The latest reports show that every week more than 25 percent of people make purchases via mobile devices. Most transactions are done through the merchant's applications. For this reason, global mobile payment incomes crossed US$1 trillion in 2019. Millennials who have grown up in the universe of gadgets are rapidly changing fintech. People worldwide are moving away from “physical” payments to digital tools, among which wallet applications (e-wallets) are of particular interest. They are useful for both sides of the deal...

Technology development in the fintech field has greatly simplified the management of personal finances. Users no longer need to queue at the cashier to complete a bank transaction. It is enough to install a desktop or mobile application, and you can quickly pay bills, transfer funds to different recipients, or deposit money.

The vast majority of banks and non-bank financial institutions understand that they will not be able to keep up with the competition without digital solutions. Therefore, online banking is one of the fastest-growing areas in fintech. It is especially true for convenient mobile products. Smartphone transactions are expected to account for88 percent of total banking money transfers by 2022.

This article will share what you need to know about how to develop an online banking application and become a part of this profitable business.

Mobile Banking Industry Overview

Facts and Statistics

Online and mobile banking comprise a suite of financial services offered by banks and similar credit organizations. The main feature is that the client’s account management and all transactions occur in a digital environment. These environments are typically desktop or, more often, smartphone banking apps.

You need to understand that internet banking and mobile banking are not the same things. In the first case, we are talking about the ability to make transactions through the worldwide web. In the second case, we are discussing an internet-based facility (software tool) that the bank provides clients so they can perform operations. Most often, financial organizations create a mobile banking application for this purpose.

Client banking, a service for corporate clients, is considered separately. In client banking, the bank installs software on the customer’s computers and provides access to its payment system and database. As part of this article, we do not consider corporate solutions since we focus on apps for individuals (but if this topic is interesting to you, let us know in the comments, and we will return to it later).

The market for banking apps is enormous, and there is still plenty of room for startups and aspiring new players. Assess your prospects:

- Statista’s forecast says that in 2023, the volume of mobile financial transactions and other contactless technologies will exceed US$220 billion;

- The number of customers using mobile banking products in 2019 was 1.75 billion and is growing by more than 30 percent annually; and

- According to Statista, 36 percent of respondents actively use mobile banking — funds are regularly transferred from every third smartphone (and the number of smartphones in the world has already reached 3 billion).

Mobile Banking Trends

Banks around the globe are investing millions in banking applications, but the popularity of such products is growing unevenly.

The trend is most noticeable in emerging markets such as China, Southeast Asia, Latin America, and Eastern Europe. Interest in mobile banking is great even in countries with a predominance of low-income populations, such as the Philippines.Other notable trends are:

- Wider implementation of payments voice control. This is a convenient tool that increases the security of the system against criminals. Therefore, if you are developing a mobile banking application, it is worth considering integration with intelligent voice assistants. It could be very effective if you supplement these with other voice services. For example, in a trading solution, the CHI Software team implemented voice recording, Cisco VoIP, and other SIP-related features.

- An increase of fraud detection tools. Tracking and preventing criminal activity is a top priority for banks seeking to mitigate big data risks. We at CHI Software use a wide range of fraud detection tools, including face recognition, strong customer authentication (SCA), and high-level standards (such as PCI DSS), and always select security systems for fintech apps individually.

- Customer support optimization through machine learning (ML) and intelligent bots. Solutions based on artificial intelligence (AI) tools like ML and natural language processing (NLP) help personalize services, predict customer behavior, and assist in making payments. For instance, in our Price Tag Tracker app we used NLP to process data and compare it with the accounting system.

- Money withdrawal from an ATM without using a card. The number of such transactions is constantly growing as digital products (such as PayPal) using other processing mechanisms increases.

- In-app debt pay down. A new trend in banking services allows borrowers to quickly repay interest and loans in the application, monitor repayment schedules, and control the state of their finances. We at CHI Software go further and implement one-touch payments, government credit line integration, and other advanced payment services (like we did in our smart system with Face ID for a customer in the Middle East).

