You’ve seen it yourself – technologies transform literally every industry, changing markets and customer expectations. What do banks and FIs have to do in such circumstances? They surely need to keep up with innovations.

Let’s look at the numbers. According to PwS, 81% of banking CEOs have concerns about the speed of tech changes. At the same time, workflow optimization, pandemic trends, and high security demands are still the biggest challenges for market participants.

Robotic Process Automation (RPA) in banking can be a powerful tool to cover numerous industry needs and keep enterprises “up to date”. So why don’t we raise this issue right now?

We’ll guide you from a basic definition to particular use cases of RPA tools in banking and their implementation into your business processes.

What Is Robotic Process Automation in Banking?

RPA in banking and finance is a set of robotic activities that replace or augment routine human tasks in the financial domain. Technologies allow companies to refocus their priorities. With them, managers can channel most of their attention to the critical organizational tasks that require creative brainwork.

RPA functions are limited per se – they can only help with the simplest actions like logging in to the system or ordering files. But many companies have gone further, and now they implement artificial intelligence (AI) to expand RPA features and gain another competitive advantage.

Read also: How to build a fintech app with our guide

Read more

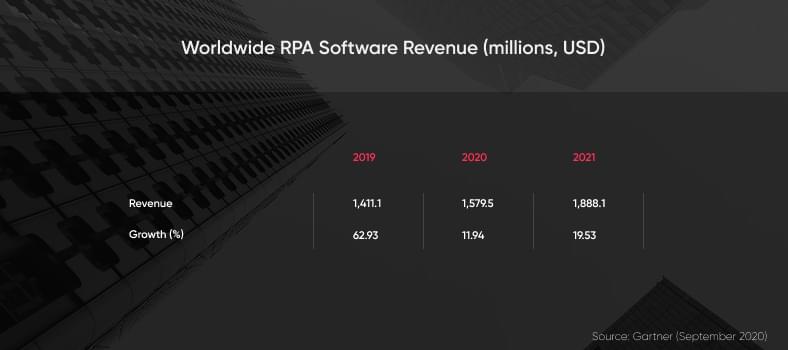

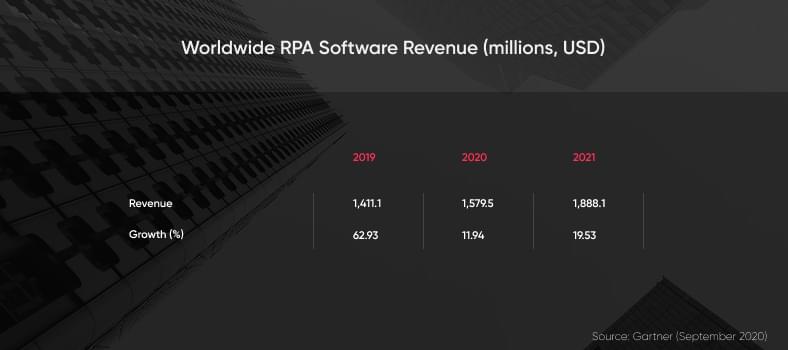

Internal and external business issues make the global RPA market flourish. By the end of 2021, it is expected to reach 1.89 billion USD – it is a 19.5% growth compared to 2020 (Gartner).

Even the harsh pandemic reality did not stop the niche’s growth. In fact, new challenges aroused even more interest in the RPA software. Gartner predicts that 90% of large businesses will adopt RPA for certain activities by 2022:

“Gartner anticipates RPA demand to grow and service providers to more consistently push RPA solutions to their clients because of the impact of COVID-19. The decreased dependency on a human workforce for routine, digital processes will be more attractive to end-users not only for cost reduction benefits but also for insuring their business against future impacts like this pandemic.” – Cathy Tornbohm, distinguished research vice president at Gartner.

What’s more, a lot of large businesses will increase their RPA capacity through 2024. That said, the highest spending will come from companies that buy add-ons for their existing RPA infrastructure.

Benefits of Robotic Process Automation for the Banking Industry

Why would so many managers and business owners rely on innovative robotic technologies? The thing is, they clearly realize what they get in exchange for RPA implementation.

-

Cut in spending

It concerns both time and money. In the long run, robotics is more cost-effective than human work. The money you pay to an employee for performing routine tasks will soon outweigh the cost to develop a robotics solution for the same work.

What’s more, robots don’t need breaks – they can continue working at night and never get tired. Your company reduces spending and gets optimized workflow at the same time.

-

Improved security

RPA tools in banking allow you to manage client data more effectively, following the KYC process. Usually, it takes a lot to collect all the details about a particular person – managers spend hours checking numerous databases. For technologies, it’s only seconds. Faster and more thorough check-ups benefit both banks (which get a more secure infrastructure) and their clients (who get prompt feedback from a bank).

