Loans designed to balance temporary money shortages are an integral part of a market economy. When requesting funds through a conventional method of applying, borrowers have always faced bureaucratic, organizational issues that are highly tedious and time-consuming to resolve. But getting loans is quick nowadays due to peer-to-peer (P2P) lending mobile applications.

Technologies transform our lives, and apps offer end-to-end solutions for easy application approval and money disbursal in just a few clicks. In this article, we will provide an overview of the P2P lending systems, detail the benefits they bring to borrowers and lenders, discuss how to create a money lending app, and figure out its features and developing costs.

Loan Lending Market Overview

The 2020 macro trends have negatively affected the credit market. As noted in the Global Lending Market Report 2020–2030, the 2020 annual growth rate (CAGR) indicator decreased to -1.9 percent, as common value dropped from 6,875.5 billion USD in 2019 to 6,751.3 billion USD by the last months of 2020.

Simultaneously, all lenders are forced to reduce loan rates. Debtwire Par notes that more than half of the loans are being issued at a rate of at least 95–98 percent lower than in previous years.

Despite the activity slowdown in H1 2020, the market demonstrates strengthening, and from July 2020, leveraged loan issuance is increasing on both sides of the Atlantic. White&Case’s Debt Explorer notes that for the first half of 2020, the level has reached 451.5 billion USD in the United States and 139.3 billion USD in Western and Southern Europe. In Latin America, loan volume has reached 7.8 billion USD, and the Asia-Pacific area, 15.7 billion USD.

The global and national markets still demonstrate a decline, but experts predict a fairly quick recovery, and the number of borrowers consistently grows. According to the Global Lending Market Report 2020–2030, the global lending market is expected to reach 7,929 billion USD by 2023.

How Does the Peer-to-Peer Lending System Work?

The term peer-to-peer means loans issued and received by individuals directly — conventional financial institutions aren’t involved. The rates can be fixed or assigned, and participants are entities or individuals from any of the transactions’ parties.

Now, the lending process is most often organized in the P2P loan app’s environment. Online systems are linking debtors and investors willing to lend. Mobile applications provide a comfortable environment where you can be a lender or a borrower.

Getting a loan comes down to a few simple steps:

- Applying for an online loan using the app developed for the lender company or other owner;

- Screening the borrower’s creditworthiness according to lending platform requirements;

- Getting a credit decision — in most cases, it takes 1–5 working days, but can be as quick as 10–40 minutes;

- Signing a contract and receiving the money.

A borrower makes a loan payment each month or sometimes each week, and the fee is determined by the repayment plan. These apps are most needed by “angel investors,” startup funding, stock firms, venture entrepreneurs, and similar businesses.

Benefits That P2P Lending Apps Offer

The best thing about mobile applications is availability 24/7. In fact, loan apps are like “banks in your pocket.” Mobile software is available for iOS and Android devices and provides opportunities for fast access to money, easy-to-do transactions, and many other benefits.

Read also: Robotic process automation (RPA) in banking

Read more

Mobile financial applications provide a high security and data privacy level, which is crucially important for any system that operates finances. Money–lending applications usually use an encrypted route, and clients’ transactions are performed safely. Passwords and personal accounts help to keep data confidential, and customers’ information is secured.

Benefits for Borrowers:

- Speed and simplicity: borrowers often get money on the day they apply, and, due to the UX interface, can navigate features easily;

- The complete digital process — all the operations are performed remotely;

- Flexible interest rate and lower security requirements;

- Transparent accountability;

- Qualified service and support inquiries are dealt with quickly.

Benefits for Lenders:

- A convenient, safe financial platform through which to invest and earn. Potential borrowers are thoroughly inspected; they must upload scanned passports and tax identification numbers;

- High investment safety level: user’s solvency shows due to a special rating;

- Access to a broad audience: with apps, it is easy to find customers from different regions of the country and the world;

- The opportunity to improve customer focus thanks to a convenient payment tool;

- Ease of management of investments and settlements with debts.

Disadvantages of Loan Applications

On the whole, P2P loan apps have more advantages than disadvantages, but there are still some negative aspects. For a borrower, there are:

- Debt collectors who make the user pays the money on time — ready or not. Even if the collecting procedure is entirely legal, it is unpleasant and morally ambiguous.

- The problem of small sums. The upper loan limit is often 50,000 USD.

