Car insurance is one of the oldest and most popular fields of the insurance industry. Given the prevalence of vehicle policies, insurers can access a plethora of opportunities by mastering the digital world and exploring their options online. In the last decade, insurers have begun to do just that, and the insurance industry landscape has changed markedly.

More and more insurance companies are offering products in web and mobile applications. Car insurance apps have revolutionized the industry, and with features like AI car damage detection, the claims process has become even more streamlined. Such applications are accessible, user-friendly, and provide quick assistance in case of a traffic incident. For the insurer, apps are an opportunity to win in a market overwhelmed with offers, decrease the number of employees, cut operational expenses, make business more customer-oriented, and achieve noticeable revenue growth.

To the digital world and tap in to these benefits, we have compiled a guide to tell you how to create a car insurance app and what you may encounter while developing it.

To help you navigate the digital world and tap in to these benefits, we have compiled a guide to tell you how to create a car insurance app and what you may encounter while developing it.

Car Insurance Market Overview

The car insurance market has undergone changes in the last decade, triggered by consumer demand. Buyers want to use digital products and are even ready to change their insurer for this. According to a PwC survey, 41 percent of consumers have expressed this intention.

BITKOM research has shown that 55 percent of German customers buy car insurance policies online, and in the age group under 30, the indicator rises to 65 percent. Germany’s statistics are standard for all countries with a high HDI (Human Development Index), and this trend does not go unnoticed.

Forced to innovate, insurance companies are continually increasing their IT costs, including car insurance mobile app development. By the beginning of 2020, these costs amounted to almost US$225 billion a year, but the pandemic has reduced investment volume. Nonetheless, growth is expected to recover in the coming years, with a compound annual growth rate (CAGR) of about 5 percent for the IT services and 10 percent for the software market.

A significant part of the funds is spent on developing mobile insurance products, an area which is also driven by demand. Customers between 20 and 35 years old spend about 54–66 percent of their time on smartphones. Therefore, car insurance mobile app development is becoming a promising source of profit for the owner company.

The following types of car insurance mobile app products prevail on the market:

- Money-saving apps. These give users tips to reduce fuel consumption, improve driving efficiency (to get insurance rewards), or find a gas station where it’s cheaper to refuel.

- Time-saving apps. These give tips, build an optimal route to the destination, predict traffic jams, and suggest simplified methods for policy registration and making insurance claims.

- Risk-reducing apps. These can’t save people from car accidents but can minimize the risk with tips for safe driving, driver’s tension reduction, etc.

Want to know more about apps for auto insurance and their potential for your growth? Schedule a consultation with our experts

Contact us

The Best Car Insurance Apps List

Car insurance app development attracts a lot of startups and well-established companies. Some of these apps succeed and become really popular. Here are the top car insurance apps:

One of the best car insurance apps ranked number one on Dynatrace’s Scorecard. In the GEICO app, users can access policies, pay insurance bills, view reports and other documents, initiate claim submissions, and get help on the road.

The app allows drivers to:

- Use an in-app parking locator and integrated GEICO Explore feature based on augmented reality (to save a list of places the driver wants to visit);

- Access a roadside virtual assistant that answers quick questions on policies and send photos of damage through the app in the case of an accident; and

- Use basic features by voice via Amazon Alexa and Google Assistant (they are supported).

Despite the convenience and the range of functions and discounts, the system also has disadvantages. Using the app, you can’t change the policy terms in a significant way. All client support is carried out mainly online; few real agents are on the network, and contacting them is not easy.

Root is not a traditional auto insurance app that rates policyholders by the usual demographics and other factors. Instead, the system measures are based on driving behavior. Root evaluates users by their actual driving manner and encourages safety with favorable insurance rates. Besides, the app allows policyholders to:

- Initiate and file claims, and track the progress;

- Get free roadside assistance and submit car photos (for instance, of damages incurred); and

- Order free Lyft rides (on certain holidays).

Root has been featured in Forbes, Fortune, Wired, and other famous magazines due to its safety rewards strategy. The user base notes the transparency of calculations and good support. However, the app does not qualify all drivers and raises the rate if the user has an accident.

