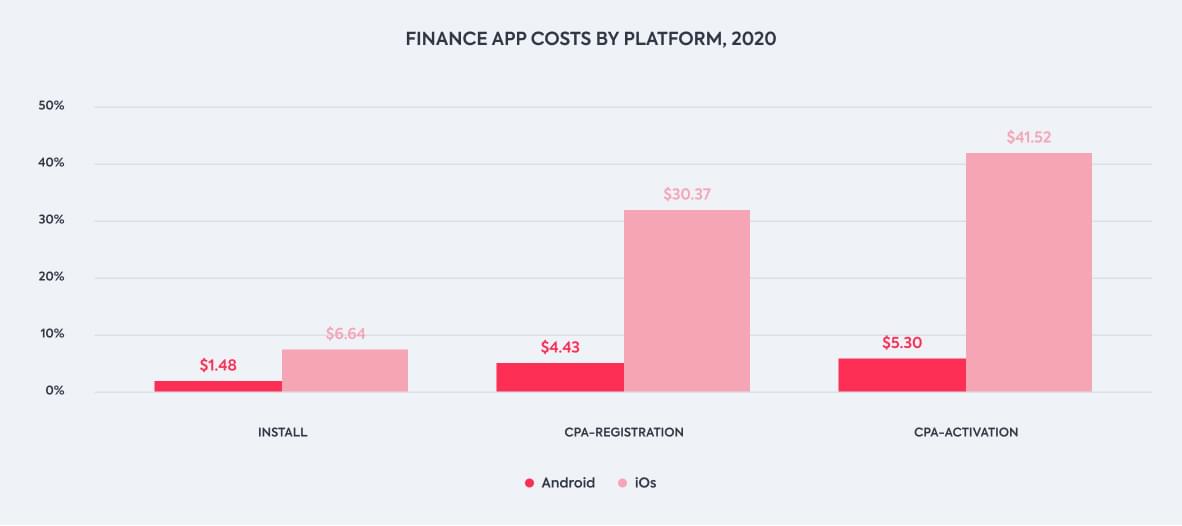

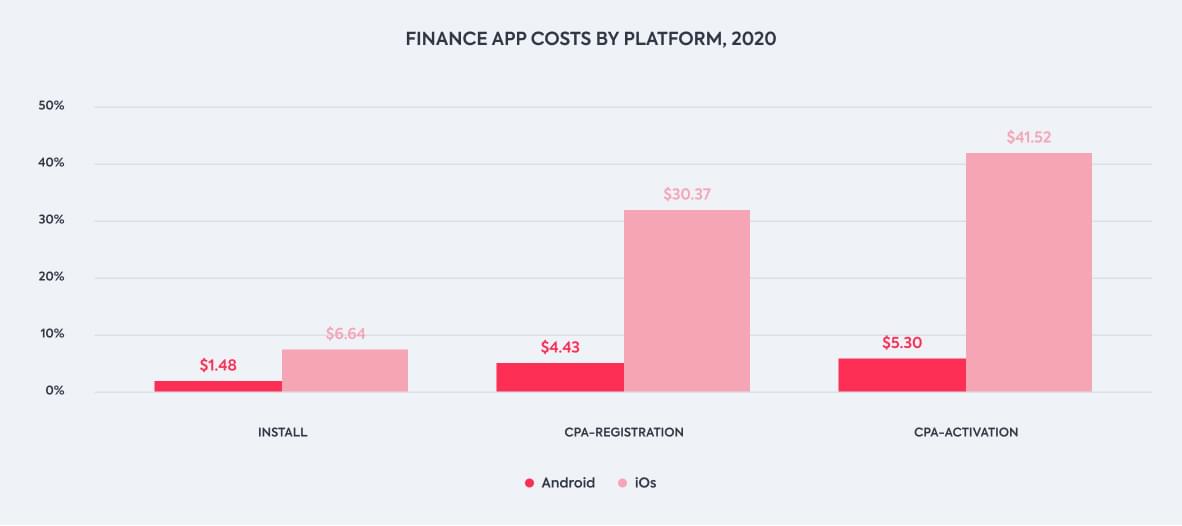

Interestingly, marketing promotion of finance apps for iPhone is way more expensive than for Android phones. And this difference rises depending on the user journey stage. For installation, iOS CPA is 4.5 times higher, while for activation, it’s almost 8 times higher. Thus, startups might decide to make a saving app for Android first.