- Excessive dependence on other people’s money and the risk of falling into a “debt hole.”

Disadvantages for lenders consist of the need to spend a lot of effort on legal compliance. Some other business types can work without a lawyer at all. But lending requires skilled professionals in this area, and also financial specialists to manage taxes, payments, and bank operations to reduce the risk of breaking the law.

Want to know more about loan lending app development?

Contact us

The Top Money Lending Apps List

Prosper is one of the best P2P lending apps. It was the first P2P platform that came into the American marketplace. The system was founded in 2005, and since then, it has facilitated more than 15 billion USD in loans.

Prosper’s advantage is its own Auto Invest tool to build a custom portfolio and new, fast APIs that run queries quickly. Borrower services are the offered API, Mobile SDK for iOS, and Mobile SDK for Android. The company can be praised for its security level provided by the industry-standard OAuth 2.0 authentication protocol.

The app’s advantages:

- Fixed and clear rate;

- A fast cash transfer to checking account after approval;

- Many options for investors.

An innovative platform founded by ex-Googlers. The company’s ultimate goal is software creation for banks and financial institutions. Upstart follows the global W3C standards and provides access for users with different physical capabilities due to TTY/TDD machines to have a call with deaf or hard–of–hearing individuals.

The most notable app feature is a unique risk calculation method based on artificial intelligence (AI). Upstart was one of the pioneers of applying AI to the industry. AI allows rewiring the verification process and assesses the borrower’s fault according to FICO score, credit and job history, etc. The system uses non-conventional variables at scale to improve debtors’ access to a loan.

The app’s advantages:

- Flexible and pretty low interest rates (starting from 8.85%);

- No prepayment penalty;

- The possibility to line up a self-directed IRA with P2P lending investments.

One of the top-list apps with low fees. The system is convenient for people with hourly wages; it allows users to enter the hours worked and get needed cash paid in advancements. That’s why Earnin is an optimal choice for those who are living paycheck to paycheck.

The company attracts consumers by paying 1–10% cashback while using enrolled cards when paying for purchases. Money rewards are powered by Empyr, the leading card-linked offer engagement platform. Earnin’s advantage for users is also a high security level, provided by SOC 2 certified third–party infrastructure.

The app’s advantages:

- A user–friendly platform allowing for complete integration of users’ bank accounts and the app;

- Overdraft protection to notify users the bank balance is getting low;

- No regular fees or commissions — customers can tip for services.

This loan app is convenient for fast funding. It’s not a traditional payday loan company, but a platform that cares about private finances and tracks spending and revenue. With a UX app and fast processing of requests, customers get money in five hours or less. Note: to access instant transfers and other features, you have to pay 9.99 USD a month.

The company has over a million members attracted by the platform’s convenience and safety. Brigit uses 256-bit encryption, and implements multi-factor authentication and ID verification. To improve services, the company uses API supplied by Plaid Technologies. The backend software is provided by SynapseFI, the Evolve Bank partner.

The app’s advantages:

- Flexibility in repayment terms and payment date extension up to 3 times;

- No late fees, tips, or interest;

- Compatibility with more than 6,000 banks and credit unions.

The perfect choice when you need a small loan. The company does not charge a fixed or variable interest rate — only a monthly fee of 1 USD.

Dave allows borrowers not only to take out loans but to find a job in the network of the company’s partners to earn money. With the Side Hustle service, customers can discover and apply for work from their phone. Another advantage attractive to users is the lack of fees from 32,000 MoneyPass ATMs. The security level is also top-notch: accounts have banking-level protection and are FDIC-insured. API is supplied by Plaid Technologies and it uses a Galileo payment processing platform.

The app’s advantages:

- Integration between customer’s bank accounts and Dave’s budgeting tools that allow managing private finances;

- Live alerts that give users notifications about the account’s state;

- No credit check required (but the system requires a steady paycheck that’s set up with account deposit);

- Flexible funding options: standard or express.

Want to know how to build a loan app at the level of the most successful examples?

We can help

Security and Legal Compliance

One of the core requirements for financial software is security and fault tolerance. The loan app development should consider that the app must:

- Work uninterruptedly even if heavy load occurs (e.g., when a large number of operations are performed at the same time);

- Be protected from cross-site scripting, sensitive data exposure, SQL injections, broken authentication, and other widespread risks;

- Include encrypted users’ authorization via PIN codes, passwords, or biometric authentication.