Metromile (for iOS and Android)

This mobile app uses an unusual pricing principle: drivers pay for the distance they drive. Therefore, insurance with Metromile is convenient for policyholders who do not use their car so often or who drive short distances. The app offers complete insurance coverage and discounts, and allows drivers to:

- Add claims and drivers,

- Get 24/7 roadside assistance and help in finding lost and stolen cars, and

- Order glass repair and other services.

Metromile offers customers a low monthly rate, but it grows with each added mile. Other disadvantages include inaccessibility in some countries and U.S. states, and user privacy concerns related to vehicle GPS tracking (but this feature can be disabled).

Challenges You Will Face

If you want to build your own car insurance app, you have to know about the challenges to avoid them.

Difficulty in claims processing

Claims management (from submitting a form to receiving a payout) is an essential but complicated insurance process. Clients are often unhappy that requests tend to take long time, and insurers seem to delay making decisions.

Artificial intelligence (AI) and machine learning (ML) technologies help speed up and improve claims processing. They will give you the edge if you build a car insurance app and want to stand out against competitors. ML-based automation significantly reduces:

- Manual processes and the number of interactions between the customer and the insurer,

- The number of issues considering the human factor, and

- Your time and funds costs.

ML algorithms can even calculate damage via satellite pictures or drones to assess extreme traffic situations. Also, AI in car inspections is revolutionizing how insurance companies assess vehicle damage. By analyzing the data and user behavior, ML-based systems can effectively adapt to client needs and select better business strategies for the insurer.

Insurance Fraud

Insurance fraud is a disaster for the industry. American companies lose at least US$80 billion annually, according to the Coalition Against Insurance Fraud. These problems can be thwarted by AI, which helps you detect suspicious activity faster and take countermeasures against it. Biometric AI, such as face recognition technologies, can identify individuals with a high degree of accuracy and detect fraudulent claims quickly.

Cloud technologies also help solve the problem. They support insurers by providing information rapidly in real-time. These technologies help to reduce the risks of duplicate and inflated claims, fake driver and vehicle damage diagnoses, overpayments, and employee fraud. Therefore, it is recommended to create a car insurance app using cloud-based solutions.

Advanced cryptographic methods of verifying transactions also help mitigate risks. Blockchain forms the basis for permanent secure access to distributed contract data by all parties. Insurers and clients can always rely on general and reliable information, and no one can change it imperceptibly for their benefit.

Find out more about AI/ML, cloud, and other insurtech technologies that increase your profitability and reduce risks

Contact us

Data processing and analysis

Insurance companies receive and process a vast amount of data about users and vehicles, and this data increases constantly. Therefore, fast processing of data has long been a vital issue in the insurance industry, and you should consider it before developing a car insurance app.

- Cutting-edge technologies help to solve the problem:

- Optical character recognition (OCR) makes it easy to receive data from printed documentation;

- Application programming interfaces (APIs) establish simple and secure access to external and public data;

- Extract, transform, and load (ETL) systems structure data for further purposes; and

- Cloud data storage improves data safety and reliability: documents are checked automatically and are rejected in case of conflicts or errors.

How to Build a Car Insurance Mobile Application

To make a car insurance app, follow a few common steps:

- Hire a development team and turn your abstract idea into a clear shape: define the written requirements and the list of features for the minimum viable product (MVP) and full-fledged app;

- Define the user interface and user experience (UI/UX) car insurance app design: navigation, menus, item layout, color, and graphic aspects;

- Select technologies to implement all the features and create an MVP and final app;

- After developing an MVP with all improvements, it has to be thoroughly tested and delivered; and

- Launch the product (place it in mobile app stores), and then continue to monitor it, providing customers with support, maintenance, and regular system updates.

A specialized car insurance app development company will help you cope with all stages of development and result in a high-quality and customer-oriented product. Experts with practical expertise in the field know how to get things done with the minimum investment and quickly find the most rational solutions.

Key Features

Regardless of the app’s type, you’ll need core MVP features. Among them are:

- User profile. A personal account usually contains data about a particular client and vehicle. You have to ensure a straightforward process of creating the profile, adding the info, and filling out and signing registration forms.

