Regulatory compliance is a challenge for financial institutions nowadays. If you’re reading this article, you probably agree, just like thousands of entrepreneurs all over the world.

Where is that compliance lifeline everyone is looking for? It lies within financial RegTech. Now we know that the RegTech market is booming: with a market size of 6.3 billion USD in 2020, it will reach 16 billion USD in 2025 (Markets And Markets). What a huge leap!

The increasing number of regulatory changes and the rising compliance costs are making more institutions opt for technological advancements, so the market growth is understandable. But when it comes to tech innovations, many managers simply don’t know where to start, and we want to make it clear for you with this blog post.

Starting from simple definitions, we’ll explain RegTech for banking piece by piece: the RegTech process, use cases, and off-the-shelf solutions to consider. Only 30 minutes of reading — and you’ll get it all.

Introduction: What Is RegTech in Banking?

RegTech (or regulatory technology) is a term to describe regulatory compliance management with the help of tech innovations. RegTech includes cloud computing, predictive analytics, machine learning, natural language processing, and other areas. The niche has evolved even further and now uses voice recognition and geographic information systems (GIS).

The term and concept first appeared after the world financial crisis in 2008, which caused the appearance of new financial regulations. For this reason, by RegTech, we usually mean banking RegTech.

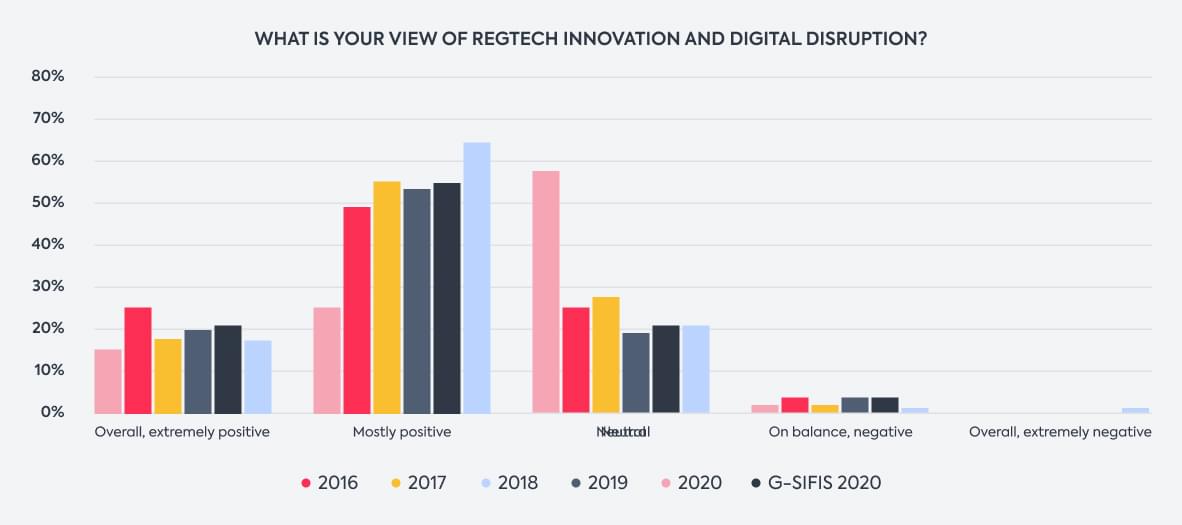

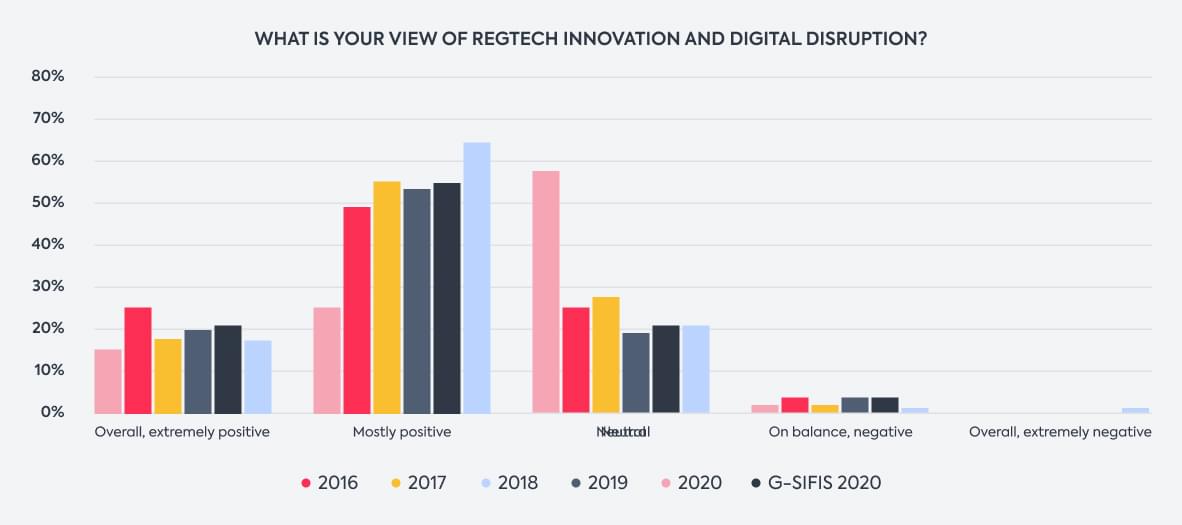

As of 2021, there are 439 RegTech companies in the world with different areas of focus (according to a Deloitte report). In addition to that, the vast majority of G-SIFIs (global systemically important financial institutions) have an extremely positive or mostly positive view of the RegTech innovation (Thomson Reuters).

Financial institutions (FIs) invest in technology to stay competitive, readily meet upcoming market challenges, and reduce possible risks. We at CHI Software are sure that RegTech in banking will shortly become more diverse, employing the most advanced tech trends.

The Difference Between RegTech and FinTech

Obviously, both terms, having the ‘Tech’ in the root, refer to technological innovations, but they are not the same.

Technologies in the financial sphere were initially applied back in 1967 with the first ATM and handheld calculator. Strictly speaking, FinTech is about all kinds of technologies that allow users to access financial services digitally.

Read also: Figure out how to build a fintech app

Read more

As we know, RegTech appeared much later, and it is basically an offshoot of the broader FinTech concept. It is hard to imagine FinTech without robust RegTech solutions and vice versa. Note that FinTech serves all kinds of users, be it individual consumers or global organizations, while RegTech is a tool to manage business risks in particular.

