Today, investment and trading platforms are changing faster than ever and moving to a digital world. Stock buying and selling on mobile is no longer an insufficiently explored area, but the “new black” in trading.

Smartphone stock-trading apps allow investors to work from wherever they are. So-called DIY (do-it-yourself) investment is very popular with millennials, who, according to Investopedia, are active in the stock market. But other categories of individuals also pay attention to mobile platforms, so trading app development brings good income. Moreover, there are excellent prospects for the future.

We have made a guide to stock trading app development and the peculiarities of creating them. In our article, you will learn how these systems work, what difficulties and costs can be faced in the development process, and how such applications generate income for the owner.

Stock Trading Market Overview

Before we learn how to make a stock trading app, let’s take a look at the market. According to a Statista report, at the beginning of 2021, the largest stock exchange in the world is still the New York Stock Exchange (NYSE), with an equity market capitalization of over US$25 trillion. The three next-biggest exchanges are the NASDAQ, London Stock Exchange, and Tokyo Stock Exchange (but their combined market caps are lower than the NYSE).

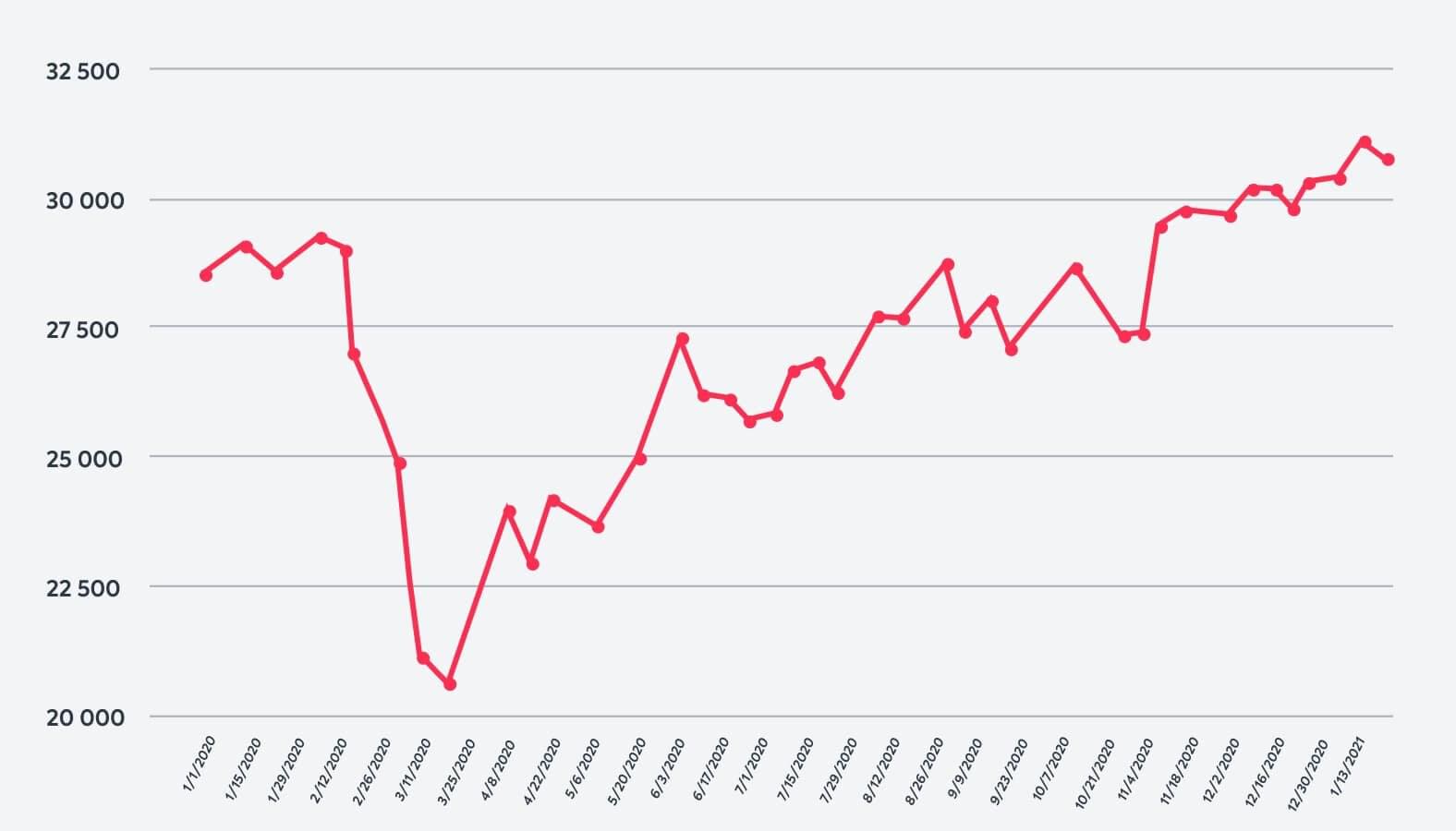

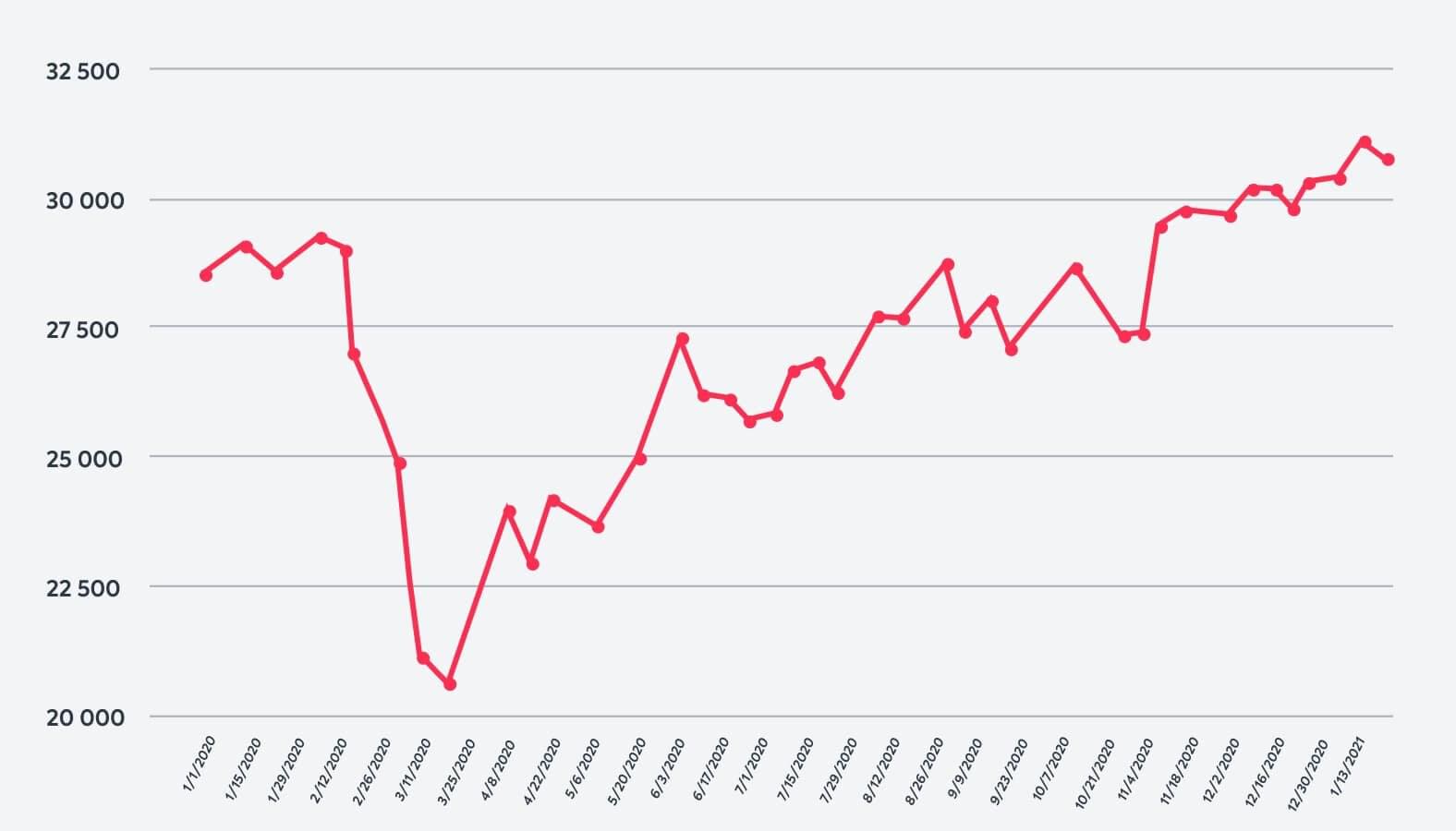

But, due to COVID-19’s influence, the stock trading market has transformed rapidly. The Dow Jones Industrial Average reported the largest one-day losses in its history. In Europe, the Financial Times Stock Exchange 100 index experienced the sharpest one-day fall in more than 30 years. Index values on the Shanghai Composite Stock Exchange, Nikkei Stock Average, and Latin America also fell sharply during the pandemic.

Changes in the Dow Jones index (Statista data) illustrate the global trends in 2020 well:

The result of these changes is an increase in the share of private online investment. Statista notes that stock trading is moving to the digital area, and 12.29 percent of the total audience are people between the ages of 18 and 29 — the millennial and Generation X groups.