- Documentation processing. Users have to access, review, and filter their insurance policies in the app; check expiration dates; enter vehicle specifications; etc. Scanning papers or capturing document images can speed up the process.

- Claims processing. You have to provide users with easy ways to fill out and submit forms through mobile gadgets and reduce the paperwork for the customer and insurers. An AI-based chatbot can help; policyholders can file claims themselves and get answers to frequently asked questions.

- Payments. The all-in-one trend is gaining popularity, and the ability to pay bills and save user credit cards in the app gives your app a competitive advantage. Remember, you have to provide superior personal data protection.

- Vehicle data processing. Due to GPS tracking in real-time, your app can collect information about a car’s location that is helpful in emergencies of any sort. The ability to build the route in advance and track it is also essential.

- Roadside assistance. When it comes to cars and driving, anything can happen, and you can never have too much help in case of an accident. Therefore, consider the ability for clients to get urgent advice and make an emergency call from the app automatically.

- Live chat. Your operators should be available during the day. Outside working hours, you can use a chatbot that will help customers go through the app. Chatbots available 24/7 work efficiently as a customer service center and reduce support and sales costs.

- Notifications. Alerts and reminders will help your app establish client contact and improve communication for service and marketing purposes. Notifications will remind users about the policy’s termination, and inform them about discounts and changes in terms or claim status.

- User support. The app’s support assistance should be multilingual, easy to interact with, and available 24/7. You also have to ensure high-quality feedback. No matter how reliable your app is, people will still be dissatisfied with something from time to time. The feedback form will help them to express their displeasure and solve their problem quickly.

Get an introductory consultation to find out how to make a car insurance app with features set customized for your needs

Contact us

UI/UX Design

The most obvious way to structure an application is to divide functions into separate screens and menu sections. When engaging in car insurance app design, you need to create at least the following:

- User profile screen with personal information, a settings panel, and data on insurance policies and vehicles;

- Policies screen – you can place one insurance plan per page to present all the crucial details (policy number, vehicle specification, expiration dates, etc.) in convenient form;

- Payment processing screen with integrated payment gateway – there should be space on the page for ID and insurance documents data and a “Policy and Terms” button;

- Claims screen that simplifies and speeds up the claim processing – as an option, you can integrate this feature into the live support chat or intellectual chatbot; and

- Support screen, where users can get 24/7 customer service and updated info regarding claims or the app itself (chat would be appropriate here, too).

We’ve already applied a similar approach in our travel insurance platform project, where multilingual support and intuitive UI design helped expand user engagement across markets.

Tech Stack and Third-Party Integrations You Will Need

Third-party integrations answer the question of how to develop a car insurance app in the shortest time without sacrificing quality. Using APIs, software development kits (SDKs), and other instruments, you can offer customers the best experience, create products with lower costs, and try disruptive business models.

APIs and SDKs

Insurance APIs make the app flexible, share data and services with third parties, and speed up the development process. In fact, they are pieces of code—an open-source library. To build your own car insurance app, you can use APIs that:

- Integrate the app and insurance companies’ systems, providing seamless access to digital insurance products in real-time. AXA, Lemonade, and other insurers offer their public APIs to manage policies, and select options and prices.

- Check the vehicle status to eliminate extensive paperwork and get all the data about a particular car: year of manufacture, model, license plates, etc. Such info is necessary for accident registration and claims, and APIs simplify its collection significantly.

- Automate the process of filing standard reporting to the insurance company or regulatory authorities. NAIC Registry and similar APIs help an application retrieve and store data on online systems for misconduct identification and other purposes.

- Prevent fraud and theft. For instance, Theft Alarm API helps alert users if someone is damaging the car or trying to steal it by sending a special notification to the owner.

- Define a car’s speed and its limit for a given road segment. Using Google Roads and similar APIs, an insurance company can analyze a vehicle’s performance or status at any given time and on a specific road segment, and thus conclude the driving safety.