The platform owners also must provide flawless legal compliance, but regulations may vary depending on the area.

GDPR

EU market lending apps have to be GDPR-compliant. The General Data Protection Regulation directs the owners of payment platforms to take measures to protect EU citizens’ data. The company should comply with the following conditions:

- All data should be collected and used only for the declared purposes, in only the amount needed for operation performing;

- All data must be accurate; otherwise, it needs to be removed or corrected;

- Personal data can be stored only during the necessary period (for processing purposes);

- Platform owners must protect personal data from damage or illegal processing.

CCPA

The abbreviation stands for the California Consumer Privacy Act, which obliges creators to fulfill its requirements when developing software for California residents. Due to CCPA, the users receive more personal data control, and financial transactions become safer. This act entered into force in January 2020. Unlike GDPR, it doesn’t tend to cover publicly available information.

According to the law, ‘for-profit companies,’ organizations with revenue above $25 million, must comply with the requirements. Companies must provide data for the last 12 months.

Loan Lending App Features

If you are going to create a loan app or choose the proper one, you have to understand the required features. Functions can be conditionally divided into primary and complementary for advanced usage.

Primary Functions:

Registration and authorization. There should be tools to sign up or log in using the customer’s email, phone numbers, social media accounts, etc. Reliable security measures have to be integrated, too.

In the case of building a money lending app, you need to use KeyChain for iOS and Android to store passwords, biometric Touch ID, and multifactor authentication to access. One of the most modern secure access technologies is Face ID, which we are successfully implementing into our solutions.

User’s profile (personal account). The borrower or lender can view the information provided and get all the needed personal details. Users can manage and change profile info, like name and location, and generate loan applications. A common best practice of developing the user profile is hiding details by default. But for first-time use, entering basic template info into the fields can be added as a prompt.

Payment gateways. Integration with multiple payment tools and platforms encrypting credit card payments and other crucial info ensures quick and secure financial transactions. You can choose one of the popular systems, like PayPal, WePay, Dwolla, Stripe, 2Checkout, and more.

Read also: Payment gateway integration in mobile applications

Read more

Anyway, if you are thinking about how to create a loan app and counting costs, don’t forget about payment gateway fees — monthly, setup, chargeback, etc. Blockchain availability will be an added benefit.

Loan calculator. The loan calculator form calculates monthly payment sums, interest rate, EMI, GST, processing fees, etc. The tool can be a ready-made CMS module. But a customized solution is a great opportunity to showcase the app’s strengths and provide full information on the product described.

Application management. This feature helps users to check various loan requests and track their status in one place. It must include:

- Detailed info, such as loan owed and paid;

- The monthly payment due, the amount, and the schedule;

- Money withdrawn from an account.

Loan proposal lists and lender search. These features make it easier for the customer to find suitable offers and allow them to choose between various conditions. It is crucial to provide an opportunity to immediately submit an application from the lenders’ list. As a rule, for this, a quick–link button or a link to go to loan processing is installed.

Chatbox. Users can exchange and share their views via text messages, for example, over their requirements regarding the loans. To make the chat more convenient, you can add tools for video communication, pinning frequently used conversations, inviting new participants, or uploading documents directly to a dialog.

Online support through the app. There should be several communication methods: phone, online form, chat correspondence, etc. Support must be available 24/7. If you want to achieve maximum innovation, pay attention to AI-based telephony services, speech recognition and synthesis technologies, and IVR voice menus. They will reduce the load on the support call center. Your clients will immediately call you and resolve basic issues automatically.

Complementary Features:

Complimentary, or advanced features, increase the app’s convenience for users. In particular, dashboards are often divided into types for borrowers, lenders, and admins. This feature allows users to quickly understand everything going on in the app: total amount lent, partners, total earnings, etc.

For a borrower, it can be accounting software or business bank account managing; for a lender, automated lending tool and earnings. The admin dashboard often includes users’ managing and screening, loan applications’ confirmation or rejection, portfolio total, and net earnings.

Other advanced features include the following:

- CMS integration. This helps manage app content with the ability to add, remove, and edit text and images easily and quickly. Mobile CMSs provide access to the extensive infrastructure required for basic updates, distribution, and maintenance. You can create custom versions of the app for each platform it will run on, such as Android, Mac OS, RIM, or Windows Mobile.