The interest of a young (but already solvent) audience in investing is increasing thanks to trading apps like Robinhood and similar services. They have a tremendous penetration rate: by the end of 2019, it stood at 25.75 percent only for Android, as a Statista report shows.

This audience is used to investing using mobile services and is unlikely to return to the previous format. Traders, brokers, and other market participants are forced to take this trend into account. Therefore, the business niche of stock trading app development is becoming more attractive for entrepreneurs.

Short Overview of the Fintech Market

The fintech market encompasses a broad range of services and technologies. Its business models directly compete with banks. According to the Fintech Adoption Index from EY, more than 30 percent of consumers use two or more fintech technologies and accept the trend. According to Finextra, the leader is the United Kingdom with 42 percent. Second place goes to Spain with 37 percent, and third place to Germany with 35 percent.

Considering this, traditional financial institutions prefer to adapt to change rather than fight it. An American Banker report shows that 82 percent of U.S. commercial banks will increase fintech investments in the next few years.

Read also: How you can use AI and ML in fintech

Read more

The primary trend is providing mobile services. More than 60 percent of adults worldwide use smartphones and applications installed on iOS and Android devices. That’s why the cost to create a trading app pays off quickly enough.

Other essential fintech trends are:

- Integration with social networks. Their users report a lot of data considering interests, relatives, places of work, purchases, etc. Machine learning (ML) algorithms analyze it to personalize financial services.

- Blockchain influence. As explained in a PwC report, 46 percent of fintech enterprises and institutions invest in this technology.

- Robo-advisers proliferation. These are apps that analyze big data and help shape individual trading strategies. BuyShares notes that this product’s market has reached US$987.4 billion in 2020, with a CAGR of 26 percent, and is expected to be US$2.4 trillion by 2024. This trend should be taken into account in trading app development.

Want to take advantage of the hottest fintech trends? Get an extensive consultation on how to build a stock trading app for your business needs

Contact us

What Is a Stock Trading App, and How Does It Work?

A stock market app is an online (web, mobile, or both) system designed to make it easier to buy and sell on trading platforms, manage and update investment portfolios, and choose robust strategies. Automated trading systems allow users to have things under control the whole time, and they fit those interested in long-term investment or short-term deals.

There are two basic types of trade management software: traditional and crypto-oriented. Apps of the first kind operate “time-tested” assets like precious metals, stocks, or currencies. These systems allow users to make well-known investments, and they are the most popular and demanded by market participants.

Apps of the second type are more specific because they concern non-fiat currencies and focus on managing such assets. Using crypto-oriented applications, you can sell, buy, and conduct transactions with Bitcoin, Ethereum, Litecoin, etc. The app can provide two options for cryptocurrency assets’ exchange: centralized, with broker participation, and decentralized, via the peer-to-peer model.

Typically, trading applications have a similar work scenario. The user:

- Registers in the app and links the bank account;

- Sets up a one-time transfer or periodic deposits;

- Buys the stock once it and its current trade come up on the screen;

- Sells stocks (this option works almost the same as buying).

The Most Popular Examples of Trading Apps

This application pioneered the online stock app industry and has become an example of how to make a trading app successfully. At the end of 2020, users saw 4.3 million average revenue trades each day. Robinhood has more than 13 million customers and provides trades in almost any amount.

The core features are:

- Trades in stocks, ETFs (exchange–traded funds), and cryptocurrencies, including Bitcoin;

- User-friendly customer service chat;

- Newsfeed and notifications that allow a user to control the investment; and

- An iOS speech controller and Android’s text-to-speech output (user can activate these tools in the app).

The platform’s advantages are commission-free trades, a highly friendly interface, and fee perks that attract a young audience limited in funds. But there is a disadvantage: paid access to some investments, such as mutual funds.

A popular trading service that is convenient for newbies and useful for experienced investors. The platform’s functionality is vast, and it is expected to get bigger after merging with Charles Schwab in 2020. TD Ameritrade provides users many trading tools, such as stocks, options, ETFs, and bonds.

The app’s core features are:

- Trading via web platform or mobile app;

- Real-time quotes, price alerts, and lists;

- Access to various accounts — standard, retirement, or education; and

- Money transfer between user and app’s accounts.

The system’s pros are a robust security system; no minimum account deposit, commission, or additional fees; and an educational content library with articles and videos. Cons are the differences in tools and features design (this can confuse users) and the low interest rate on uninvested cash.

An online pioneer platform that now belongs to Morgan Stanley. E*Trade started with a California–based brokerage that offered online trading based on AOL (America Online). It is an excellent multifunctional tool for trading various assets, from stocks and ETFs to bonds and mutual funds.

The app’s core features are:

- A platform for investment choice making, portfolio building, and trading;

- Analysis tools for choosing trading strategy;

- An educational environment that provides webinars and newsletter; and

- 24/7 phone/online chat support.