Source: App Annie & Liftoff

These trends are not likely to change anytime soon. All kinds of financial activities (including money-saving) will retain their popularity in both developed and developing markets. And while it’s happening, finance apps are a real business opportunity.

Examples of Successful Apps for Saving Money

We’ve seen the numbers — now let’s look at the products. These solutions are somewhat similar, but each has a twist.

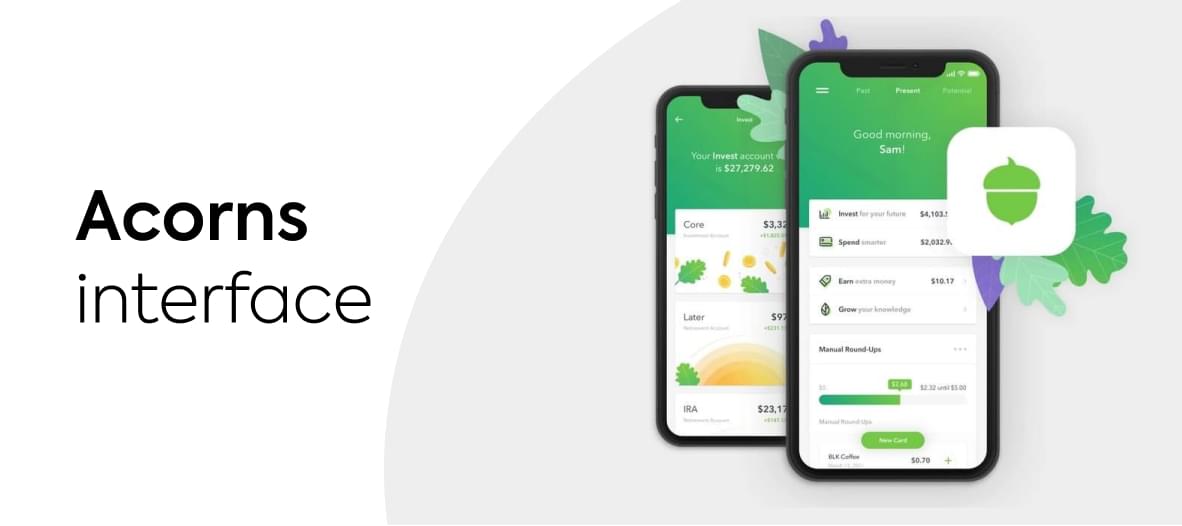

Acorns

- Available for iOS and Android

- Price: $3 monthly (personal plan) and $5 monthly (family plan)

This app allows users to save money effortlessly. For example, a person has to pay $5.50 for coffee. The app withdraws $6 from the linked credit or debit card, and the change will be sent to the user’s investment account. Acorns also offers a list of investment portfolio options as a bonus (e.g., saving for kids or retirement).

Digit

- Available for iOS and Android

- Price: $5 monthly with a free 30-day trial

This app is similar to Acorns but smarter. It helps users to save a spare dollar by analyzing trends of income and spending and coming up with a saving sum. Based on 2020 statistics, an average user can save up to $2500 per year with Digit.

PocketGuard

- Available for iOS and Android

- Price: Free, with in-app purchases

In a nutshell, PocketGuard allows users to stay on top of their personal funds. A consumer can link several accounts to the app, and it will track and classify all their spending. Users also can set spending limits, and PocketGuard will notify them if they are about to cross the line.

Albert

This is another complex finance app that includes saving and budgeting features. Its twist is real human expert support to deal with any type of customer queries. Albert tracks the account’s transfers to automatically identify spare sums for saving.

How Does a Money-Saving Application Work?