- Bank partner management. This feature simplifies the interaction between users and banks integrated into the system. With payment withdrawal, users can transfer the loan amount. You can choose Plaid (like some of the popular loan apps) or another platform for securely connecting to bank accounts.

- Cloud storage integration. Users’ data is stored with security and privacy care. Сloud solutions’ flexibility allows the choice of the needed OS, platform, database, and other services. You can select AWS, Google, Microsoft Azure services, etc., and store any data amount from a mobile app.

- Reporting and analytics. Real-time information helps to monitor and organize data into summaries and extract actionable and meaningful insights. This way, lending app owner or service provider can make proper decisions to improve performance.

- Repayment. The tool allows repaying the system and returning the money that has not been used. The mobile payment SDK makes the user’s card data inaccessible for reading so that the app’s developers do not accidentally program the application to transfer data to an uncertified server.

What Should You Do Before You Start Developing an Application?

Before you start thinking about how to build a loan app, you should note that a great idea is not enough. You have to start with a business registration to work as a legal entity in a country that suits you from the point of view of financial sphere legislative regulation:

- Choose what model is appropriate for you: an entrepreneur, corporation with full tax reporting and accounting, LLC with an agreement that distributes profits and losses, etc.

- Form initial capital. It can be collected through ICO to attract investments, partners or venture funds, bank loans, or your own money.

- Register a business name. It has to be new and meet legal requirements for wording.

- Register a business. It is necessary to collect the statutory documentation, pay the fee, fill out an application, and submit it to the local authority. After registration, you will receive a document allowing you to work legally.

After the formalities are fulfilled, you can create a money lending mobile app and start to earn on it. First, find a development team. In mobile apps, this usually includes a project manager, a requirement analyst, Android/iOS developers, designers, and a QA specialist.

You can hire your team, but it’s a somewhat outdated and inefficient way of working, and looking for the right talents and skillsets is a complicated process. Ask yourself: are you sure you need in-house staff to develop just one app? Can you correctly assess the candidates’ qualifications? On the other side, having a dedicated team of developers will help to minimize risks. A reliable partner company reduces the time for recruiting and hiring personnel, and your team’s professionalism is guaranteed.

You can also use ready-made app builders, but they are not always customizable and require high-level technical skills. If you want your app to be fast-acting, bug-free, and UX-friendly, standard solutions are unlikely to work. A software development company can help you distinguish your product from competitors favorably and offer customers a unique and in-demand product.

Another way is outsourcing via freelancers, but here you face the problem of specialists’ compatibility. It won’t be easy to put them together, unlike hiring a software company’s team that already works together smoothly, efficiently, and quickly. Highly qualified experts who are good at what they do will provide the safest and most rational solution, using a team that is already working together will solve the compatibility problem, and you’ll receive the app in the shortest time.