The platform’s advantages are no commissions for stock and ETF trades, high-speed execution, innovative mobile app, and advanced research tools. There are some cons too; in particular, the fee for options contracts (US$ 0.65 each).

This app perfectly suits beginners due to its intuitive user interface (UI) and educational resources. The account is one of the easiest to use and set up. The Betterment menu is optimized for mobile devices, including the Checking and Cash Reserve feature and a deposit that adds to the user’s checking account.

The app’s core features are:

- Five portfolio types (users can change the strategy easily),

- Support for users’ debit cards (account reimburses ATMs and foreign transaction fees),

- Changeable assets‘ allocation, and

- Cash transfer into the reserve account with a higher rate of interest.

Betterment’s cons are a low entry threshold (US$10 minimum) and account synchronization with individual goals. Among the disadvantages is the charge of US$199+ for a talk with a financial planner and less controllable socially responsible portfolios (because they are invested in ETFs).

Business Model Canvas: Where Is the Money?

For you as a software owner, it is not enough to create your own trading app. You have to monetize it and make it profitable.

For trading apps, the most natural and obvious strategy for making money is commission. The system charges interest on deposits, user transactions, and stock transactions. This is the primary monetization strategy for E*Trade and many other applications.

Robinhood app uses a similar strategy but combines it with a freemium approach. Essential product features are free for all users, but additional features are available for a fee. It can be advanced analytics, access to a credit account, or, in the case of Robinhood, extended trading times available in the Robinhood Gold package. You can opt out of charging a commission and make commission-free trades your competitive advantage by using the freemium approach.

Alternative income sources help to make the business model more sustainable. These can be:

- Revenue for directing orders for trade execution: the income is insignificant for small retail trades, but by forwarding billions of dollars to market makers, you can make a lot of money on order flow;

- In-app ads: access to a solvent audience of investors, traders, and brokers will be of interest to many advertisers from the fintech industry, insurance, etc.; or

- Paid admission to the technology stack: for example, APIs developed by E*Trade, Marketstack, and Intrinio are actively used to build similar products.

Explore how to create a trading app with high-speed monetization and significant business value

Contact us

Challenges and Legal Issues

To create a well-functioning system, you must know how to make a stock trading app and resolve all legal issues. First of all, this concerns compliance with the PSD2 Directive, SIPC, FINRA, and similar norms.

If you have an authorized brokerage business and want to expand into mobile markets, the legalities challenges will be easier to solve. But, in the case of a startup or newly established company, you have to think over the legal issues beforehand.

Consider the following issues:

- As a stockbroker, you’ll be dealing with securities and money. Therefore, you’ll need to obtain a license from the regulatory body in the country in which your trading platform will be operating. For instance, in the United States it is the Securities and Exchange Commission (SEC).

- To increase credibility, you have to join investor protection programs and regulatory institutions like SIPC (Securities Investor Protection Corporation) and FINRA (Financial Industry Regulatory Authority). Particular background check requirements depend on bodies, states, and countries.

- You’ll have to put up with a thorough review of all the data you provide and follow the rules to protect consumers’ rights of payment services. You have to fulfill the requirements of the PSD2 Directive if you want to work in the EU market or similar rules of other regions of business presence.

One of the priority considerations of trading app development is security. You have to protect against external attacks, theft of money, and user accounts information. Your app must have multifactor authentication, including biometric access such as Touch ID and face recognition.

Other security measures to consider:

- Proactive mitigation of security risks such as XML external entities and cross-site scripting;

- Encryption of 256-bit AES (advanced standard) and next-gen firewalls;

- Real-time threat intelligence and fraud prevention based on artificial intelligence (AI) and machine learning (ML) tools;

- Secure application programming interfaces (APIs), which you integrate with the app as third parties;

- “Compliance as code” for testing and security in the CI/CD (Continuous integration & Continuous delivery) timeline; and

- Cloud computing or hybrid (distributed) cloud deployment.

When you start to develop a trading app, you also have to ensure the system’s immediate responses to market changes and user actions. Therefore, you must take care of real-time processing of vast amounts of data, and AI/ML tools can help you.

Features of Trading Applications

In most cases, trading applications are similar in basic features. To gain a competitive advantage, you have to “polish” core functionality and add advanced solutions that appeal your company or startup’s customers.

Our experts will advise you on how to make a stock trading app with a set of features customized for your business needs

Contact us

Check-in and user profile

Standard practice for web and mobile apps is registering an individual account. Multifactor authentication is used for logging in after the profile’s creation. An additional advantage is a registration and login through social media accounts.

The profile contains user info and preferences. The user should:

- Edit and update settings and profile data;

- Track payments, transactions, and flow of funds on the personal page; and

- Monitor all quotes and updates in real-time.