- Quickly implement push notifications or a chatbot feature (for instance, via Firebase API or OneSignal SDK), recognize license plates by image, etc.

Payments

Third-party APIs and SDKs can also be helpful for in-app payment processing. The user won’t be able to buy insurance policies and manage bills without a payment gateway. You can use popular and reliable tools like Stripe API and Braintree SDK or choose another system. In any case, your solution should

- Provide users with easy payment methods, including bank cards, net banking, mobile wallets, or even cryptocurrency;

- Perform in-app payments quickly, and allow a user to control payment processing; and

- Protect customer personal and financial data from leakage and illegal use.

Tracking, Mapping, and Geolocation

Those features and tools allow your clients to find the correct route when traveling in unfamiliar terrain and also help the insurer learn about customers’ movements via the app. Using car geolocation and real-time GPS tracking, insurance agents and road assistance operators can guide drivers to find a needed institution or get help. Most mobile gadgets have GPS modules, so it will be easy to implement this function into the app.

Read also: How to Create a Medical App

Read more

However, to go beyond the standard tracking and route planner, you need better solutions. AI and ML will help you implement them and build a car insurance app that outstrips the competition. Also, AI technologies like hail damage inspection allow car insurance apps to provide real-time damage assessments after weather-related incidents, enhancing the app’s overall value.

Technologies allow you to analyze driver behavior on a deeper level and collect various data on the vehicle condition and the mileage. Such valuable information enables the insurance company to manage risk better and leverage new business models such as usage-based insurance (UBI), pay-as-you-drive (PAYD), and pay-how-you-drive (PHYD).

You can take advantage of these opportunities by combining AI with mobile GPS services and Internet of Things (IoT) external devices installed on transport. Such solutions are called telematics, and they open a new era in auto insurance and vehicle control in general.

IoT and Telematics

The Internet of Things has the potential to revolutionize driving behavior analysis, car risk management, and vehicle data collection. This is reflected in the increasingly widespread use of telematics:

- Motion and fuel sensors, gyroscopes, accelerometers, and other devices installed on a vehicle collect data about speed, location, accidents, travel distance, smartphone utilization while driving, etc.;

- External equipment integrates with GPS modules and mobile app software and transmits data into the system; and

- Machine learning algorithms analyze driving behavior and evaluate criteria of safe driving.

Using this information, an insurer can create individual insurance plans and provide customers with rewards or discounts on an insurance policy.

Additional capabilities

We at CHI Software go further and use ML-based anomaly detection, which allows the app to identify signs of behavior that are not specific to a particular user and prevent theft and fraud. To optimize insurance operations, we also create microservice ecosystems that can be easily integrated into various business processes. By combining advanced, proven, and thoroughly tested technologies from the AI stack while developing a car insurance app, we adapt their capabilities to clients’ needs.

You can apply and combine services such as:

- Face detection/people counter;

- Face and voice recognition;

- Document text recognition and auto form–filling;

- Intellectual chatbots;

- Computer vision (CV) object recognition;

- Big data analysis, natural language processing (NLP), etc.

Cost of Car Insurance App Development

To estimate the approximate cost to create such a car insurance app, you have to know the development team composition and each specialist’s hourly rate. By adjusting this data for the amount of work, you get the total cost of your system.

As a rule, the development team consists of one project manager, a business analyst, a UI/UX designer, several developers (Android and iOS, frontend and backend), and one or more QA specialists. To implement more complex (but potentially more profitable) solutions, you’ll need a data scientist, cloud computing architect, AI/ML engineers, and other team participants.

For example, look at the average hourly rates of U.S. specialists at the beginning of 2021:

| Specialization |

Hourly rates, in US$ |

| Business Analyst |

110–205 |

| UI/UX Designer |

79–163 |

| Developer |

105–187 |

| QA Engineer |

77–169 |

| Project Manager |

133–233 |

Keep in mind that prices are typically 50 percent lower in Europe and 70–80 percent lower in Asia and India (compared to the USA).

For car insurance app development via React Native or another cross-platform solution, you need 350–450 working hours. The creation of native apps for iOS and Android takes a bit more time. The choice between them and a cross-platform solution depends on your business needs, budget, timing, and other factors.

