The digital revolution is gaining momentum and changing regular affairs, including the financial sphere. In recent years, the pandemic inevitably contributed to this, and this trend will continue.

Banking services continue to move steadily to the virtual space, and users are concerned about the reliability and convenience of the mobile banking interface, their health, and well-being.

Today, banking can be considered modern only if it successfully fulfils the role of a personal financial assistant, but one that not only informs but also entertains — a kind of financial-edutainment personal assistant for your client. How to achieve it? Let’s take a closer look.

What Exactly Is Mobile Banking?

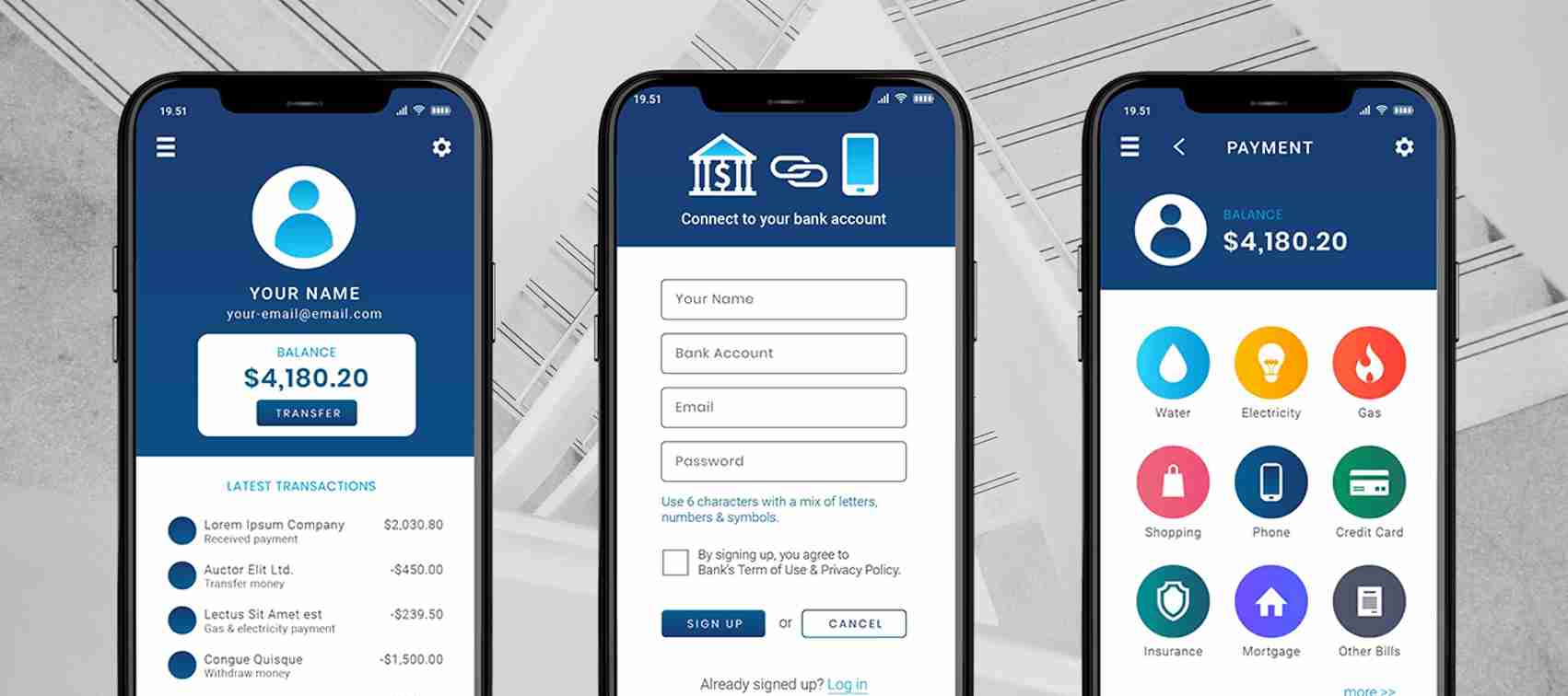

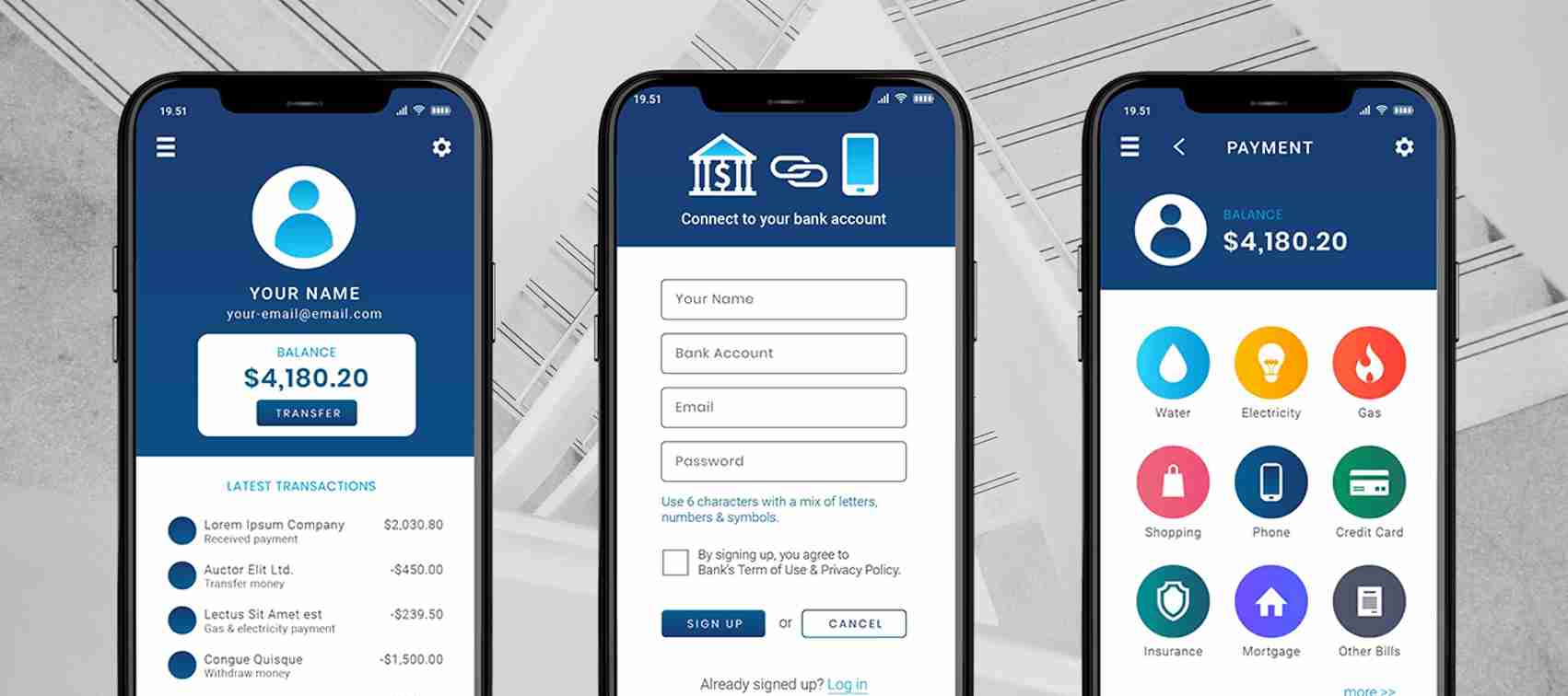

By definition, a mobile bank is a financial and credit institution that uses remote banking technology through an official application installed on a smartphone or tablet based on the iOS and Android platforms.

I’ll tell you that mobile banking is an alternative to branches. “Bank in a smartphone” helps us interact with the bank, saving us time. Paying utilities, purchasing goods in an online store, or transferring money with one touch – this approach is finding more and more supporters.

Read also: The key steps to build a fintech app

As they continue to respond to new customer needs, even conservative financial organizations are transforming their business processes. For banks, the availability of mobile applications, internet banking, chatbots, and customer support is no longer a matter of prestige but a daily necessity.