A handy add-on feature is sorting and filtering. With it, the user will be able to display data in a convenient format.

Stock trading

Trading is the core feature and the reason why the user installs your app. You have to provide tools to execute orders, monitor market positions and the flow of funds, and display real-time data.

It is crucial that the user track and edit transactions on shares or mutual funds, companies’ profiles, and other relevant information for investment decisions. To make your app more convenient, you should offer a list of updatable portfolios available in real-time.

Wide range of assets

The more assets for investment are supported, the higher the number of users it can have. So try to expand your line of trade stocks, ETFs, and other funds. It is also recommended to add a deposit feature with the ability to check its status in real-time when you develop a trading app.

To enable users to find assets easily and view active stocks or their present market rate, provide a search feature.

Analytics and advisors

A great way to distinguish your app from others is to implement the analytics and review of statistics on trades, transactions, and investments. Using these tools, traders will observe their results in performance charts and reports.

You can expand the analytics functionality by implementing a robo-advisor. This ready-made software helps users with creating portfolios, reinvesting dividends, or managing taxes. Robo-advisors like Acorns or RobotFX Fluid also are able to integrate with customer relationship management (CRM) systems, banking research systems, and other financial services software.

Notifications and news

Integrated push notifications give users an idea of how stocks have moved. Consider in advance how often you will send a notification. They should be timed in a proper way to not distract users.

A newsfeed helps to keep investors informed. It is a crucial stock trading app feature, especially for new and amateur traders. The stock market is susceptible to local or global events, which is reflected in the quotes. Therefore, players need to always be aware of the latest events. With a newsfeed, users will get real-time info on exchange rates, initial public offerings (IPOs), mergers and acquisitions (M&A), etc.

It should be noted:

Most stock trading features require complex technical solutions. To simplify the development and implementation of all functions, you can use ready-made SDKs (Software Development Kits) and APIs. Many platforms provide such tools and documentation with code examples, descriptions of requests and responses, and detailed explanations of parameters.

For instance:

- E*TRADE provides an API to manage user account data, retrieve option chains, search for exchanges, and get quotes;

- Marketstack’s API helps to receive and parse data from more than 70 global exchanges; and

- Intrinio provides an API that gives you access to real-time and historical price data and SDKs for Python, JS, Java, etc.

How to Build a Stock Trading App

Now let’s examine how to build a stock trading app from the moment you come to a software development company. The process includes the following phases:

- Formulation of the development approach and tools;

- The development process; and

- Testing, delivery, and maintenance.

For fintech apps, the generally accepted methodology of work is Agile. Following this approach, small, cross-functional teams work together in close collaboration with application owners. All business requirements are fixed in product backlog documentation. In most cases, the development team consists of UI/UX designers, frontend and backend developers, quality assurance (QA) and DevOps engineers, and the project manager (PM).

Do you need to start stock trading app development as quickly as possible? We will assemble a team in the shortest time!

Contact us

Discovery and research

At this stage, the idea of a product is validated and turns to a business model and development roadmap. To initiate the project, you need to hire a professional team that specializes in financial software and understands how to create a trading app that meets all legal requirements, user needs, and your business goals.

You have to onboard business analysts (BAs), marketers, IT architects, and a project manager in the research stage. To configure requirements and features of a basic app, the minimum viable product (MVP), the team is doing:

- Discovery sessions to understand what app users need and what is valuable for them;

- Market research and marketing strategy development; and

- Features’ prioritization using pain and gain map, prioritization matrix, and other tools.

Discovery and research give experts all the info they need to define the project scope, app’s features, design strategy, and line-up.

Formulation of the development approach and tools

Now it’s time to define the application architecture and the platform type. To choose the best development approach, experts study all the pros and cons of programming languages, rules, APIs for performing large-scale automated operations, and other tools and solutions.

Developers consider the following “building blocks”:

- Mobile app’s platform. You can choose native (Android and iOS), hybrid, orcross-platform solutions. The final decision depends on your timing, budget, business needs, and many other factors. As a rule, native mobile apps offer better user experience, security, and performance, but cross-platform solutions can be more cost-effective and faster to develop.

- Mobile site or web application. The mobile app is a more preferred, convenient, and modern solution for a trading app. Experts often advise clients to choose it instead of a mobile site. However, to cover more customers, you can offer them a web application or a website.

- Managed cloud services. Platforms like PaaS (Platform-as-a-Service) and MBaaS (Mobile-Backend-as-a-Service) can expedite the development and reduce time and costs. The professional team will help you choose the most suitable provider for you.

- Third-party APIs for core and non-core features. Their proper design and development will enable you to use the full range of your business capabilities. Experts also choose tools for API hosting, documenting, proactive security risk mitigation, NoSQL databases, etc.