5 RegTech Categories and How You Can Use Them in Your Business Processes

The world of RegTech is complex and involves several types of activities. Deloitte distinguished five main areas in which existing RegTech companies operate. It will give you a more detailed view of the RegTech market and its functions.

-

Compliance

Compliance is the basis of the RegTech niche, so it’s not surprising this category is the biggest one, with 181 companies out of 439.

The capabilities of AI and machine learning in regulatory compliance include:

- Tracking new and updated regulations in the industry,

- Analyzing new documentation,

- Adopting regulations according to specific business demands,

- Visualizing data, and

- Assisting in training employees on their obligations.

Technologies never sleep — they monitor data in real time, so there’s no chance you’ll miss anything. Plus, considering the volume of regulatory documents, you save way more resources than you think.

-

Identity Management & Control

ID verification is vital to reduce money laundering risks, but it’s also extremely laborious. When it comes to “risky” groups of customers that require even more careful screening, the procedure may take twice as much time. All that sounds familiar to you, doesn’t it?

Banks using RegTech can remove this manual KYC (know your customer) procedure altogether. They not only get their time back but also acquire in-depth details (for example, after scanning phone calls). With all these advantages, FIs using RegTech have the most powerful tool for fraud detection.

-

Regulatory Reporting

As the number of regulations around your business continues to grow, so does the data in your organization. Sometimes, compliance means providing ridiculous amounts of documents because documenting things is the only way you can prove that they really happened.

Here is the good news: You don’t have to do any of that manually — entrust AI to do the dirty work instead. It can collect necessary datasets, classify them, and form reports according to the established regulatory standards.

-

Risk Management

Another way to use AI’s powers of data analysis is to predict possible issues and challenges. RegTech solutions for banks can process big chunks of data in no time, and, more importantly, they are always attentive to the tiniest details. This combo of features makes RegTech the best tool to identify and assess compliance risks.

-

Transaction Monitoring

Transaction monitoring is an ongoing but still challenging task for financial organizations. Just think about how many transactions you can check manually — it’s hardly a big portion of the total number. But still, you have to report all fraudulent transfers. It sounds overwhelming, doesn’t it?

The best way to get rid of unnecessary fuss in this regard is to opt for RegTech. Technologies can monitor every transaction in real time and send alerts in case of suspicious activity. This is the highest monitoring speed that you’ll ever get.