If we take the team’s average hourly rate, the native app development costs (both iOS and Android) are between US$45,000 and US$70,000. The minimum price of building such systems ranges from US$14,000 to US$18,000.

Contact us to get a full estimate and professional advice on app development costs

Contact us

Our Use Cases

At CHI Software, we successfully develop car insurance solutions for startups, enterprises, and businesses of various sizes.

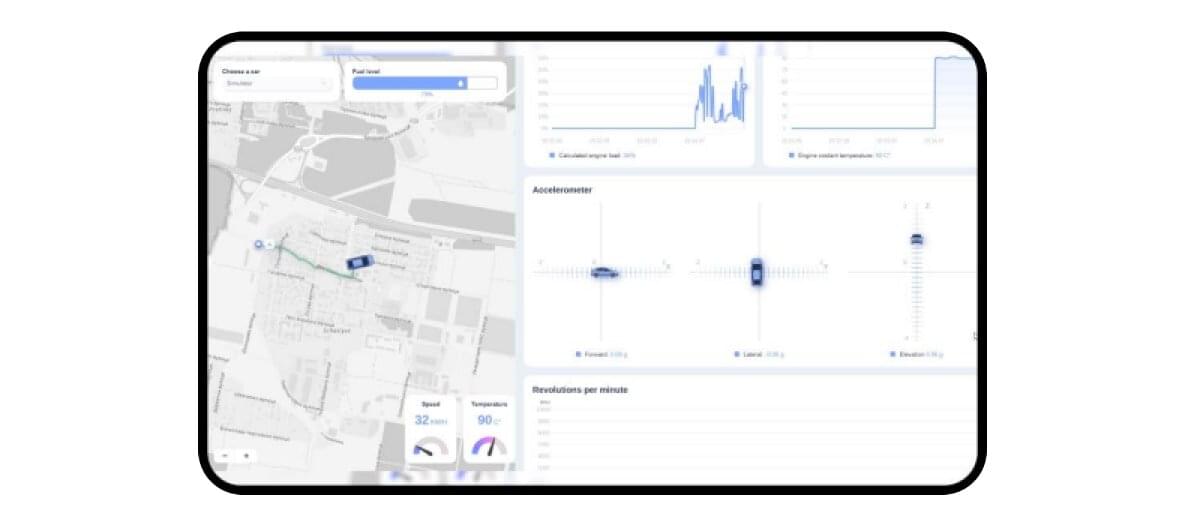

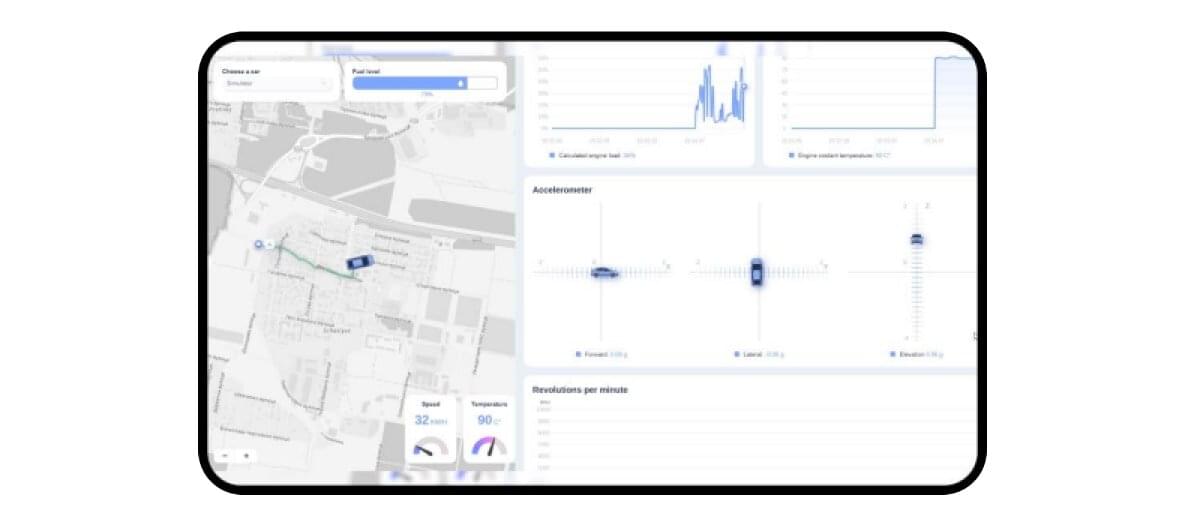

Connected Cars X

One of the clearest examples of our capabilities is the Connected Cars X app that we developed for a taxi fleet owner in the Middle East. It is a software solution that collects required car parameters with IoT devices’ help.

The app uses AI for processing real-time and aggregated data to get behavior analytics. It helps to solve the client’s core problem: fast deterioration of vehicles. Damages led to extra expenses on insurance, maintenance, and repair services.

To address this problem we developed Connected Cars X, a useful tool for transparent control of the vehicle condition and driving style monitoring. The solution analyzes:

- Driving scores,

- Trip comfort,

- Aggressiveness scores,

- Braking intensity,

- Vibration level, and

- Optimal speed.

Thanks to our product, the fleet owner can collect real-time data, analyze the causes of rapid vehicle deterioration, and successfully negotiate the insurance company’s rates.

Technologies used: C++, Python, JavaScript, AWS IoT Greengrass, MQTT + SSL, OBD2, AI/ML.