Top 5 Mobile Banking Applications List

If you are thinking over how to create a banking app, these examples of success can help you to find your own ideas and solutions:

Bank of America

The largest national bank in the U.S. has created a high-tech application recognized as a leader in financial security. The mobile solution is primarily intended for serving American users’ accounts. The app uses more than 110 technologies, including Viewport Meta, Google Analytics, and jQuery for JavaScript and HTML interaction.

The application provides tools for performing standard banking operations, as well as saving and managing finances:

- Payment of electronic invoices, making payments and transfers (for example, with Zelle);

- Multilevel security: biometric Touch ID access, changing network identifiers and passwords, notifications for any suspicious actions in the account;

- Services for travels: search for ATMs, reports to the bank about trips;

- Cashback from purchases and mobile deposit;

- Virtual assistant, and much more.

Capital One

This app has earned a high rating due to its excellent customer service and many saving tools. Like the Bank of America system, it is well protected and notifies the account holder of suspicious activity. The iOS and Android banking app uses almost 100 technology tools, including Java as a core programming language, HTML5, SPF, and jQuery. It also has Touch ID access and blocks bank cards if they have been stolen or lost.

Read also: Check out the list of RegTech solutions for banks

Other features:

- Storing cards in the application and 24/7 access to them;

- Bank account management, including mortgage and vehicle loans;

- Purchases and credit history tracking;

- Control of transactions via push notifications; and

- App control via Apple Watch.

CommBank

Commonwealth Bank of Australia has developed many digital products for its clients, but this app has an extensive set of unique and valuable features. It maintains a high data security level and allows users to log in via Touch ID or PIN code. The app is completely personalized for each customer due to a combination of ML, deep data analytics, and behavioral science, backed by the bank’s strong capabilities in AI.

Other facilities:

- Complete control of bank cards — activation, blocking, cancellation, and replacement (you can also open an account in the app);

- Making payments via PayID, BPAY, account number, and mobile phone with NFC;

- Management of credit limits and purchasing power parameters;

- Tracking transactions using notifications;

- Bonus card storage, cardless CashGet tool, etc.

Wells Fargo

This large financial institution has created a convenient application for money transactions and investment management. With it, you can control expenses and invest in stocks, mutual funds, and other assets. Among the technological tools used are HTML5, Google Analytics, PHP, Java EE, and Bootstrap framework for fast layout.

The following functions are available to customers:

- Creating accounts for savings and transactions (security is supported by Touch ID, Face ID, and other tools);

- Paying bills and investing funds;

- Balance, transaction history, and credit card details viewing;

- In-app text messages and email notifications; and

- Stock quotes and current market information viewing.

Deutsche Bank Mobile

A well-known European bank has developed a banking application in Android and iOS with simple navigation and a guaranteed high security level. 3D Touch helps to access core operations and functions, and Touch ID/Face ID is provided to log into an account. The bank uses a wide range of technology services, including SAS Visual Analytics, Neo4j database, IBM Tivoli software, and Elastic search search server.

Among the core features are:

- Management of documents and passwords via the eSafe manager;

- A financial planner;

- Interactive transaction management;

- Assistance in searching for the bank’s physical branches and ATMs; and

- High-tech services such as Siri translations and a CO2 indicator to track the user’s carbon footprint.

Why You Need to Develop a Banking App

Financial products require a lot of time and effort to develop, and the cost to build a banking app can be high. In spite of this, banks, companies, and startups are actively investing in such solutions. The reason for this is the many benefits for the owner and his clients.

Benefits for Clients

Building a banking application can benefit the owner by increasing customer focus and growing the user base. Clients appreciate the convenience and easy 24/7 access to their bank account wherever they are. According to statistics, almost half of the respondents choose mobile banking for this very reason.

Other benefits for users:

- Versatility: a multifunctional application becomes a single solution to all personal finance management issues;

- Convenience and profitability of mobile transactions: as a rule, they are cheaper than transactions at ATMs and bank branches, and it takes literally less than a minute to complete them;

- Saving time and round-the-clock access to funds: no need to visit the bank’s office, as transactions with money can be carried out from practically anywhere in the world;

- Complete control over funds and the ability to automate payments;

- Professional support, etc.