Mobile Banking: Pros and Cons

Mobile banking has the following advantages:

- Simplification of access to accounts and cards, as well as basic operations on them

- Control over the balance on the card and ongoing transactions at any time and anywhere

- Alternative ways to confirm transactions (push notifications, fingerprints)

- Additional features, depending on the bank

- Prompt receipt of payment details, blocking and reissuing cards.

Yes, of course, the system has its flaws because no one is perfect. There is a possibility that an unauthorized person will gain access to the application – for example, if the phone is lost.

How Is It Different from Internet Banking?

Modern browsers, built into smartphones or installed separately, open up all the possibilities inherent in browsers on classic personal computers. So, for example, it is possible to work with Internet banking through a mobile browser.

However, mobile banking involves the mandatory installation of a special application (supplied directly by the bank or its official partner) compatible with the platform.

The advanced features of the mobile app include the following:

- Determine the exact location and search for ATMs nearby.

- Login to the application using biometric data (fingerprints, retina, face identification, etc.).

- Recognition of details of accounts/payment documents from photographs.

- Reading QR codes from payments.

- Built-in antivirus.

- Instant notifications about the movement of funds and other operations (push notifications).

- Contactless payments (if you have an NFC module).

Mobile Banking for Everyone

Mobile banking is modern only if it successfully fulfils the role of a personal financial assistant that informs and entertains. Let me explain what I am talking about.

Modern banking is about digital technologies, freedom of choice, and tangible benefits from every transaction. Today, it should combine digital, individualization, and convenience. Let’s see:

Digital

Of course, it is the main element. It is challenging to imagine a metropolis resident without a smartphone, and almost all areas of our lives are digitised. Here are some essential features:

- Interactivity with the application must be fun and should not take too much time.

- Explanatory video content. One such video should contain one key message – due to the constant lack of attention and switching from one to another; it will take a long time to hold attention.

- Card sharing with family members and transaction analytics.

Personalization

When it comes to banking, it must also be a tool for strengthening their individuality and uniqueness. For example:

- Easy but smart UI/UX design;

- Personal messages and notifications;

- Smart transactions displaying different data and actions depending on the context.

Read also: How to build a money-saving app

Convenience

It is about clarity, clarity, and tangible benefit to customers:

- Personal financial manager

- Bonuses

- Financial goals

- Synchronisation with other smartphone radios.

Features to Make a Banking App Stand Out

Of course, it’s good to know what it takes to get different generations to use your banking app. But how can this be achieved?

- Secure authentication. For example, biometric authentication verifies customers based on their physical characteristics, such as their face, fingerprints, and voice.

- AI-powered assistants. Good old chatbots provide 24/7 customer support. Using real-time simulations, they can respond to consumer inquiries instantly.

- Virtual assistants with voice recognition. Touchless payment features allow users to ask their virtual assistants to pay their bills or complete a purchase.

- The key financial transactions. A mobile banking app should integrate Google Pay/Apple Pay, enabling touchless payment, the transfer of money via RTGS or IMPS, allowing users to check balances, pay bills online, and make credit and insurance payments.

- Monitoring and management of transactions. Users must view the entire payment history to understand how much was debited, when, and for what purpose. Customers are more likely to use your app if the transaction dashboard allows them to track the movement of their money.

- An offline account access option. A poor Internet connection (or no Internet connection) will not prevent the user from managing their profile if the application supports it. Combining this feature with geolocation tools makes the system versatile.

- Withdrawals from ATMs without a card. Even though the world goes paperless, sometimes we still need some cash on hand. NFC technology and QR code scanning will enable customers to interact with ATMs simply through their mobile phones without using their cards.

How to Build a Banking App Step-By-Step

So, if you’re planning to build a mobile banking application, you should follow these steps:

- Research and plan the project;

- Design a prototype and a user interface/user experience (UI/UX);

- Create a minimum viable product (MVP) and test it;

- Launch and market the app; and

- Assist users with app maintenance and support.

How Can CHI Software Help?