UI/UX design

Stock trading is a specific area, and designers will have to consider many important points to make the app easy to navigate and manage. To make an intuitive UI for a mobile app, you can follow the Material Design Guidelines for Android and Human Interface Guidelines for iOS.

The rules for web app UI development differ from solutions for smartphones with modern resolution and bezel-less displays. You can follow Jakob Nielsen and Rolf Molich’s heuristics, Ben Shneiderman’s “golden rules,” or other widely used approaches.

One of the crucial a spectsis graphics in the app. Digital products related to the stock market are characterized by the constant use of line and bar charts, candlestick graphs, stochastic oscillators, and other visual analytics. You need to understand which of them to choose for each indicator (open, high/ low and close prices, margin, etc.). For example, line charts are simple and convenient for novice traders, while candlestick graphs aggregate different data and are suitable for experienced professionals.

The development process

The actual development process is divided into several lines: mobile and web, frontend and backend, iOS and Android, etc. The actual development process is divided into several lines: mobile and web, frontend and backend, iOS and Android, etc. For teams working on trading platform modernization or building new fintech solutions, these parallel development tracks help ensure scalability and smooth performance across all devices.

To create a native app, you’ll need mobile development services. The most common practice is Swift or Objective C language and Xcode (IDE for Apple) for iOS apps, and Java, Kotlin, or JavaScript language and Android Studio for Android products.

Frontend development is used to create a client part of the app. Most often, developers use CSS, JavaScript, and:

- HTML5 or other markup languages to structure and present the content;

- Frontend frameworks like Bootstrap;

- Angular, Vue.js, and React (with appropriate technology stack) as JavaScript frameworks and libraries for complex solutions.

You also need backend development to manage the architecture, software logic, databases, and servers. The choice of a programming language depends on your priorities and technical decision. Typically, these are Ruby, NodeJS, Python, Java, or .Net. Developers also need to set up work with databases — the relative ones (MySQL, PostgreSQL, Oracle, MSSQL) or distributed ones like SingleStore or DolphinDB to store linear and transactional data.

The backend structure consists of several essential elements. Among them are user account management, payments proceeding, newsfeed and alerts setup, transactions, and so on. You need to integrate all the third-party APIs to implement these features quickly and easily. When working with the APIs, you can use different tools, for example:

- Java and .NET as a language for writing code;

- Postman as a tool to expedite API development; and

- Swagger to document APIs.

Of course, we’ve mentioned several possible and frequently used examples, and there are many other options to choose from.

Are you looking for a cost-effective and customized solution? Our experts will select the optimal technology stack for your application

Contact us

Testing, delivery, and maintenance

After MVP and full-fledged app development, engineers conduct complex testing across platforms and devices. QA (Quality Assurance) services help identify and eliminate all bugs and establish the correct function performance.

To make testing easier, engineers use a mobile device and browser labs on the cloud (e.g., pCloudy), XCTest for iOS apps, and Espresso for Android. QA, quality control, and functional and non-functional requirements testing ensure that the system is defect-free and can work under the required traffic and load.

Now it is finally time to deliver your stock trading app and place it in stores. But it isn’t the end of the story. You have to ensure quality technical support and regularly update your product to keep it competitive. Responsible development companies typically offer maintenance services for their products as a natural continuation of the collaboration. It guarantees fast updates, quality technical support and troubleshooting, and more straightforward implementation of new features.

Costs to Build a Stock Trading App

Now that we’ve examined how to make a trading app, it’s time for a question that’s no less important: how much can it cost?

The price depends on the time that the development team needs in order to create the full-fledged application. The costs are determined by the solution complexity, features set, and additional factors, such as connecting payment gateways, cloud services, robo-advisors, etc. On average, you can estimate the time as follows:

On average, developing a native Android and iOS app takes 5–10 months, and a web app takes 4–9 months. The time cost needs to be adjusted for the average hourly rate of programmers, designers, QA engineers, and other specialists.

The total price depends on the company’s location and the model of engagement between customer and contractor. Median market hourly rates vary from US$15–20 to US$100 or more. So, the cost to create a trading app can be either US$25,000 or US$300,000, depending on a combination of factors. The average price of a mobile application similar to the ones mentioned in the article is US$55,000.