Let’s discuss the advantages of RegTech for your business

Contact us

How It Works: The Process of Banking RegTech

Now, let’s unravel how the RegTech process looks. Regardless of your goals, the flow consists of five fundamental parts.

-

Customer authorization

Any business starts with customer needs and their satisfaction — the same is true for financial institutions. Before you go any further, you should introduce your customers to the system, verify their assets, and ensure quality onboarding. RegTech already starts working at this stage, checking user ID with different sources.

-

Monitoring

The routine part comes next. FIs have to monitor a lot of continual activities that happen every day and make sure all of them comply:

- Thresholds

- Suspicious actions

- Records

- Personnel supervision

- New and updated regulations

- Market changes.

-

Detection

RegTech is an effective detection tool for all kinds of fraud activities and a means of protection from terrorist finance. Technologies identify risk signs or fraud patterns to warn the bank’s managers.

-

Reporting

This is a vital part of the process because only reporting can prove that you follow regulation rules. Machine learning algorithms gather enough information to prove that suspicious actions have taken place. Prompt reporting is the foreground guarantee of your market reputation for both customers and authorities.

-

Means of control

Last but not least, efficient RegTech is hardly possible without control tools. They ensure compliance, risk mitigation, and smooth processes across the four parts of the general workflow. It is a firm foundation to keep the RegTech system stable and scalable.

RegTech Solutions for Banks: 5 Market Examples

Now that we know RegTech and banking form a great duo, it’s time to examine specific solutions that already exist on the market. This is how RegTech looks in practice.

This is a set of solutions focused on data analytics and compliance technology. Its first and foremost goal is to make compliance simpler and more cost-effective for FIs.

Key solutions and their capabilities:

- SteelEye data platform keeps records from several sources (like orders or daily communication) and delivers analytical information.

- Regulatory transaction reporting according to EMIR (European Market Infrastructure Regulation) and MiFID II (The Markets in Financial Instruments Directive) with almost 100 percent accuracy.

- Trade oversight monitors every trading activity, identifying potential fraud threats and other risks.

- Communication oversight keeps track of and analyzes ongoing communication and helps to detect unfavorable behavior.

- Insights allow building complex reports based on compliance information from different departments.

This is an SaaS company that provides tools for cloud-based robust reporting. It allows you to keep an eye on the essential business aspects: finance, risk management, compliance, and accounting.

Key solutions and their capabilities:

- Integrating documentation needed for Sarbanes-Oxley Act (SOX) compliance.

- Documenting information and forming reports for DFAST, CCAR, RRP, and other regulations.

- Providing ESG reporting (environmental,social, andgovernance data).

- Establishing smooth GRC (governance,risk management, and compliance) reporting.

The complete list of reporting capabilities contains 31 solutions and can cover pretty much any processing and reporting need.

The main goal of Continuity is to help banks and financial organizations automate everything related to compliance and risk management. This is one of the leading companies in the niche; it was founded back in 2008, at the very beginning of the RegTech era.

Key solutions and their capabilities:

- A set of compliance management solutions (CMS) help financial firms to comply with changing laws and regulations and automate manual workflows.

- Enterprise risk management (ERM) technology helps FIs to cope with various risks, including strategic, regulatory, and compliance.

- Vendor management technology assists with risks related to third-party relationships. Continuous tech monitoring allows organizations to reduce extra spending for consulting and outsourcing.

- Performance management technology keeps track of the three points listed above: compliance, risk, and vendor management.

Acuant offers services for businesses from different niches, including more than 400 FinTech companies. This is an identity verification tool enabling secure transactions for customers all over the globe.

Key solutions and their capabilities:

- Acuant Verify guarantees secure user verification regardless of the device and location.

- Acuant Compliance helps businesses satisfy the demands of anti-money laundering (AML) regulations.

- Acuant Identity stands on the patented technology that covers the full cycle of identity management: building, analyzing, and verifying user identities.

Other solutions include auxiliary services or instruments. For example, Acuant GO allows for quick RegTech deployment.

We love the company’s slogan “Compliance doesn’t have to be painful” — it truly addresses the major challenge. With the help of AI and NLP, the company provides anti-money laundering technology to any regulated organization.

Key solutions and their capabilities:

- Customer screening and monitoring helps to identify fraud risks nipped in the bud.

- Transaction monitoring implies using a rule engine that identifies suspicious behavior patterns.

- Transaction screening scans transfers against connected sanctions lists.

- Adverse information and media insight ensures screening against FATF (Financial Action Task Force).