With over 15 years of experience in the finance industry, CHI Software has continuously expanded its team of experts to provide essential services for the financial sector, including consulting, design, coding, testing, and DevOps engineering.

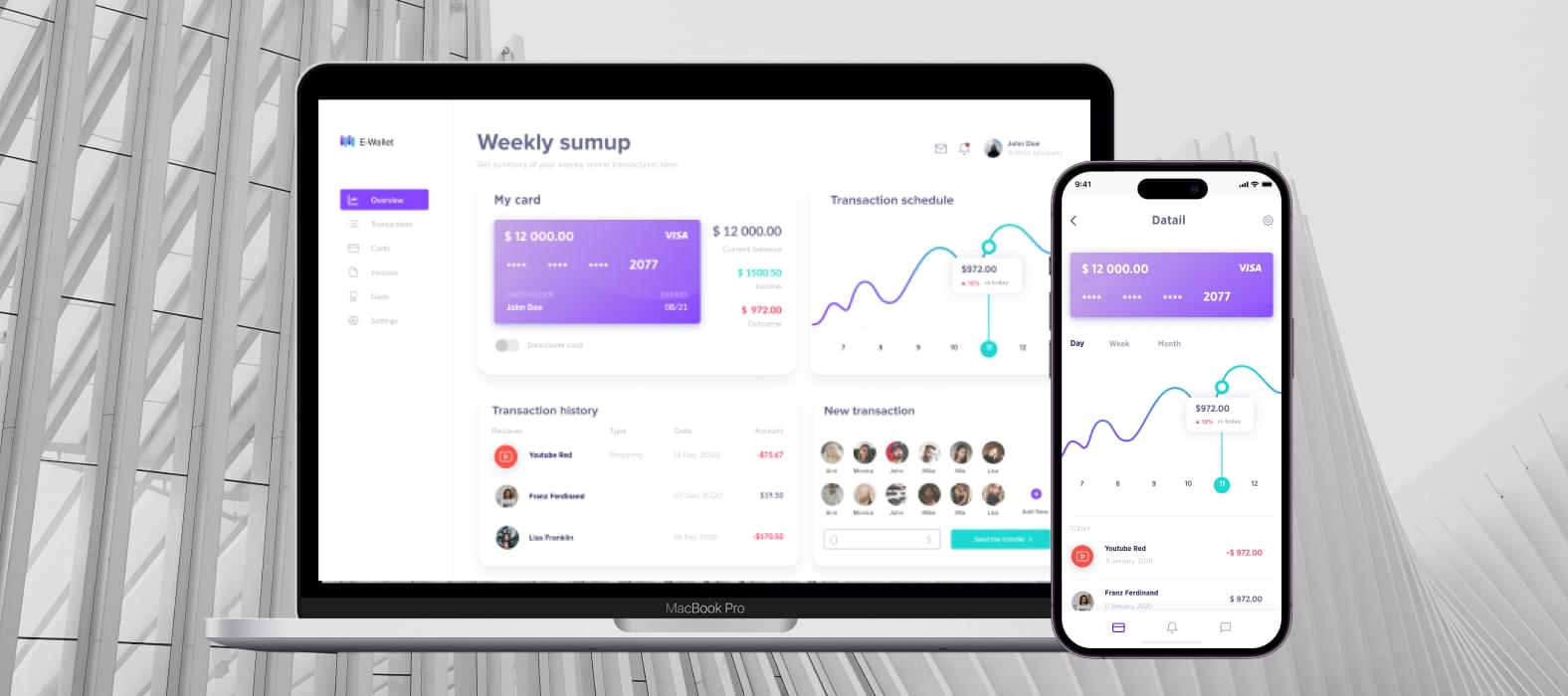

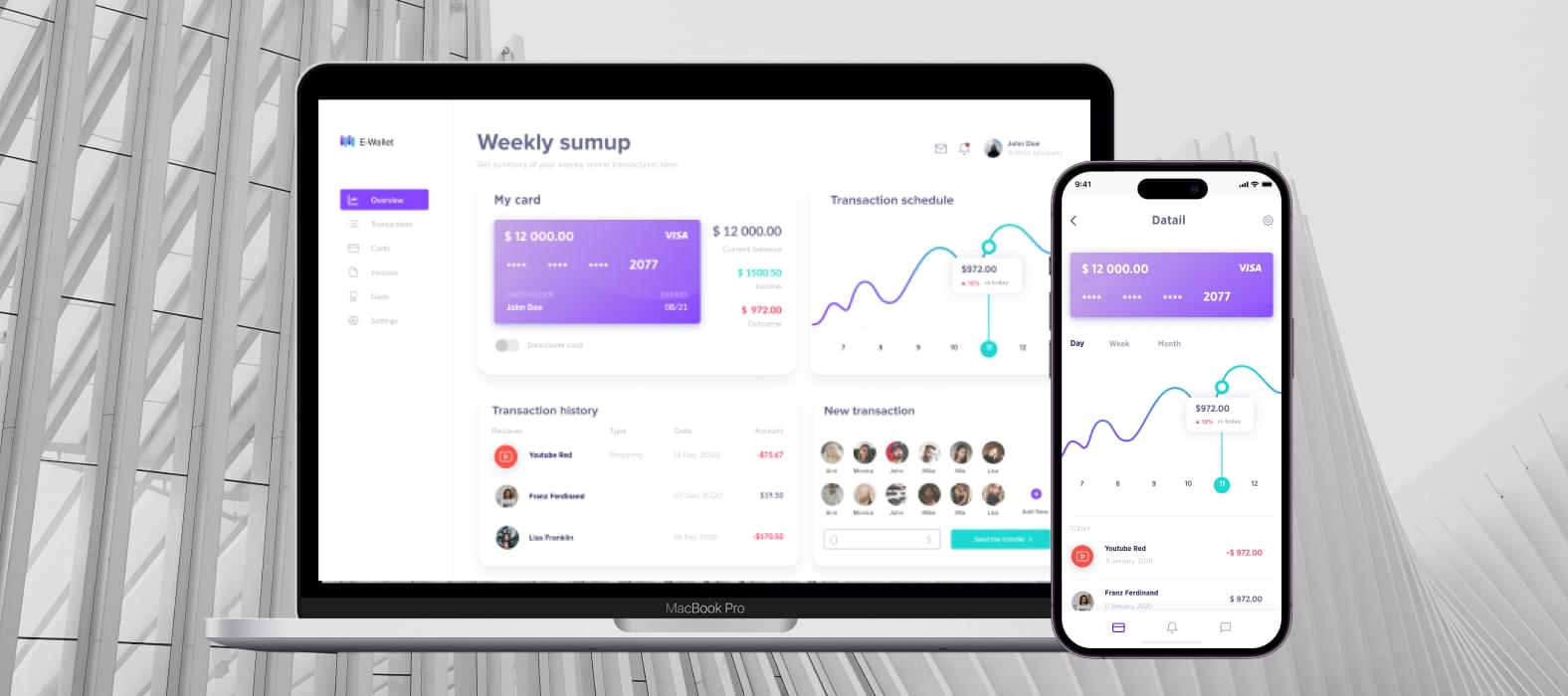

One of our clients is a fintech startup focusing mainly on innovative smart solutions for daily financial operations. Their main request was to create a financial tool, an e-wallet app, that allows users to operate money via the web, Android, and iOS smartphones using contactless payments.

The project aimed to consolidate the finest fintech app practices in contactless, cashless transactions into a single online and mobile solution, improve its security, and give end-customers an innovative digital experience. CHI Software team completed all tasks within the estimated deadlines. You can verify this by reading the details of the case.

To Sum Up

Banking in the modern era is all about digital technology, freedom of choice, and tangible benefits from every transaction you make. There should be a combination of three elements in today’s system – digital, individualization, and convenience.

Building a modern banking app takes just 5 steps. And it is easy and fast to do it with an experienced team of CHI Software specialists. Please get in touch with me if you need a brainstorming partner or have an app idea. I am always ready to help.

About the author

Anna Pronina

Business Development Manager

With over 15 years of banking experience, Anna has the expert ability to figure out efficient and modern IT solutions for her clients.