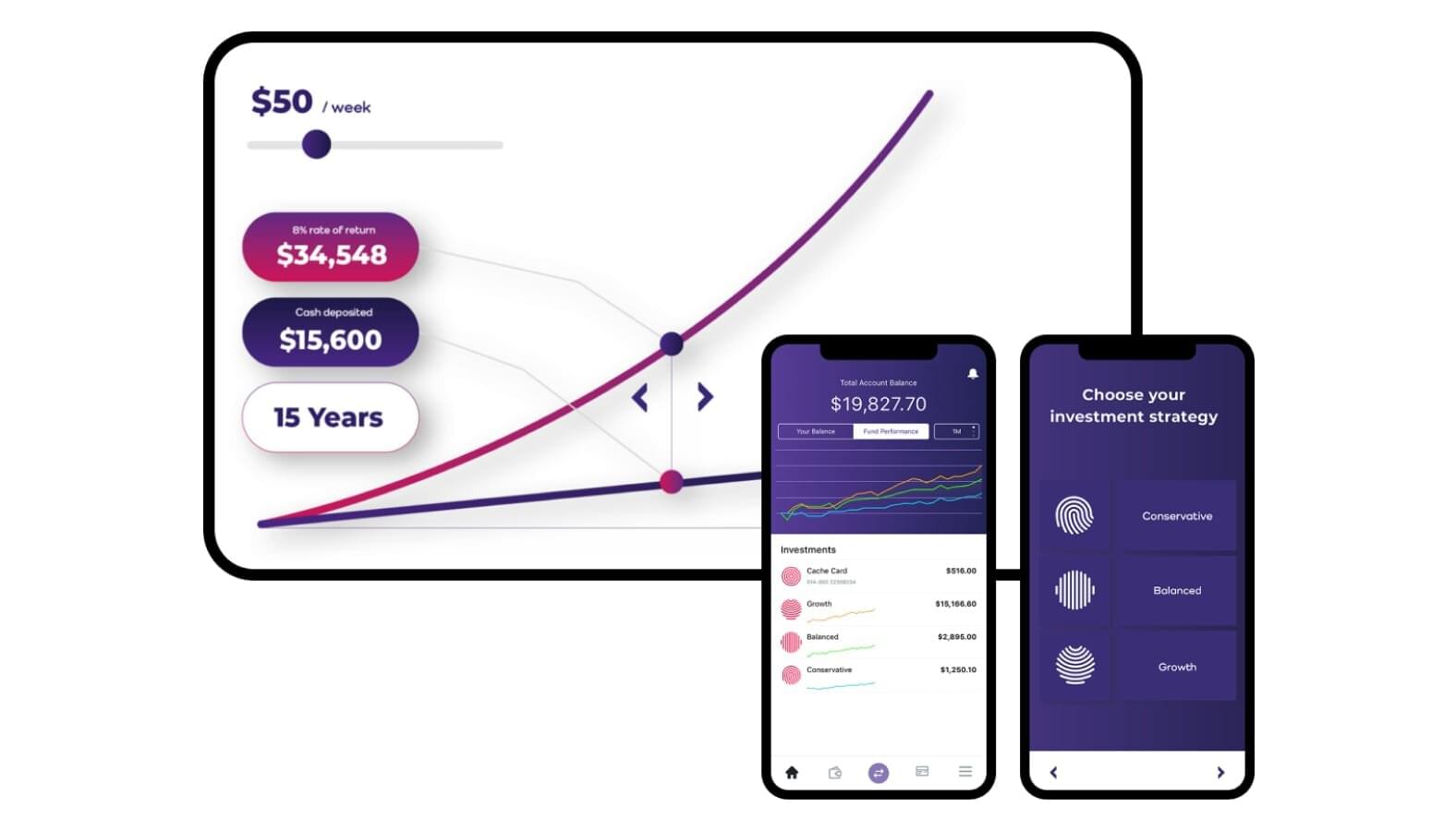

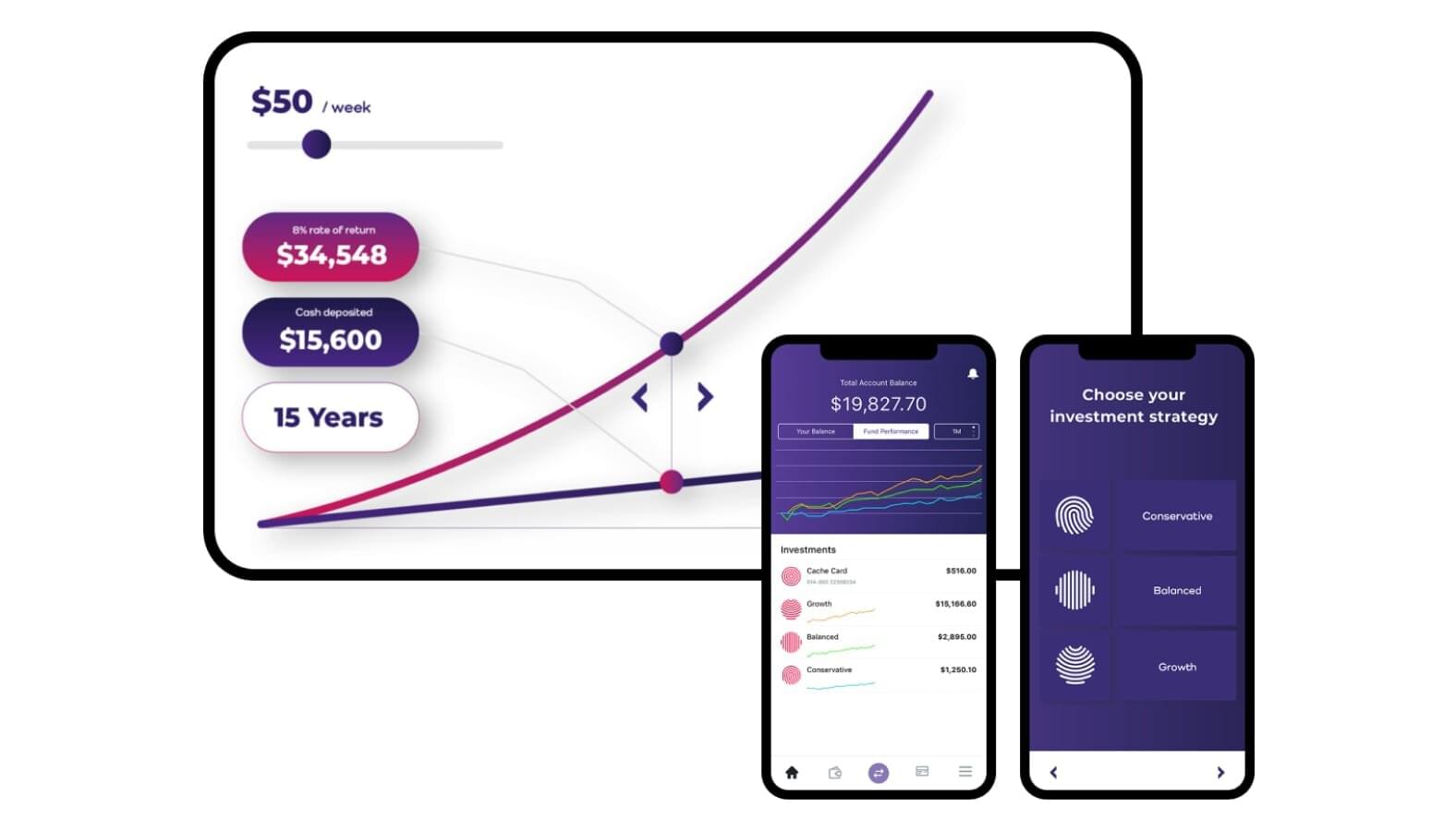

CHI Software’s Case Study

Now let’s illustrate the use of different technologies and tools with the CHI Software app example.

Development of a backend for an investment app that makes the trading process clear and easy for an average customer:

We were tasked with developing a fintech solution that simplifies investing for clients with different levels of trading experience. It was necessary to improve platform functionality, integrate with EML as a payment provider, ensure PCI compliance, and make investment flow control transparent.

CHI Software’s team developed the backend part of the project from scratch, using the following technologies: Java 11, PostgreSQL 9, Hibernate 5, FlyWay (design, migration), Spring-Boot 2, OrikaMapper, Docker, Kubernetes, AWS, Maven, Test Containers, Payment Provider Integration.

The result:

- App users can easily add money to the Cache account, set up an investment portfolio, adjust/change options, and withdraw investments;

- The platform’s functionality has been improved by savings accounts that generate a compelling return on investment in real-time;

- PCI compliance was implemented successfully: we kept the banking data on certain services only, used an internal payment gateway service for the transactions, and worked with card identification and partially encrypted card numbers; and

- All cash flow in credit/debit cards, investing, and receiving cashback tracks transparently, and integrating with EML is maintained correctly.

| Work Type |

Time Costs For a Native Mobile App (Hours) |

Time Costs For a Web App (Hours) |

| Setup Environment |

15-25 |

15-25 |

| UI/UX Design |

410-710 |

430-740 |

| Development (Including Backend) |

1330-2470 |

1050-2040 |

| Quality Assurance |

80-100 |

80-100 |

| Release and Delivery |

30-40 |

30-40 |

| Total |

1865-3345 |

1605-2945 |

Conclusion

With our answers to the critical questions about how to build a stock trading app, you stand a good chance of becoming a player in the investment app marketplace. Following the article’s advice, you can already try to create your platform. But keep in mind that these applications have many complications. All the issues must be wisely solved if you want a high return, security, and user satisfaction.

At CHI Software, we offer the broadest range of technologies and tools, combining them into customized solutions that are perfect for the client. Using all the advanced fintech developments, we create digital products that take your business to a fundamentally new level. Get inspired by promising ideas, find the best ways to implement them, and become more successful with us.

Let’s turn your idea into a successful stock trading app

Contact us

Rate this article

22 ratings, average: 4.5 out of 5