What to ask a RegTech vendor:

- How strong is your API? This is a fundamental part that determines how easy it will be to integrate a given solution with your business software.

- Give me more details on your reporting feature. Reports are crucial to meet regulatory requirements.

- Do third parties own any product parts? The vendor should have strong connections with third-party services (if any) to make sure the product’s infrastructure is regularly maintained and updated.

- How do you handle customer support and overall product updates? If customer support works smoothly, a product keeps pace with market trends.

How to Figure Out If You Need to Build a Custom Banking RegTech Solution

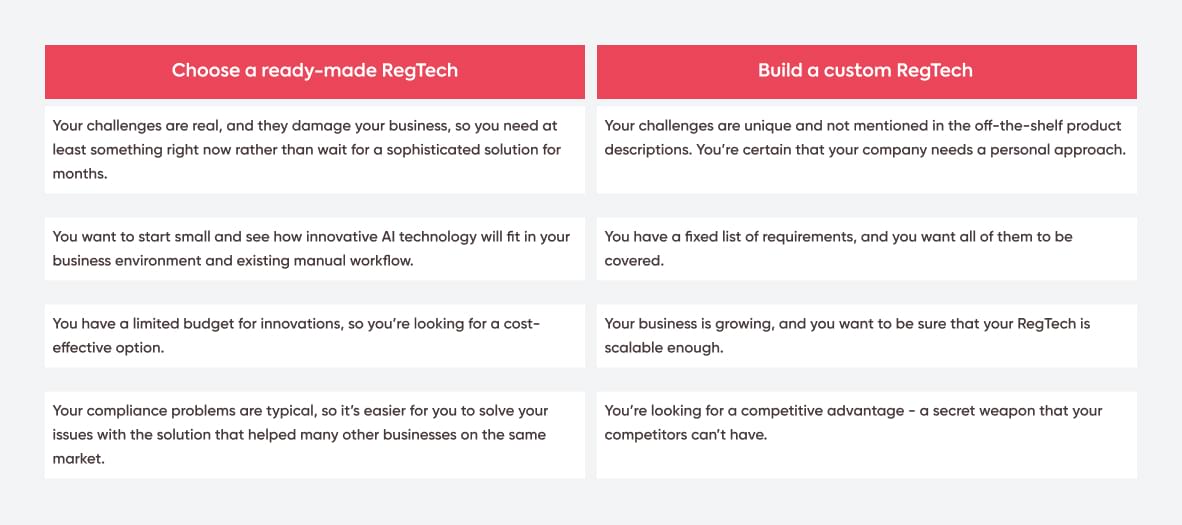

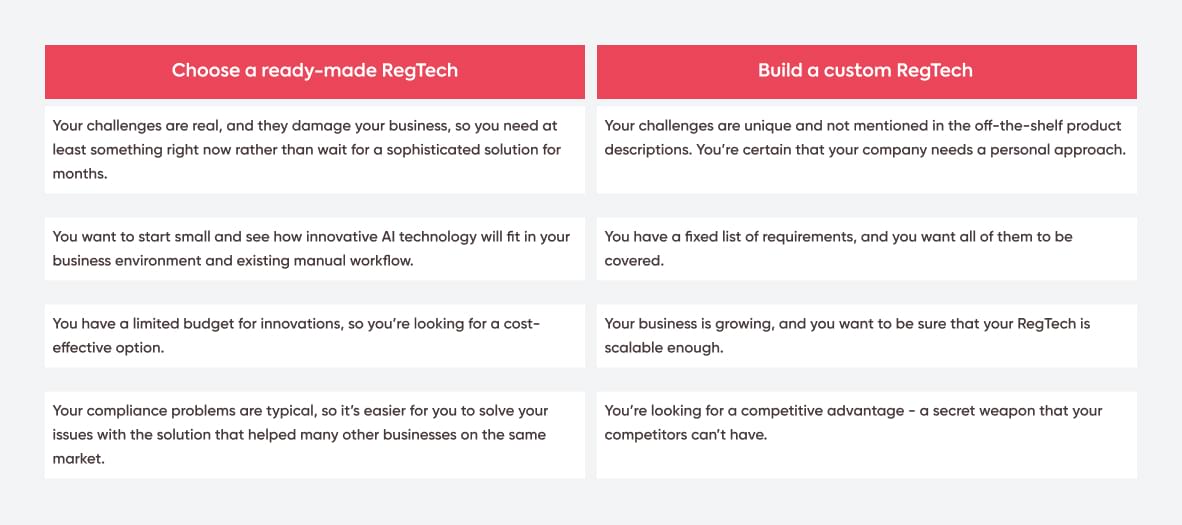

Financial regulatory technology is easily accessible and can be integrated into your workflow as soon as you need it. But what if market solutions are not enough? Let’s find out if that’s the case in your situation.