As you can see, apps available on the market all have unique features, but they should have some things in common as well. Keep this flow in mind when building a money-saving mobile application.

- Users create an account in the system.

- They add their financial information and link cards and bank accounts.

- Then, users pick a savings/investment plan if they have options.

- They use their cards and accounts while the app automatically withdraws savings according to the chosen plan.

This flow is similar to the Acorns app. If you have in mind something more complex like Digit, the system should have an advanced algorithm under the hood. For customers, it should remain pretty much the same. Remember, users appreciate apps that require minimum effort.

How about creating an awesome budgeting app together? You know what to do

Contact us

A natural question is: How can you, as an entrepreneur, make money while your customers save it?

“Key point in monetization of saving-money application is: what features will involve new users and produce revenue, and which one will generate income.”

The key monetization models of money-saving apps include:

- Subscription. This is the most popular one. Users pay fees each month. Options may include a “lite” plan with limited functionality, “standard” for full-fledged individual usage, and “family” for a group of people with a common card.

- Freemium. This plan implies free usage and paid options. For example, you can offer investment portfolio support at an additional cost.

- Ad integrations. This option means that you leave some space in the app’s design for advertisements. You probably realize that it would annoy your customers, so consider it carefully. You can offer an ad-free app for extra payment as a part of the freemium model.

Don’t rush to pick a monetization model — your decision will depend on the app’s functionality. The key features should attract new users (these are basically minimum viable product [MVP] and a couple of unique features), while further additions leverage your future income.

Must-have Features of an App for Saving Money

Now, how do you make the app’s workflow run? Start to build a money-saving app with essential features first — they form the application’s MVP. It’s a finished product with a set of features that are just enough to start using the application, no extra capabilities included.

- Sign-up and onboarding. This stage is more complex for finance apps because people have to add a lot of additional info. Try to divide the registration process into several parts, with no more than three questions in each part (screen). And consider adding biometric authentication.

- Bank accounts management. This is the user’s in-app space where they can add financial information and manage their wallets.In the beginning, they should have a current budget and savings separated.

- Spending tracker. Providing spending categories is vital. They give users a general understanding of where their money goes and what category requires more attention. Category examples include food (with groceries and restaurants included), shopping, housing (rent, utilities, etc.), transport, entertainment, and so on.

- Automatic savings withdrawal. This feature can vary depending on the app’s complexity. A certain amount of money is regularly withdrawn from the user’s account. The smarter the algorithms you have, the better they will adapt to the user’s spending and form a savings sum.

- Investments. It’s a natural extension of the savings feature. You can help users make their money work even if it’s not being used at the moment. This feature may also be more advanced: in-built artificial intelligence (AI) algorithms can analyze spending and offer an investment plan tailored to the user’s spending habits.

What Market Demands to Consider Before Development Starts

They say look before you leap. Optimistic market trends are not the only thing to consider before entering the money-saving app niche. Let’s see what’s beneath the surface.

Security and compliance

Security is one of the biggest concerns for any digital product. Imagine what it is for finance apps — they have direct access to the person’s financial data. You should carefully discuss this issue with your development team and come up with an action plan for top-notch security.

Read also: Your guide to build a banking app

Read more

As soon as you decide to get access to the user’s financial information, ensure your app meets the requirements of GDPR and/or ISO/IEC 27001. They control your app’s security at the legislative level.

GDPR (General Data Protection Regulation) is a document relevant to businesses working on EU territory. ISO/IEC 27001 is a standard applicable internationally to provide information protection and security practices to companies of any size and domain.

Integration with banks and financial organizations

The ability to link bank accounts and payment systems together in one app is a huge advantage for the user. They don’t have to track their spending themselves — your app should do all the dirty work. For this reason, integration is a crucial stage of the process when you create a money-saving application.

Data visualization

It’s no secret that visuals make an app attractive and easier for the end user to understand. People expect that from your budgeting application as well. For example, colored graphs provide the fastest insight into the size of spending categories. Plus, unique coloring makes your app recognizable among competitors.

Tech Stack Needed to Build a Money-Saving App

A tech stack is a list of technological tools needed to create an app from scratch.