Benefits for Owners

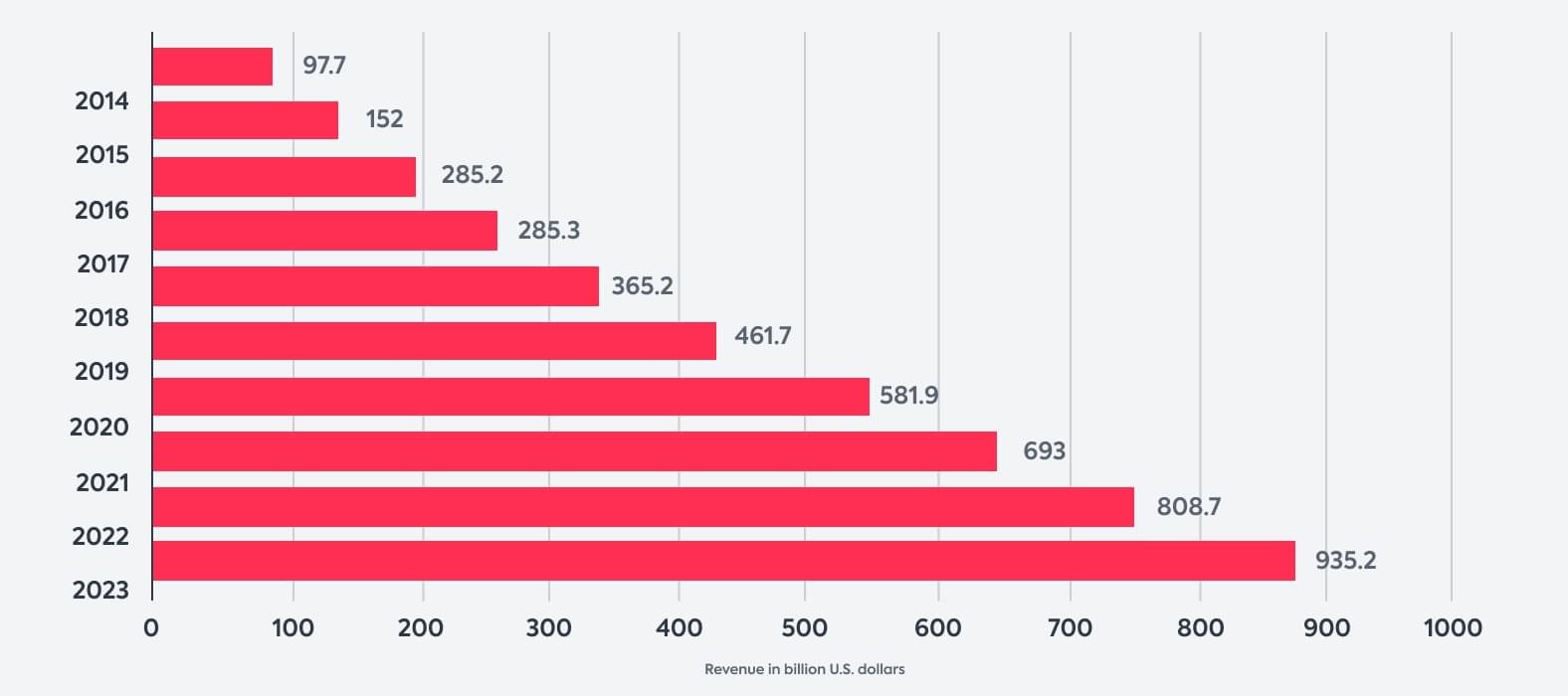

For owners, having a mobile application means, first of all, financial savings. Banks can reduce operating costs and the number of staff working in the branches while maintaining the customer service level or even increasing it. And the statistics prove it: it is estimated that by 2023, revenue from mobile apps will reach US$935 billion, which is more than 10 percent more than in 2014 (see Statista graph below):

Other advantages for the owner:

- The ability to organize paperless accounting, reduce costs, and simplify the workflow. According to The Paperless Project, the annual maintenance of a filing cabinet costs US$1,500. Digital services can save money and reduce the burden on the environment (this will attract users who care about ecology).

