Project background

Having a background in finance and law, the startup’s founder saw that many people were still missing out on the benefits of investing. They either found the process too difficult or couldn’t find an investment option that would suit their needs. On the other hand, a lot of companies came up with innovative investment products (for example, those enabling smart contracts through AI technology) but struggled with launching them.

This understanding led to the idea of building an IaaS platform that would make both offering an investment product and investing in it as easy and comprehensive as possible. This holistic solution would ensure the offerings’ regulatory compliance and security, take on web development needs, and simplify investment product management.

To realize the ambitious plan, our client needed to enhance its tech expertise. So, the CHI Software team, who had much experience in developing IaaS for fintech, joined the project from the very beginning to assist with analysis, design, and web development, maintain the end-to-end investment platform, and continuously improve it with new features the customers wanted.

- Duration: 5 years

- Location: Australia

- Industry: Fintech

Business needs

01

Exemplary Regulatory Compliance:An essential project requirement was to ensure that the investment technology solution perfectly follows financial regulation frameworks: AFS, AML, CTF, APRA, etc. and maintains comprehensive records for audits and legal reviews. The platform was supposed to be used as an IaaS for banks, too, so the regulatory standards were very strict.

02

Data Security and Privacy:Given the utmost importance of security and privacy for fintech solutions, no compromises could be made when it came to safety. The most robust security measures needed to be implemented to protect sensitive financial data and earn users’ trust. Our client’s customers deserved a completely secure investment platform.

03

Smooth Performance and Scalability:Scaling seamlessly with surging user demand was a must for the IaaS solution hosting multiple popular investment products. So were high availability and performance, including in remote areas with varying Internet speeds. Our client required a perfectly scalable IaaS solution.

04

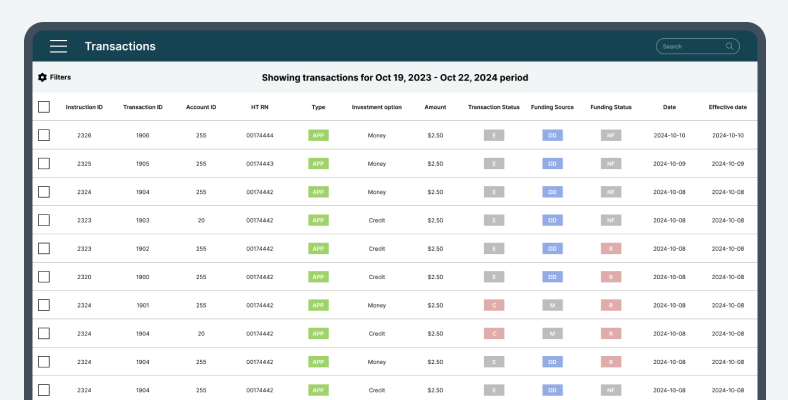

Quick Transaction Processing:Our client needed the fintech platform to swiftly process transactions and data updates. Ensuring the investing as a service solution’s speed and convenience was crucial to make it really useful for customers so that they would be happy with it.

Product features

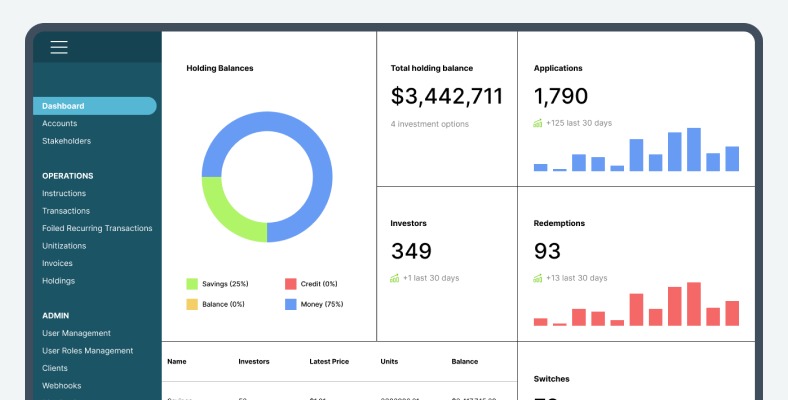

– Investor Dashboard: End users can conveniently view their financial portfolio and information, such as holdings, investments, returns, analytics, etc. in this section.

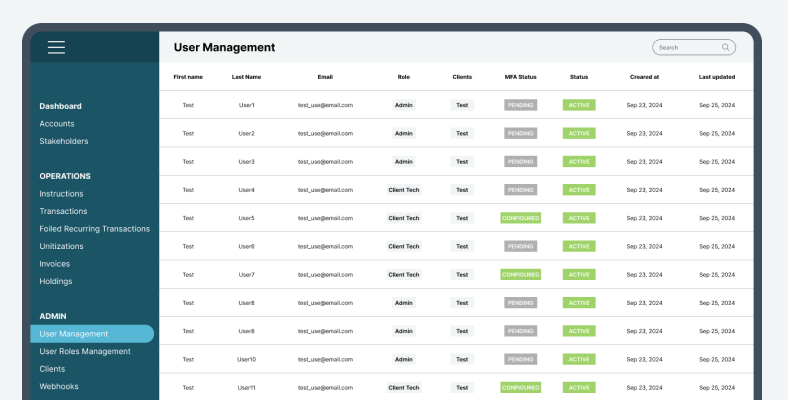

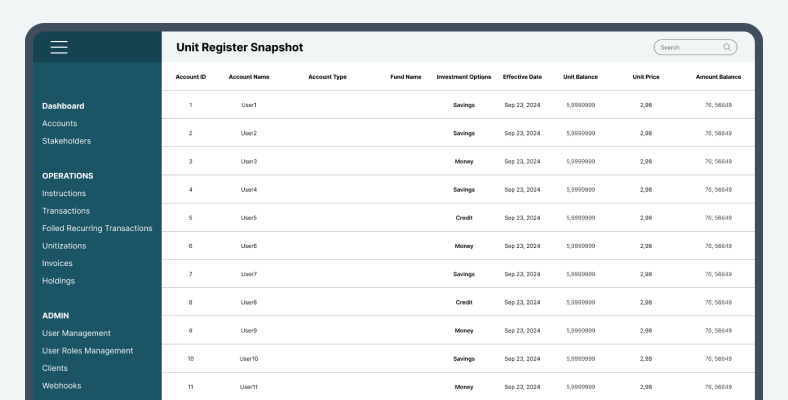

– Admin Dashboard: Here, administrators representing investment product owners can manage users, clients, invoicing, reporting, offerings, webhooks, etc. The dashboard also includes risk monitoring functionality.

– Instant Deposits and Withdrawals: Users can perform quick consistent transactions within the Investment-as-a-Service platform using multiple payment methods.

– Recurring Transactions Automation: Customers can automate recurring payments and contributions to save time and effort.

– Investment Recommendations: The fintech solution recommends suitable custom investment options based on the user’s profile.

– Trust and Fund Management: Customers can create and manage trusts, funds, pooled investments, etc.

– Access and Permission Management: The admin can set up and control role-based user access to different layers of the cloud-based platform to ensure privacy and security.

– Reporting and Documentation: The Investment-as-a-Service platform offers a quick and convenient way to generate, view, and download financial and tax reports. The automated report generation option saves much time and effort.