We’re not saying you have to know every detail of it (you’ll have a tech team for that). But it’s a good idea to keep in mind the most popular development instruments.

How can you build a modern banking app?

Read more

Also, taking time to pick the right tech stack for your project will allow you to scale your solution with minimum effort. The better you prepare, the more likely it is you’ll prosper.

Frontend

Simply put, frontend is what users see on their screens and the elements they interact with.

Basic instruments used by frontend developers include:

- HTML: to structure information on the page (like headings and paragraphs);

- CSS: to add style to page elements;

- JavaScript: to make a page “alive” with animations, interactive elements, and so on.

Frameworks, being sets of pre-built tools, help to speed up the working process. For mobile app development, our team, uses React Native, Flutter, and Xamarin, among others.

If you choose to develop a money-saving app for iOS, our team will use native programming languages, such as Swift (most of the latest iOS solutions are built with it) and Objective-C. For Android, we use Kotlin and Java.

Backend

Backend is a server-side part of the app, its technical stuffing. Here we should mention that many frontend languages have been used on the backend as well (for example, Swift, Kotlin, and Java).

Top backend languages used by our team include:

- Python: supports libraries tailored for fintech solutions;

- Java: secure and fits both web and mobile development;

- Kotlin: the main alternative to Java, with more advanced features.

Databases

A solid database allows your app to handle heavy loads and a growing number of user queries. Proven tools that we use for fintech development include:

- PostgreSQL: quickly processes data;

- MySQL: has a cross-platform database and encryption algorithms for better security;

- MongoDB: flexible and scalable.

If you plan advanced features in your app, you’ll need the latest technologies. For example, AI algorithms are necessary to calculate savings for each user individually.