- Complete, fast collection of customer analytics to improve customer focus and demand for services. According to a McKinsey report, more than 85 percent of companies that use client IT analytics say it significantly adds to their business value.

- A greater financial information security level. Modern IT infrastructure is well protected from data leakage, theft, internal fraud, and even server-side vulnerabilities, which, according to Positive Technologies, account for 54 percent of all detected threats.

What Is Worth Paying Attention To?

Before answering the question, “How to make a banking app?” we should consider some crucial points regarding planning and development.

Banking App Features

Before you start a banking app, you have to define a list of its basic functions to draw up the clear product and technical requirements. Among the essential features are:

A user account with a page for registration and login. Consider a secure way to activate your profile (for example, by email or one-time PIN codes by phone number), password login, Touch ID, or face recognition. The account must contain all information about the user: name, bank account numbers, card details, etc.

Key financial transactions. It is desirable that the application supports integration with Google Pay/Apple Pay, transferring money via systems such as RTGS or IMPS, allowing users to check balances, paying bills online, and making credit, insurance, and other payments. Many apps also have mobile deposits and the scheduling of regular transfers.

Transaction management. It is essential for the user to view the entire payment history and transaction details to understand how much was debited, when, and for what. A clear transaction dashboard helps customers to control money movement and increases their loyalty to your app.

Notifications. The app must inform the user about each transaction and changes in the account status and warn if there are suspicions or fraudulent calls, spam, or phishing. Push notifications can also contain information about discounts, your new services, bonuses, etc.

Offline access to the account. If the application supports it, a poor internet connection (or lack of it) will not prevent the user from managing the profile. This feature can be conveniently combined with geolocation tools to make the system work in any situation.

Support. For many operations (for example, unlocking a card), professional help from technical service staff is needed, but it is more convenient to use AI-based chatbots for solving basic issues. Intelligent assistants reduce the load on the support, are available 24/7, and allow you to speed up the processing of requests, even if there are many of them.

If you want to make a mobile banking app stand out from the competition, you need more advanced features. This could be:

- Support for multiple bank accounts and cards (not all applications offer integrated budgeting);

- Additional financial services: for example, the Ally app allows users to receive interest on current accounts, and BB&T offers investment analytics;

- Wearable integration — if your app will enable smartwatches to be used for checking balances or making payments(as Bank of Melbourne’s system does), customers will appreciate it; and

- Technologies at the service of convenience: QR scanners for purchases and cardless ATM withdrawals, voice navigation, geolocation to find the nearest bank office, AR/VR to get virtual access to an account (as in the BNP Paribas app), and so on.

Challenges

If you want to create a mobile banking app, be prepared to face the challenges. Don’t be afraid of problems: if you are forewarned, you are forearmed, and a professional software company will help you cope with the risks.

Among the notable challenges are data, transactions, and client money security, and the need to comply with national and international legislation in finance, crime prevention, and personal data protection. Most financial institutions cite security as their top concern. To ensure the protection of information and client money, it is necessary to:

- Think over the network architecture and the choice of cloud data storage;

- Provide for digital signatures and multifactor authentication when logging in to the system; and

- Enable an in-apptimer for system usage sessions and strong encryption.

You can also create a banking app like Revolut that uses the transport layer security (TLS) protocol to authenticate clients and check data integrity.

The system’s function and purpose determine the list of laws and regulations that your application must follow. If it supports payment card transactions, it must follow the PCI DSS security standard. Store your clients’ data? Make sure you comply with the European GDPR directive, California CCPA, or similar territorial regulation. Provide payment services in the EU? Take steps to comply with the PSD2 directive.

These are all rules you need to consider before starting the development, so you should have a financial consultant or IT business analyst to help.