Read also: Introduction to Natural Language Generation

Read more

-

High scalability

Robots add scalability to internal business processes. For example, they can easily cope with high volumes of data with no stress, especially at busy hours. While they are at work, you can use the power of the human brain for the bigger goal – strategic business growth that requires focus and creativity.

-

Minimum infrastructure

When implementing an IT project, you have to create a new infrastructure for it by default. But this rule doesn’t apply to RPA innovations – this time, you’ll need minimum preparations. All you have to do is to use the existing infrastructure and build robotics upon it.

-

Enhanced engagement and customer satisfaction

RPA is beneficial for your customers as well, and trust us, they will notice the difference. Starting from customer assistance (chatbots) up to optimized data processing time – robotics is an essential part of it.

How AI revolutionizes traditional tourism

Read more

Before now, lots of operations used to require a client to come to a bank branch and communicate with managers. Chatbots can take over a part of this communication with no need to leave home.

-

24/7 availability

No matter what your goals are, technologies will be by your side any time of the day ready to accomplish your tasks. And what’s more important – they are equally productive at night and in the morning.

RPA Opportunities in the Banking Sector

Now, how can you profit from all the advantages listed above? There are several scenarios that banks need to try out.

-

Communication with customers

Huge numbers of queries from clients are among the fundamental pain points for financial institutions. But the good news is that lots of questions are typical and can be assigned to smart technologies in the form of chatbots. While they answer queries in real time, human support specialists can address only advanced issues.

-

Validation of requests and applications

Not so long ago, it took several weeks to validate credit card details. Long waiting times and overdue deadlines frustrated hundreds of customers, but banks couldn’t sacrifice financial security. Technologies remove this struggle altogether.

Read also: What is loan lending app development?

Read more

Know Your Customer (KYC), credit card applications, or mortgage processing – RPA in banking covers it all. Algorithms analyze available databases several times faster and with a higher accuracy. By removing the human factor from data processing, you can achieve high customer engagement and refine working processes in the support department.

-

Invoice processing

Another daunting task for bank managers is processing accounts payable. Optical Character Recognition (OCR) technology can verify data and digitize paper documents to form invoices. While robots are busy with these repetitive tasks, bank managers can focus on the issues that require an individual approach.

-

Account closure optimization

Account closure is usually initiated by customers, but banks also do that if they don’t get proof of funds. RPA tools can send automatic reminders to customers to provide the necessary documentation. At the same time, these tools can process account closure requests from clients by following a prescribed list of steps.

-

Fraud detection

Technological development leads to the growth of fraudulent activities across many industries, including finance and commercial banking. Obviously, bank employees can’t provide verification of every transaction for security purposes, but robotics can.

Algorithms detect fraudulent transactions, flag them, and then pass a notification to the security department. Meanwhile, suspicious accounts can be put on hold until employees manage this issue.

-

Automated regulatory compliance

Keeping an eye on every regulation is obligatory for financial institutions and extremely challenging at the same time. Technologies can manage this process by following rule updates and then checking transaction compliance – this process is called Regulatory Technology (RegTech).

-

Optimized reporting

Reporting is another stumbling block for the financial industry. Have you counted how many reports are generated in your company every month? Technologies can help you with each of them by collecting and organizing necessary information in one document. It releases a lot of working hours for employees and, more importantly, provides accurate reporting data for further decision-making.

Want to use RPA as your business advantage?

Contact us

RPA Examples in Banking and Finance

Robotics has started a digital transformation in the financial sector several years ago, so now we can review the most successful use cases.

Radius Financial Group: intelligent mortgage processing

Back in 2016, Keith Polaski (cofounder) and David O’Connor (CTO) of Radius started investigating AI and automation solutions to ease up mortgage processing. The goal was to minimize human work.

Eventually, the company opted for RPA to automate as many routine tasks as possible (for example, sending emails to those involved in the mortgage application).

The same project also implied using AI technology to extract valuable information from mortgage documents. To do that, the AI vendor used image detection technology that can scan and “understand” around 200 types of forms used in mortgage processing.

Now, the complex automation system of RPA and AI can recognize and process up to 94% of documents sent to the company.

The AI part is synchronized with the RPA tools, LOS (Loan Origination System), and other instruments to provide a high level of automation. Further on, this innovation helped to optimize working processes and gain more agility during the pandemic.

OCBC Bank: robots for processing applications and generating reports

OCBC Bank located in Singapore has started its robotics transformation back in 2015. Two years later, the company released an official statement about Bob and Zac – two robots employed for different types of tasks.

Bob assists in processing housing loan restructuring applications, while Zac helps to generate sales reports. Both of them perform easy monotonous tasks, which are time-consuming for human employees. The bank staff are now focused on advanced assignments aimed at improving customer service.