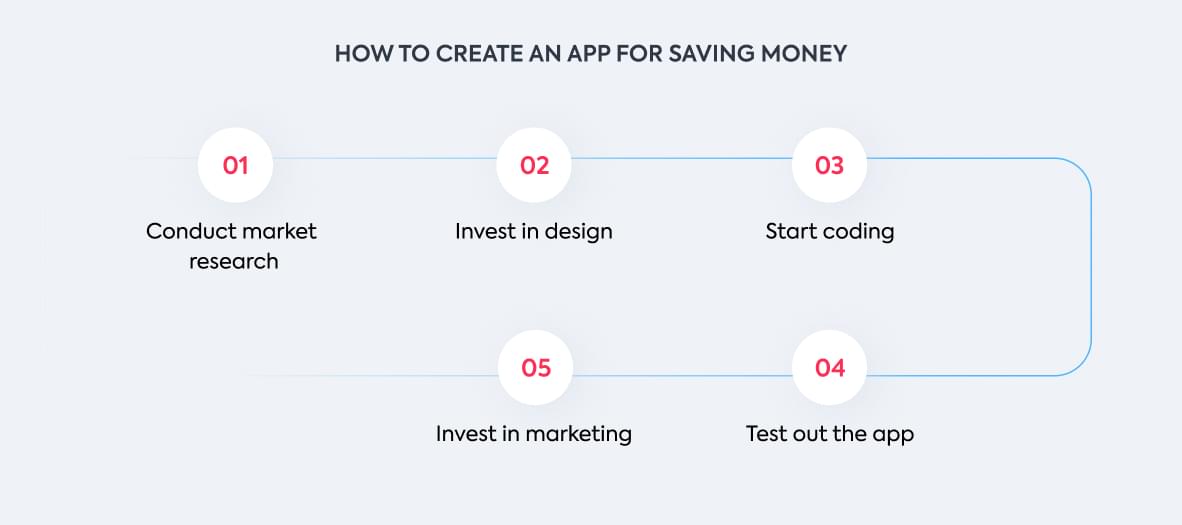

5 Steps to Create an App for Saving Money

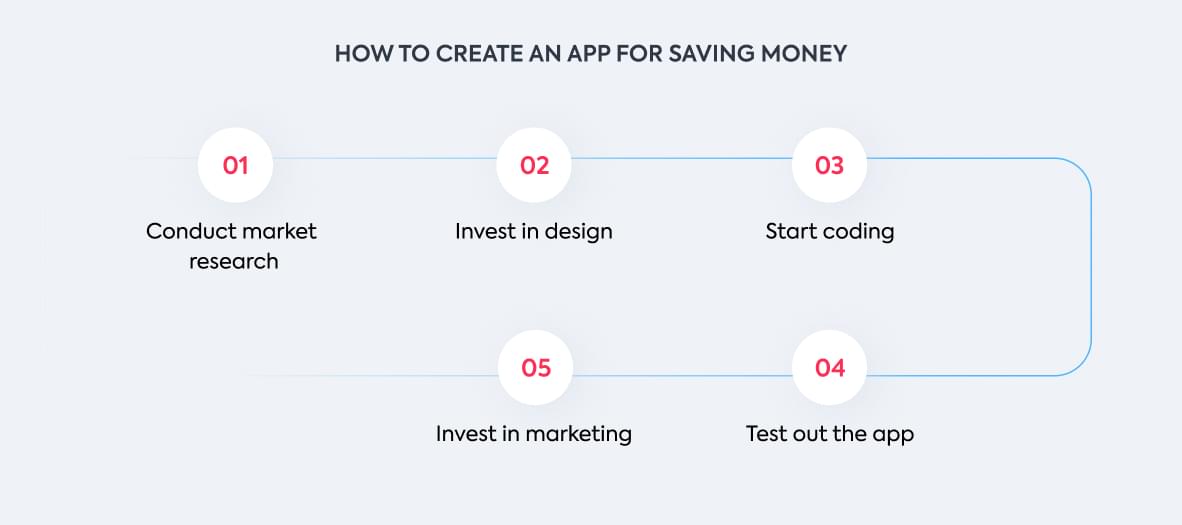

It’s time for an action plan. In this section, we have step-by-step instructions on how to create a money-saving app. Each of these points is crucial for a successful outcome, so we don’t recommend skipping a thing.

-

Conduct market research

Any business idea can happily live on its own in the creator’s head. But things become more complicated when a product hits the market. What will happen then? You can make some assumptions based on the research.

- Define who your users are and what pain points they have at the moment. Do they need your product?

- Check out your potential competitors and their market niche. Are there any gaps you can fill?

After this research, you should clearly define your target audience and your strongest competitive advantages.

-

Invest in quality design

At this stage already, you should share your work with specialists. It’s better if one vendor is responsible for both the design and development stages.

Key points to consider:

- Minimalism. The more complex the money-saving app you’re going to create is, the simpler the interface it should have. Finance is not a trivial subject on its own, so users expect your app to lighten the burden.

- User flow clarity. Another way to make finance less complicated is to create clear app navigation. Users should quickly realize what button to tap next and where it will bring them.

- Animations. We mean something minor to make your application more lively and easier to understand. Micro-animations are aimed to demonstrate an action or a change in the interface. It’s another way to add more clarity.

-

Start the coding part

At this stage, your tech team should get a complete work scope from you. Let developers finish an MVP part before moving any further and adding new functionality to the list. You should get a firm foundation first, on which you’ll be able to build up a solid digital product. Download our free eBook for invaluable insights into digital product improvement for dynamic businesses.

Discuss milestones, deadlines, and means of communication — thorough planning contributes a lot to the project’s success.

-

Test out the app with real users

Detailed feedback from real users is a valuable asset before the app hits the shelves. Let your potential customers try out your MVP and check its navigation. You’ll be surprised how many details you can miss when you practically live with your business idea every day.

Your users, on the contrary, keep only their goals in mind and don’t know any of the development details. They can tell you if they will use this solution, and if not, what you can do to change their mind.

To make the testing process more efficient, use one of the tracking systems available on the market. They analyze the user’s actions and notify you if something goes wrong. Examples of such tools include Hotjar, Mouseflow, Freshmarketer, etc.

-

Invest in marketing

No matter how great your app is, the world still doesn’t know a thing about it. Only well-thought-out marketing activities can help you in this regard.