Tech Stack

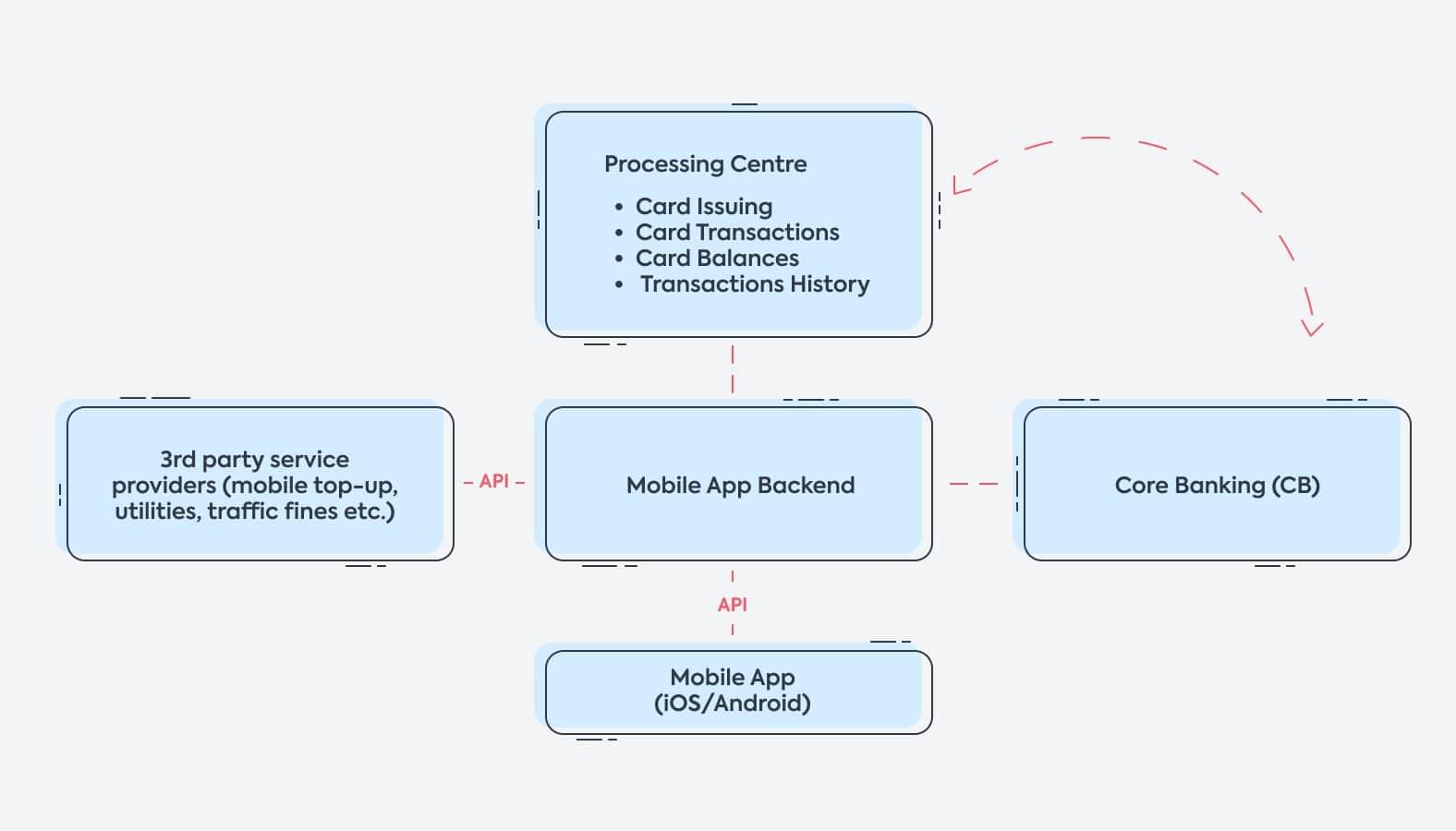

Understanding the required technology stack will help you better define the budget and time needed to develop a banking application. You’ll need technologies for:

- Frontend development with a selected solution (native, hybrid, cross-platform);

- Creation of the server-side — concentration of business logic and the main connecting link between your mobile application and third-party processing and service providers; and

- Integration of third-party services: application programming interfaces (APIs), cloud servers, payment systems, etc.