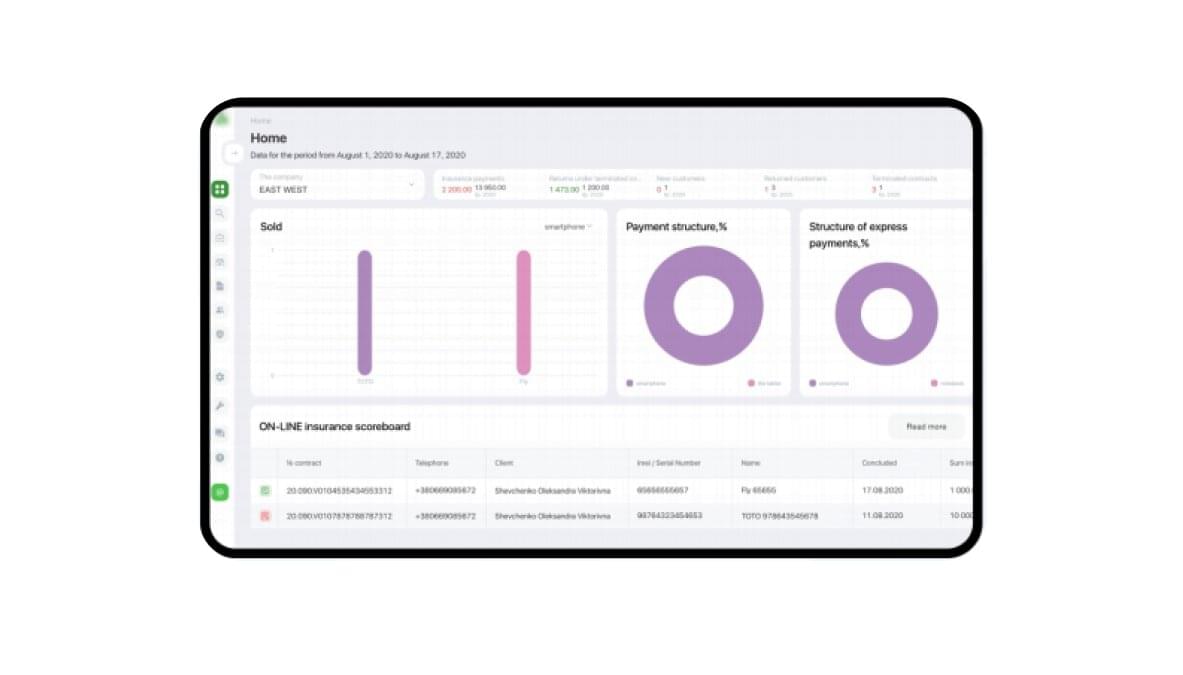

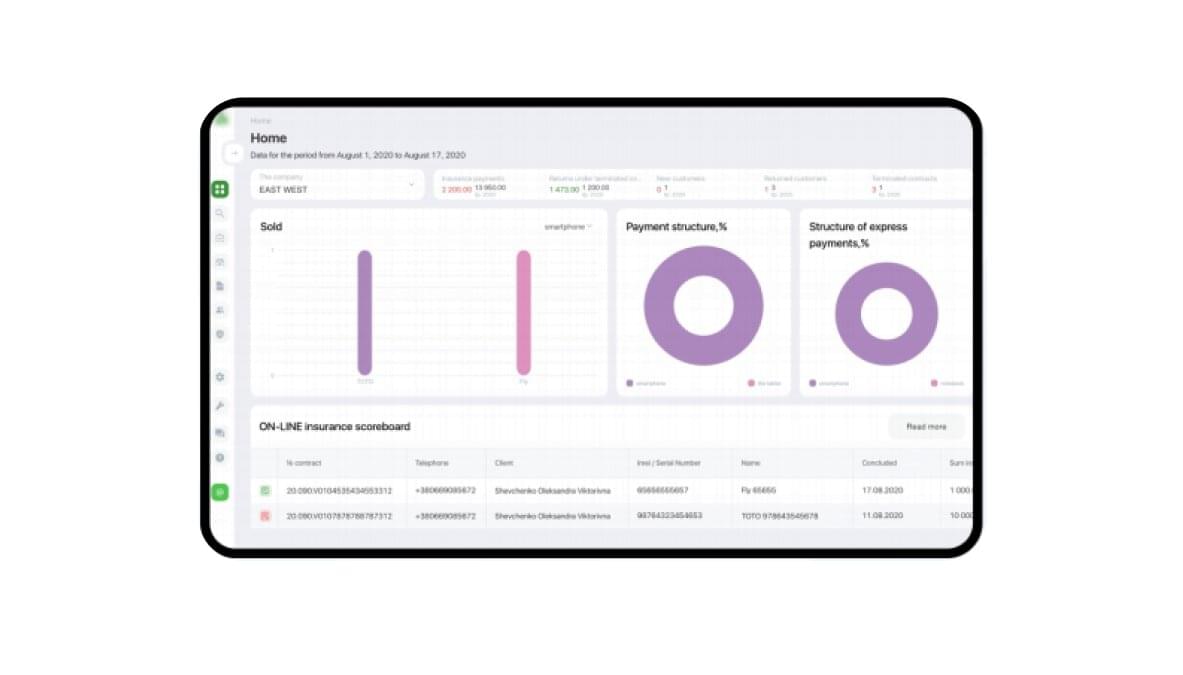

Cloud-based platform for insurtech

We would also like to note that you can create additional value by integrating cloud solutions from Google Cloud Platform, MS Azure, AWS, and other providers into your app with our help.

An example of our work is a cloud-based insurtech platform for global providers. Our team developed a solution that helps insurance institutions in their everyday tasks. The platform supports every phase of the claims process in real-time. Data storage is also added to the system. Thanks to it, recorded information is accumulated in a safe place for further reporting.

Technologies used: Ruby on Rails, Angular.JS, Amazon Web Services (SQS, RDS, Dynamodb, Lambda, API Gateway), Node JS, MySQL, Twilio, Zapier, Opentok.

Conclusion

In this article, we have touched on all the issues related to developing an insurtech solution for vehicle owners. However, the topic is incredibly vast, and it is simply impossible to cover everything at once.

We can tell you a lot about how to build a car insurance app that helps you monitor driving safety, track vehicle movement along a route, control fuel levels, or process enormous amounts of insurance data in seconds. Add to this the power of the innovative solutions we offer, and you’ll receive an app that is remarkably ahead of the competition, benefits your customers, and gives you a stable income for the long term.

Ready to impress your customers and outstrip competitors? Contact us and get all the help you need to create a car insurance app

Contact us

Rate this article

22 ratings, average: 4.5 out of 5