At this point, get back to the first research step. To spend your marketing budget wisely, you should carefully consider your product’s naming, competitive advantages, and early-bird pricing. These points will add a lot to your viral marketing and self-promotion activities, especially if your budget is limited.

According to AppsFlyer, EMEA territory heavily depends on marketing efforts: more than 50 percent of finance app installs are non-organic. Be it a banking or a money-saving application, it requires a lot of attention from your marketing team.

How Much Does It Cost to Develop a Money-Saving App MVP?

And now we’re heading to the most intriguing question: what’s the cost to make your own money-saving application? Here, you’ll find an MVP cost because it’s a common start for any business idea. Each new feature beyond the basic list must be discussed with the chosen vendor.

First, let’s review the working hours required to build MVP features. In other words, this covers development efforts for one mobile platform only (iOS or Android).

| Feature |

Hours |

| Sign-up and onboarding |

200 |

| Bank accounts management |

360 |

| Spending tracker |

650 |

| Automatic savings withdrawal |

700 |

| Investments |

670 |

| Total |

2580 |

But any project requires more than a development team, and you’ve probably realized it, reviewing the development steps.

| Specialist |

Hours |

| Business analyst |

180 |

| Project manager |

320 |

| UI/UX designer |

250 |

| Tester/QA manager |

820 |

| Frontend and backend developers |

2580 |

| Total |

4150 |

To give you an idea of the average rates on the IT market, we’re turning to Clutch. Naturally, the rates vary in different countries, so here are the ranges:

| Location |

Hourly rate, USD |

MVP Cost, USD |

| United States (New York City, NY) |

100–200 |

$415,000–$830,000 |

| Western Europe (London, UK) |

50–200 |

$207,500–$830,000 |

| Eastern Europe (Ukraine) |

50–100 |

$207,500–$415,000 |

Lower rates are not the only reason why entrepreneurs choose development teams from Eastern Europe. Ukraine, in particular, is a country with thousands of IT companies that invest in the continuous education of their experts.

CHI Software has several development centers across Ukraine and representative centers in Cyprus, the U.S., and Israel. You get flexibility, high-quality coding, and transparent communication. Isn’t it a perfect price–quality ratio?

How We Can Help in Starting an App for Saving Money

The CHI Software team specializes in fintech solutions for different purposes, including payment and investment platforms. Here’s one of our use cases.

Our client: A fintech company headquartered in Sydney, Australia.

Business needs: Initially, the client required integration with EML Payments to issue banking cards and provide online transactions. CHI Software was responsible for the backend part.

Solution: Our team finished integration on the backend and also offered a solution to simplify the investment process for the end user. A dedicated team helped improve the platform’s functionality, which leverages cost savings to deliver real-time ROI.

Investments became a process of four simple steps for users. Literally, anyone can manage it now:

- Users add money to a personal account.

- They pick an investment plan.

- They can withdraw investments at any time.

- They can change investment settings.

Our job is to do the best we can, so you’ll get a team who cares if you start a money-saving app with us.

Conclusion

No other person or device knows us better than our smartphones. And it’s not a bad thing. Today, we’ve found out what impact mobile apps have on our savings and how to build an app for saving money:

- The COVID-19 pandemic has been a trigger for the finance apps market. In 2020, the number of downloads grew by 25 percent compared to 2019;

- Promoting Android finance apps is several times cheaper than iOS products;

- Even though there is one core principle in money-saving apps, each solution has its unique traits, including implemented AI algorithms;

- There are at least three ways to monetize an app for saving money, let alone their combinations;

- There are five essential features to develop a budgeting app MVP;

- To create a money-saving application, you should focus not only on development but testing and marketing as well;

- Keep in mind that your app’s cost strongly depends on the vendor’s location.

About the author

Polina is a curious writer who strongly believes in the power of quality content. She loves telling stories about trending innovations and making them understandable for the reader. Her favorite subjects include AI, AR, VR, IoT, design, and management.

Rate this article

22 ratings, average: 4.5 out of 5