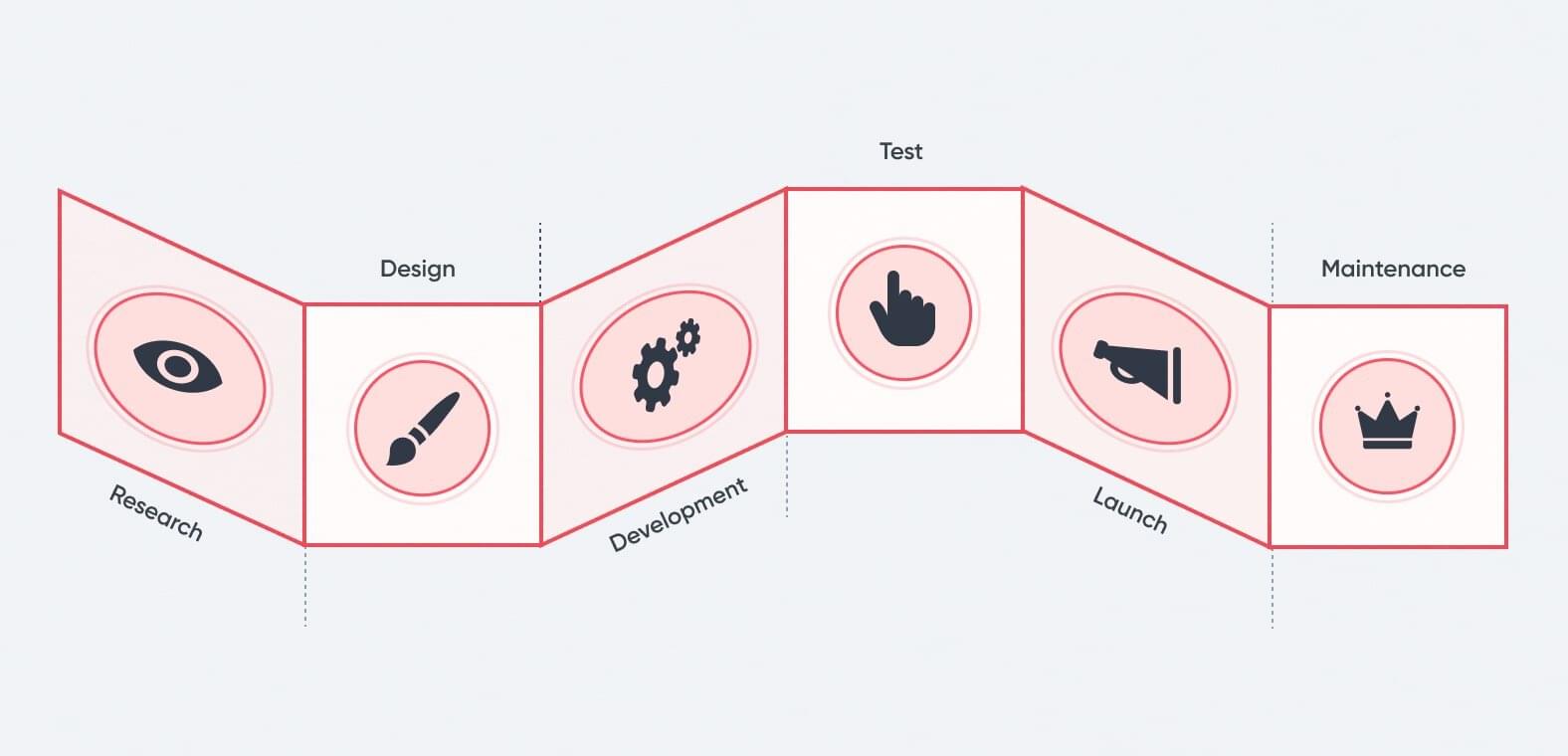

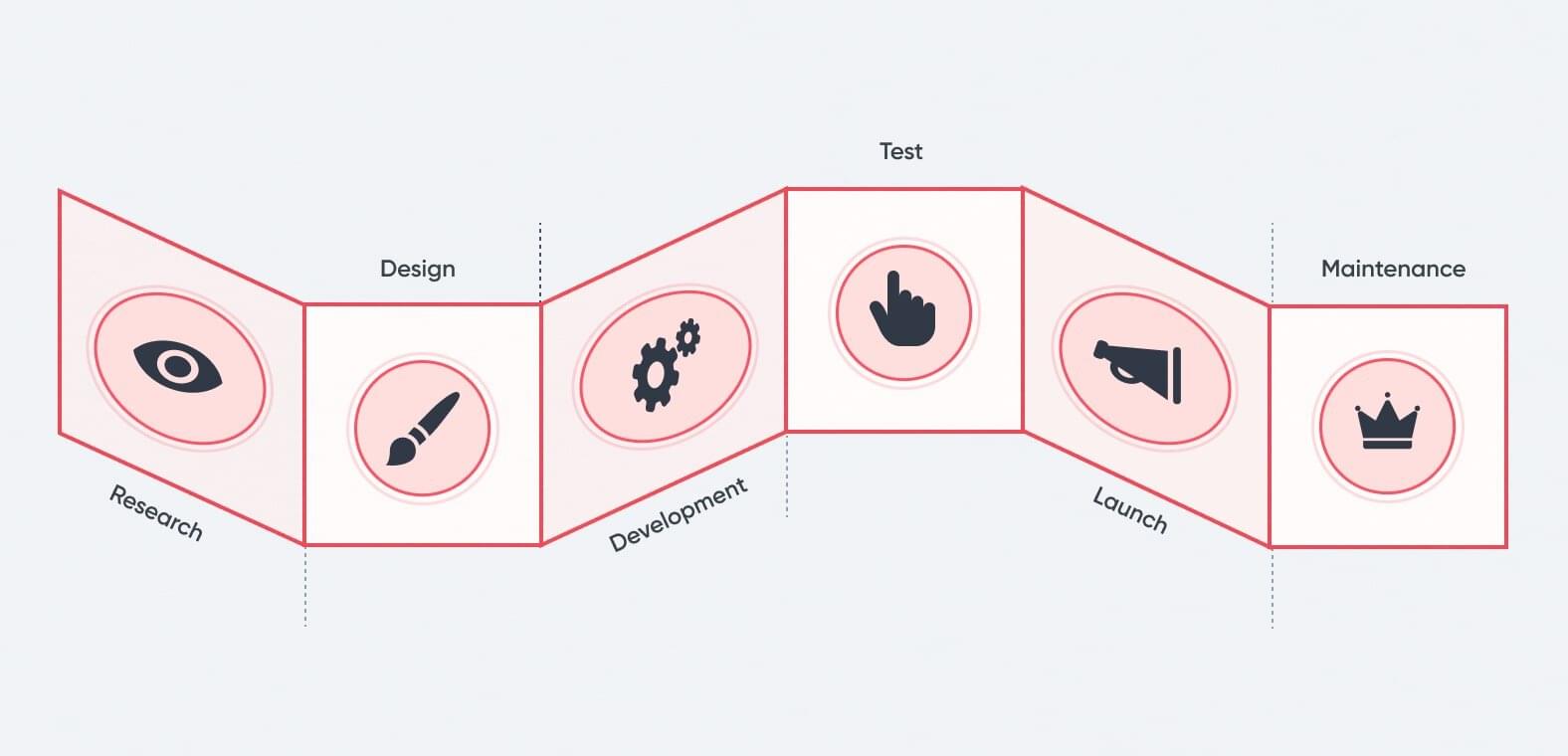

How to Build a Loan App Step-by-Step

First, you need an idea of what kind of loans you’ll facilitate with the mobile app, its functionality, and the target audience. Ideation helps to concretize fantasies and simplifies the analysis of existing or potential competitors.

The next step is the loan lending app development and design. It is important to choose application architecture and functionality, cloud solutions, domain, and other essential points. Now let’s figure out how to create a loan app step-by-step.

The research phase

Professional research helps in formulating the concept. Proper market analysis and user interface (UI) design separates the product from others and helps identify unique features and the best selling proposition. Business analysts, solution architects, and technical experts that think outside the box will help you receive scalable and high-performance iOS, Android, and cross-platform apps.

At this stage, we are figuring out the business requirements, selecting the team of consultants, and giving a client recommendations package for a software solution. You’ll receive a complete idea of where to go next.

Definition of the components available to you

You need to address the first dilemma before building the app: the target platforms — Android, iOS, or hybrid. Native applications are written using a programming language like Java and Kotlin for Android, and Swift, or Objective C for iOS. Hybrid apps launch on both platforms. They are more functional and convenient; you can apply different payment mechanisms, such as in-app purchases.