Your decision should be guided by business needs, your budget, and your desired development time. Native apps are reliable and high-performance, and Android and iOS features reduce the number of third-party APIs. Hybrid applications have a single codebase and can be used across platforms, just like cross-platform products.

Here are examples of tech stacks for various apps (but you can always use other combinations and options):

- Native for iOS: Swift or Objective-C, Apple XCode, and iOS SDK;

- Native for Android: Java, Kotlin, Android Studio&Developer tools, and Android SDK;

- Hybrid: JavaScript, HTML, Xamarin, Ionic, or PhoneGap frameworks; and

- Cross-platform: C#, APIs, and frameworks like JS-based React Native.

We also recommend using separate cross-platform tools to create parts of the application. For example, cutting-edge frontend Node.JS provides many tools and libraries to build a robust framework. Flutter can be an optimal cross-platform solution that reduces future support costs and simplifies development in general by compiling a single code base for multiple platforms.

To configure the server-side and ensure its fast and trouble-proof work, you can use a mobile backend as a service (MBaaS) and out-of-the-box APIs. As we know from practical experience, they reduce workload and give you flexibility building an app.

How to Build a Banking App Step-by-Step

There are essential roadmap steps for when you build a mobile banking app:

- Do the research and planning;

- Create a prototype and the user interface and user experience (UI/UX) design;

- Develop and test the minimum viable product (MVP) and full-fledged app;

- Deploy and market the app; and

- Provide maintenance and support to app users.

Research and Planning

In the phase of discovery and research, you have to:

- Define your target market, core issues, and their appropriate and alternative solutions;

- Identify competitors and analyze their offering; and

- Evaluate the best procedures and make a detailed development plan.

As a result, you’ll get a functional specification that can be a foundation for your budget, development tech stack, and app toolkit.

Prototyping and the UI/UX design

Every app starts with an idea, and you have to create a prototype to live it out. A prototype explains and shows the structure and order of design elements, visuals, etc. Designers start working earlier than developers because we need to understand the app’s navigation before coding it.

Typically, low-fidelity UI wireframes, UX design, and layouts are created first. Designers sketch a home screen, users’ profiles, and dashboards and then turn them into a high-fidelity prototype.While creating the UI/UX design, you have to consider fintech products’ specifics, customers’ cultural differences (for instance, right-to-left localization for Arabic texts), and iOS and Android guidelines.

Among the important recommendations are:

- A meaningful UX design element to the fintech vertical is in-app messaging. You should test its interruptive and non-interruptive forms to identify what works best for the target audience.

- Pay attention to visual uniqueness. Typography, icons, color palette, and elements should match your style and brand and distinguish your product from competitors.

- The navigation should reflect the app’s logical architecture. In the case of fintech solutions, it should be transparent, easy to understand, and minimize the number of steps required to complete transactions.

Development and Testing

The next challenge is to bring the finished design to life with frontend and backend development. In the first case, programming engineers create a user interface. When developing a backend, the team configures the server-side, performs data integration, ensures security, etc.When programming engineers create a banking app, they need to combine the user interface, all the functionality, and external tools such as APIs, payment gateways, and third-party services.

In most cases, an MVP is created first. It is required to test the “liveness” of your application. An MVP is fast in delivery and requires less investment to build. Based on the MVP, you can develop a fully working application with a more detailed list of functions.

Once a product has been created, it must be thoroughly tested using manual, automated, or a combination of techniques. QA engineers check:

- Functionality and performance,

- Peak performance,

- Integrations, and

- System components.

If everything is OK, the app is prepared for release.

Deployment, Marketing, and Maintenance

To send your app to the Google Play Market and the AppStore (or maybe to the Microsoft Store, too), you need to prepare screenshots and all information about the application, make sure its performance is adequate, and ensure the app is incompliance with the store’s requirements. It is convenient to use the Play Market and AppStore guidelines for checking this.