Bob completes one application in one minute compared to 45 minutes of human work. Zac generates a sales report in 12 minutes – while it takes more than two hours from a bank employee.

Heads of E-Business and Finance Departments state that robotics has dramatically improved the existing workflow and decision-making. It also contributes to employees’ motivation, as now they can dedicate more time to complex and creative work.

Sumitomo Mitsui: overall workflow optimization

Sumitomo Mitsui Financial Group (SMFG) and Sumitomo Mitsui Banking Corporation (SMBC) created the Productivity Management Department in 2017 to achieve higher corporate efficiency and productivity. The key asset of the future activities was RPA implementation.

At the beginning of the RPA transformation, around 200 operations were removed, releasing 400 000 working hours annually. The bigger goal is to free up 3 million working hours, which equals the workload of around 1500 people.

The work comprised several steps:

- Working processes in all departments were evaluated.

- Unnecessary or outdated processes were removed altogether, while tedious tasks were integrated.

- Severaltasks weretransformed for the RPA transition.

- The firstRPA banking processeswere integrated into the existing workload.

BNY Mellon: robots to automate everyday operations

The Bank of New York Mellon Corp is another company that decided to keep up with the market innovations. It took 15 months for the organization to deploy 220 robots across various business activities.

These bots are used for different purposes, such as responding to requests from auditors or correcting data mistakes in fund transfers.

The bank states that fund transfer bots alone save the company 300 000 USD annually by eliminating human tasks.

Just like in other examples of RPA in the banking industry, BNY Mellon aimed at optimizing the staff workload. At the same time, faster financial services provided by bots improve customer experience and reduce the bank’s outgoings.

For instance, bots answer requests from auditors within 24 hours. Previously, the same response took 6-10 business days. The work involves checking the data in six IT systems, which is easily achievable for technologies but not for the bank’s personnel.

KeyBank: mortgage originations,processing requests, and sorting real estate capital document

The main role of KeyBank’s digitization was to simplify existing internal and external processes. Employees can focus on client-centric activities, while clients enjoy an optimized experience.

Starting in 2017, the company has tried out several RPA applications in banking, such as simplifying credit requests or updating the client’s account automatically when its status changes.

KeyBank continued employing bots in 2020 when a lot of small businesses got stranded by the pandemic. Robotics helped the company with loan processing within the CARES program, which eventually covered 1000 FTE.

Bots manage more than 180 processes and 2400 tasks every day, which equals the work of 300 full-time employees.

As of lately, the bank’s bots are used in three ways:

- Mortgage originations. Bots control document quality and conduct regular check-ups at night so that by 9 a.m. documentation is ready for further activities performed by human employees.

- Requests processing. During a crisis, when many clients require payment delays, bots assist employees in decision-making. By collecting data from other systems, bots manage a bigger portion of incoming requests.

- Real Estate Capital document sorting. Following the predefined terms, bots classify documentation received by the Real Estate Capital Department.

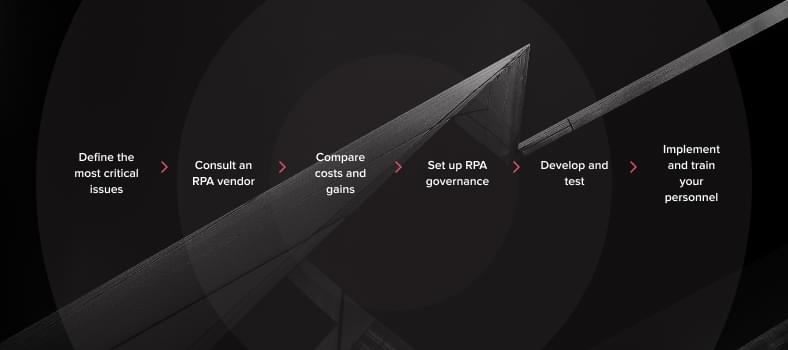

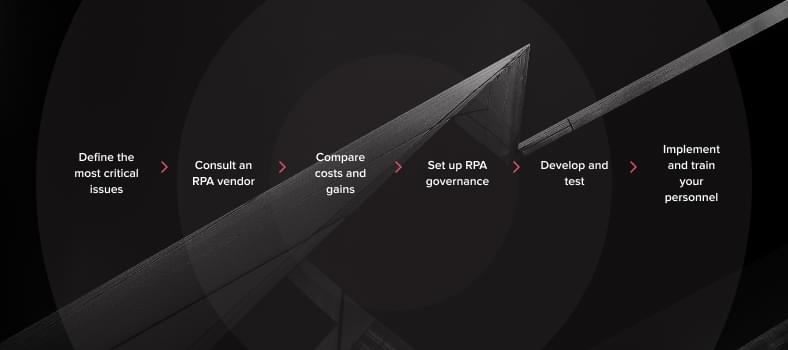

6 Steps of RPA Implementation in Banking

It’s time to get down to business. Robotic process automation in the banking industry requires a systematic step-by-step approach. This is what you should consider.