The next step is searching for available SDKs, APIs, and code libraries. The choice depends on the features needed in the solution. There are many ready-made SDKs, APIs, and code libraries that simplify and speed up development. For example, you can use Twilio for two-factor authentication or a chat, social media, and Google or Apple accounts for quick login. But in any case, you will need the help of a specialist to select a high-quality mobile SDK.

A customized solution will allow you to:

- Create a dynamic mobile app;

- Add new features to the mobile application;

- Ensure your app is reliable and stable.

When we at CHISW choose a mobile SDK, we also pay attention to the need for the customer’s permission to use personal data.

For using all the features and website integration with iOS/Android mobile apps, you need an API. For example, when we faced the challenge of developing a financial application that determines the customer’s credit rating and the financial risks of interacting with him, we used Mambu API, CallCredit API, and related tools. To get all the banking functionality (e.g., one-click payment, auto payments, no-commission funds holding), you’ll need the specific bank API.

Figuring out the app’s UI/UX, architecture, and MVP

Figuring out UI/UX perspectives helps you understand the navigational flow, better integrate MVP and advanced features, and make the interface user-friendly. The app should be easy–to–comprehend P2P architecture, so the simpler the design is, the more people will use your system. The interface shouldn’t be overloaded with lots of pictures and icons; it must contain all of the MVP features and main additional ones.

After the UX/UI is verified with test users, it’s time to develop an MVP app version and, if needed, a website for administering loans. In web portals’ mobile versions, developers usually use JavaScript frameworks that provide tools for building sites optimized for WebKit engine-based browsers. If you target mass consumers, the rational decision will be cross-platform frameworks and tools like React Native that accelerate development.