You have to carefully weigh the pros, cons, and your business situation before making a final decision. Try to think in isolation from what your competitors do and focus strictly on your current needs.

Looking for an experienced RegTech vendor? You’ve just found one

Contact us

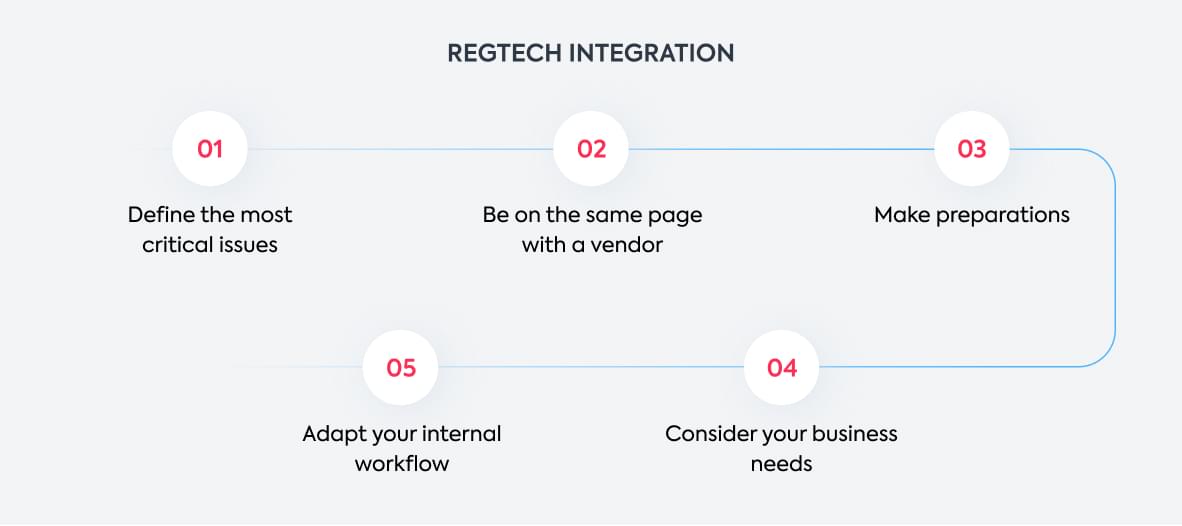

Things to Consider for Successful RegTech Integration

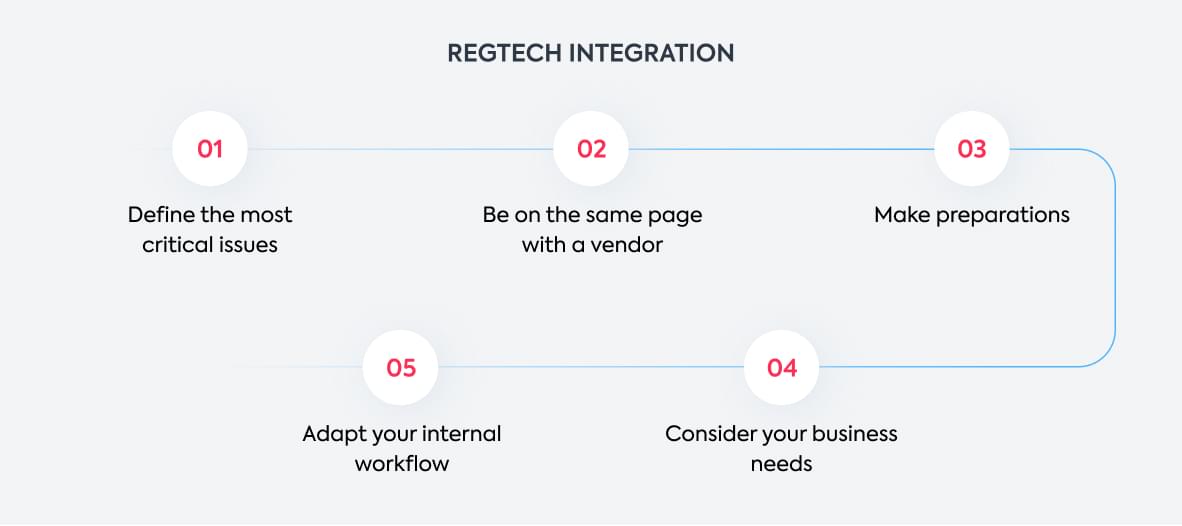

They say you won’t get anywhere if you don’t know where to start. Below, you have a list of steps for successful RegTech integration.