Once your app appears in the stores, you should control ratings and comments that come in and provide your customers with the necessary feedback. If you focus on iOS products, you can submit the app to Apple’s editorial team for an expert review.

But the app launch is not the end of the journey. You have to provide further maintenance and quick support in case of problems and consistently update features to ensure that the application works with the latest OS and mobile platforms.

The Cost of Developing a Mobile Banking App

To answer the question how much does it costs to develop a banking app with an estimate, you need to know the amount of time needed to create it and the average hourly rate of all technical and non-technical specialists on the project.

The first value depends on the set and complexity of the system’s functions. A few years ago, Clutch calculated that when choosing a simple, basic solution, you would have to spend at least US$20,000, while complex systems cost at least US$200,000. By updating the data, we get an average price in the range of US$60,000 to US$120,000. If the application is being developed for a bank, the estimate is around US$130,000. This amount includes:

- Application concept and definition of its functions;

- The worktime of technical specialists who develop a banking app;

- The worktime of designers who create the corporate identity and design of the system;

- Application integration with banking and payment systems, implementation of security measures, and other additional options; and

- Scope of warranty service and support after the delivery of the app.

The specialists’ hourly rate, and therefore the cost of the app as a whole, depends on the selected software company’s pricing policy and location. The table shows indicative figures:

| Region | Average hourly rates, US$ |

|---|---|

| USA and Australia | 100–170 |

| EU and Great Britain | 70-125 |

| Eastern Europe | 35-85 |

| Southeast Asia and India | 25-35 |

Start Your Own Banking App with CHI Software

In general, the main factor influencing a mobile app’s cost remains the executing company’s rate. But in pursuit of a good price, you cannot sacrifice the quality of the finished product. That is why companies and startups around the world choose Ukrainian development services. They are distinguished by the best balance of high-quality ready-made software and reasonable prices.

In Ukraine, the cost of developing a mobile banking app is lower than in North America and Western Europe. The hourly rate for net development time rarely exceeds US$50 (but it depends on the solution’s complexity). Ukraine is known for its long history of high technology production, a highly qualified engineering workforce, and excellent IT infrastructure.

CHI Software is a software company that has provided services for fintech, banking, and many other business domains since 2006. Our four development centers’ expertise covers AI/ML, mobile, web, cloud apps, IoT and Embedded, AR/VR, etc. Our services include technological consulting, product development, dedicated engineering teams, and on-demand staffing.

Why CHI Software?

- Our working language is English, and we successfully communicate and partner with companies all over the globe;

- We are always open to negotiation and tend to offer our customers the best price/quality ratio;

- Creating a favorable business climate is our goal in negotiation with every customer; and

- CHI Software has experts with PMP, Oracle, Microsoft, MSCA, ISTQB, AWS, BEC Vantage, CPE, and CELTA certifications.

Let us illustrate our capabilities with an example of a finance solution for banking that we successfully developed. Our client is focused entirely on digital financial services and decided to improve the server app and its performance to attract new customers.

CHI Software’s dedicated team implemented performance testing and suggested migrating from Spray HTTP to Akka HTTP. Moving to (Twitter) Finagle HTTP client helped to reach the best results. During the process:

- The productivity of monitoring was improved (opentracing, Zipkin, Grafana Dashboards);

- Development productivity increased through migration from kryo to protobuf, .proto file generation using Scala Macros (the solution made app upgrading safer); and

- Newsfeed aggregation was performed as a secondary informational service intended to attract new customers.

As a result, we increased the general performance of the service. The application became safer and now works faster due to the migration to protobuf. In just one fiscal year, the client announced a revenue increase of 33 percent.

Technologies used: Scala macros, Scalameta, Reactive Streams, Monix, Kafka, local and distributed caching, MacWire, scalaxb/soap, itextpdf, protobuf, gRPC, spray (json, HTTP), SBT, Gatling, etc.

Conclusion

Banking is challenging and full of subtle nuances. But do not be afraid of difficulties on the way to success. With accurate planning, a roadmap, a realistic budget, and a strong development team, you will be able to offer users a product that improves their financial experience and brings you profit in just a few months.