Depending on the case, various tools can be used in application development:

- Big data and machine learning (ML) services to build scalable solutions that enable apps to collect, store, and process vast amounts of data (we use them for better data understanding);

- AI-driven solutions that combine big data and management, analyze the financial institution performance, and automate the key organizational processes;

- Platforms and languages like JS, Ruby, Python, PHP, Java, iOS, Android, etc.

For your application to process large data amounts quickly and securely, you need cloud solutions. CHI Software is a certified Cloud Consulting Partner, and we have the expertise to consult and develop various tools to improve your product.

A case example:

Our client has come to us with a need for cloud-based self-service platform processing operations in real-time. To make a convenient app, we choose, in particular:

- AWS Mobile SDK, AWS SQS to decouple and scale microservices;

- Amazon Lambda to run a script that, as a result, constructs all necessary graphs and tables;

- AWS RDS to easily setup, operate, and scale a relational database in the cloud.

The client has received a flexible and innovative platform that helps in customer care improvement and business risk elimination.

In developing apps that connect different users (borrowers and lenders), the accessibility and security of negotiations are often overlooked. At CHISW, we solve this problem by introducing ZRTP secure voice/video calls, GPG encrypted text communications, and a video-based telephone relay system for hard-of-hearing individuals.

Application development and testing

After the MVP creation, it is time to develop a finished, improved product that implements basic and advanced functions. However, you cannot receive a high-quality, bug-free, and stable application without QA services. Advanced testing tools cover the entire lifecycle or join at any stage, from design to deployment and regular releases.

QA experts use a variety of manual and automated testing tools:

- Test Rails, TestLink, Zephyr, or similar tools for test case management;

- Redmine, JIRA, or other defect tracking and project management tools;

- Automation tools to cut costs, reduce time, and optimize the workflow: JMeter, SoapUI, Fiddler, Appium, Wireshark, etc.

Launching, follow-up maintenance, and support

When your app is successfully implemented, you’ll need technical support for it. Responsible development companies offer this option to clients as a logical continuation of cooperation and an integrity guarantee.

Mobile apps are continuously evolving, adding new features. To improve user experience and keep the application up-to-date, you need to leverage new functionalities to the fullest extent. Your loan–lending app should support the latest OS versions, offer trending features to users (like live widgets), and grow constantly.

The Cost to Develop a Loan Lending App

When entrepreneurs start thinking about how to start a loan app, they have to estimate the development and implementation costs. The total investment depends on the complexity and scope of functions, the solutions used, and the application’s features. Machine learning, big data integration, and smart contract implementation will increase costs, but they will pay off due to your product’s convenience and innovation.

The essential factor to be considered is the location. The price can be significantly different depending on the area. For example:

| Region |

Loan lending app development – hourly rates, $ |

| North America |

50-250 |

| South America |

15-75 |

| Eastern Europe |

15-100 |

| Western Europe |

50-200 |

| Asia and India |

10-50 |

| Australia |

40-170 |

On the whole, lending applications range from 5000 USD and up, and come to around 20,000–30,000 USD. To get a precise understanding of cost and budget, you can select several companies and request a quote.

And don’t forget: some additional factors affect the volume of expenses. One in particular is domain registration if you need a website. The cost may vary from 20 USD to 100 USD and more.

To get an estimate on developing an app, contact us

Drop a line

Conclusion

Now that you know how to build a loan app, maybe it’s time to create your own. A properly designed product quickly brings a return on your investment and becomes an effective tool for generating consistently high income. People always borrow money, and mobile services have already become an integral part of our lives. Therefore, the online lending business will not lose its relevance.

When you explore how to build and implement a loan app, you may find it rather laborious and challenging to create. But any problem is solved with a thoughtful approach and the involvement of professionals. Innovative technologies turn a complex process into a transparent and controlled sequence of actions. Lending software solutions help streamline the workflow, scale the business up, and offer customers useful, convenient, and competitive products.

Successfully uniting the mobile, web, and cloud technologies, we create high-performance apps for fintech and network architecture that meets the most security-sensitive organizations’ requirements.

So if you want to run your application on the loan lending market, have a plan, or don’t know how to begin, contact us, and we’ll assist in making the idea a reality.

Rate this article

22 ratings, average: 4.5 out of 5