1. Define the most critical issues

Why do you need financial RegTech in the first place? Think of the targeted issues that will bring the highest ROI and concrete business benefits.

For example, if your goal is AML optimization, your immediate advantages include:

- Meeting regulatory demands;

- Reducing manual processes and, hence, the impact of the human factor;

- Achieving high-quality reporting, and

- Creating a safer space for all groups of customers.

Read also: Build a banking app with our guide

Read more

Do the same with your business issues and see what is likely to happen after RegTech implementation. Is the game worth the candle? Then go for it!

2. Be on the same page with a RegTech vendor

The more expectations and fears you share with a software vendor, the better. Developers don’t know your business and its strategic plans, so take time for an honest conversation:

- Discuss a time frame suitable for both sides and a complete work scope that should be finished by the deadline. Depending on the plan, it could be better to divide the work into smaller milestones.

- Mention what budget you have as of now and how it will change in the future. Discuss necessary payments and their purpose.

- Decide if your company will require technical support, then talk about its format and its cost.

3. Make necessary preparations

Follow these points:

- Carefully check what data you have at hand and which documents you will need for the RegTech process (for instance, KYC information).

- Next, make sure that you’re aware of all the sources where this information is stored (for example, only in a CRM system).

- Define where this data is transmitted by your managers — this manual workflow will be replaced by AI for the most part.

- Start a trial period if you opt for an existing solution, or try out your custom solution with several datasets to start. This will help you understand if the process meets your requirements.

4. Adapt your internal workflow to the changes

There will always be people who are above any tech advancement, so make sure that your team is ready for transformation:

- There should be a manager who knows the current compliance needs and problematic issues of your company. This person will be responsible for communication with a tech team.

- A tech specialist from your side should help a RegTech vendor set up a new working process and speak the same language with developers (which you and managers cannot do).

- Provide training to your employees who, in turn, should pass this information to customers (if your RegTech concerns them).

5. Consider unique features of your business

Even if you use a ready-made RegTech solution, a vendor should take into account the unique profile of your company, which includes the following:

- Paying attention to each of your requirements and consider them when setting up your RegTech infrastructure. There shouldn’t be any white spots in the workflow.

- Providing enough analytical tools for managers and scalability for the ongoing business growth.

- Offering in-depth training for your non-tech employees for them to understand the system’s work principles and regularly use them.

Our Experience of Developing Regtech for Banking

The client: CHI Software collaborated with a company focused on vendor-independent financial compliance technology.

Business needs: We mentioned in this post that RegTech helps to monitor voice recordings — this is what our client wanted to add to the platform’s features. But this task requires professional expertise that our client didn’t have, which resulted in a high risk of errors for end customers.

Solution: Our team developed a full range of telecom features, allowing for an error-free workflow. The system now can carry out automated test calls, detect and report flaws, and form statistical reports. Our effort helped eliminate human error, optimize and upgrade the platform’s functionality, and cut time and money waste for our client.

Wrapping Up

It seems like the financial world will never be the same since RegTech has entered the industry. Regulations are here to stay, while innovations are here to make compliance a natural part of the workflow. To recap:

- RegTech is a set of technologies based on AI, NLP, predictive analytics, and other technologies to help FIs comply with existing and appearing regulations.

- The RegTech phenomenon appeared in 2008 after the financial crisis and initially concerned solely the financial industry. Now it can be helpful for any domain that is subject to regulations.

- Thirteen years later, there are more than 430 RegTech vendors in the world.

- There are five main RegTech categories in banking: compliance, identity management, regulatory reporting, risk management, and transaction monitoring.

- RegTech solutions for banks control and monitor the full circle of your customer relationship, starting from user verification and up to suspicious transaction reporting.

We provide RegTech and FinTech solutions with meaning

Contact us

About the author

Polina is a curious writer who strongly believes in the power of quality content. She loves telling stories about trending innovations and making them understandable for the reader. Her favorite subjects include AI, AR, VR, IoT, design, and management.

Rate this article

22 ratings, average: 4.5 out of 5