Step 1. Defining the most critical issues for automation

If you’re reading this article, you probably know what organizational issues need tech optimization. In case you’re not sure, it’s the right time to distinguish the weak spots. We recommend focusing on one or two points first.

What operations take too much time? What does your staff do daily? Are there any complaints about your services from customers? Answers to these questions can give you ideas about the most critical problems to solve.

Step 2. Consulting an RPA vendor

This one is crucial. Basically, this step impacts all of the following activities. When talking to tech specialists, discuss these points:

- The list of features. Most likely, this list won’t be too long at the beginning. Make sure to thoroughly explain why you need RPA and what manual processes it should cover. Provide as many details as possible.

- Expectations. Ask the vendor for the time and cost estimation and discuss what you will receive by the end of each project milestone.

When it’s done, make sure your agreements are documented and can be addressed at any moment.

Step 3. Comparing costs and gains

All banks using RPA have unique needs and, subsequently, unique results. No one can say for sure that it’s the right time for your company to start robotic process automation except yourself.

Read also: How to build a banking app

Read more

At this stage, you have to consider the following points:

- The cost of the RPA development,

- The number of working hours that can be saved with the new software,

- Salary expenses you save by employing RPA,

- Possible ROI.

If it takes too much time to cover RPA expenses now, it’s better to shift your focus from investing into robotics to improving other processes.

Step 4. Setting up RPA governance

This point is often overlooked by organizations because everyone is thinking about technologies but not about the people behind their implementation.

Every bank or financial institution should have a managing unit responsible for a successful RPA campaign and negotiations with RPA experts. This person or a group of people will prepare the business infrastructure for the innovation and explain the existing workflow in detail.

Step 5. Development and testing

This part of the work is on the vendor’s shoulders. But keep in mind that the process can slow down if you don’t have transparent communication. At the beginning of the project, discuss how often you will get updates and what messengers and task trackers you will use to keep up with the progress.

Also, do not hurry the team to finish the work – coding should go hand in hand with checking and testing. It is necessary to guarantee high quality and prevent software errors.

Step 6. Implementation and training

Finally, your RPA solution is ready to meet your business face to face. At this stage, the vendor closely collaborates with the RPA unit of your organization and provides training for company workers. It is important to remember that robotics can’t manage itself – your employees should be fully-equipped for that.

More often than not, banks and FIs don’t limit themselves to one RPA solution – they continue this innovative journey. But even if you don’t have further plans for tech development, your robotics software will need ongoing support from the vendor.

Our Bonus Tips on RPA for Banks and FIs

CHI Software has been working in the fintech niche for several years. Now, we are sure that the finance industry is among those benefiting the most from innovative technologies. If you’re up for new RPA opportunities, keep in mind our tips:

- Be ready to wait. Don’t be surprised if you hear about the deadline of three months and more from the RPA vendor. Automation does take time, and the more complex a solution is, the more time it requires. Thus, a multipurpose solution can take up to a year to develop from scratch.

- Think about different scenarios. One operation can have several scenarios, and it’s important to consider them all before development starts. If at some point employees need to interfere in the bot’s work, it means some minor actions were overlooked.

- Measure RPA impact on your business. As soon as the implementation is over, start measuring the time required for a robot to complete an operation and the number of operations finished daily. These figures help to realize if you’re on the right path in your implementation journey.

Conclusion

It’s been around four years since banks started active RPA implementation. As of now, robotics can be applied to pretty much any repetitive operation. Here’s what we know about it:

- The global RPA market is expected to grow by 19.5% this year compared to 2020;

- The most common RPA benefits for banks and financial institutions are reduced time and money spending, improved customer experience, and optimized working processes;

- Robotic process automation examples in banking include processing and answering typical customer requests, validating applications, fraud detection, optimized reporting, and others;

- Before addressing an RPA vendor, you should identify the most critical issues in your workflow and describe them from top to bottom considering multiple scenarios;

- You should compare operational costs and gains to make the final decision on RPA banking processes;

- In this article, we’re reviewing how such organizations as Radius Financial Group, OCBC Bank, Sumitomo Mitsui, BNY Mellon, and KeyBank have implemented RPA innovations.

About the author

Polina is a curious writer who strongly believes in the power of quality content. She loves telling stories about trending innovations and making them understandable for the reader. Her favorite subjects include AI, AR, VR, IoT, design, and management.

Rate this article

22 ratings, average: 4.5 out of 5