The latest reports show that every week more than 25 percent of people make purchases via mobile devices. Most transactions are done through the merchant’s applications. For this reason, global mobile payment incomes crossed US$1 trillion in 2019.

Millennials who have grown up in the universe of gadgets are rapidly changing fintech. People worldwide are moving away from “physical” payments to digital tools, among which wallet applications (e-wallets) are of particular interest. They are useful for both sides of the deal — users and traders.

Let’s consider how such systems work, their advantages and types, and how to create a mobile wallet app.

Global Mobile Wallet Market Overview

Recent studies have shown that the mobile wallet market is growing noticeably. The ResearchAndMarkets 2020 report indicates that the market’s size reached US$1,043.1 billion in 2019. According to the forecast, the total market amount will reach US$7,580.1 billion by 2027, showing a compound annual growth rate (CAGR) of 28.2 percent.

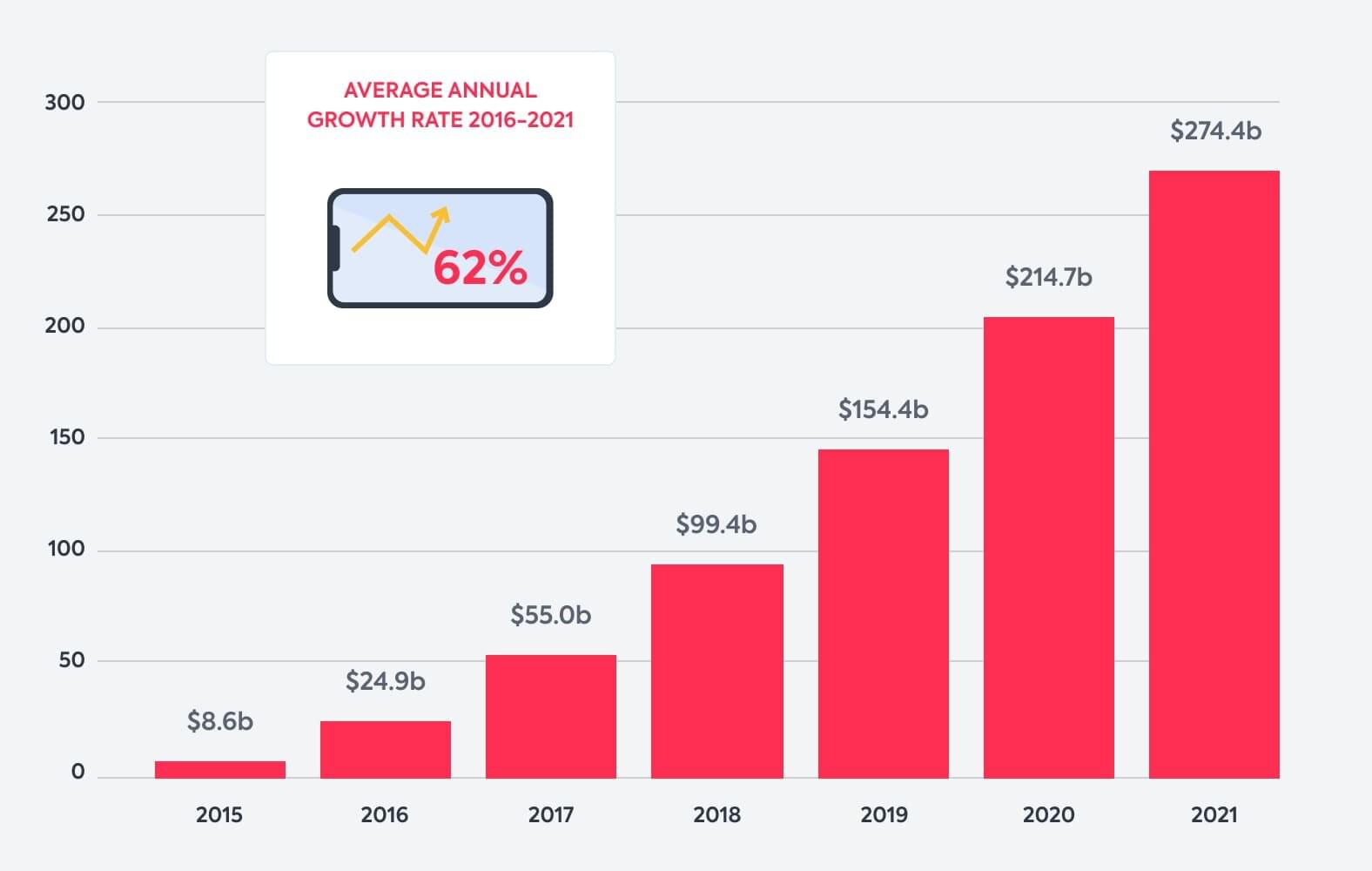

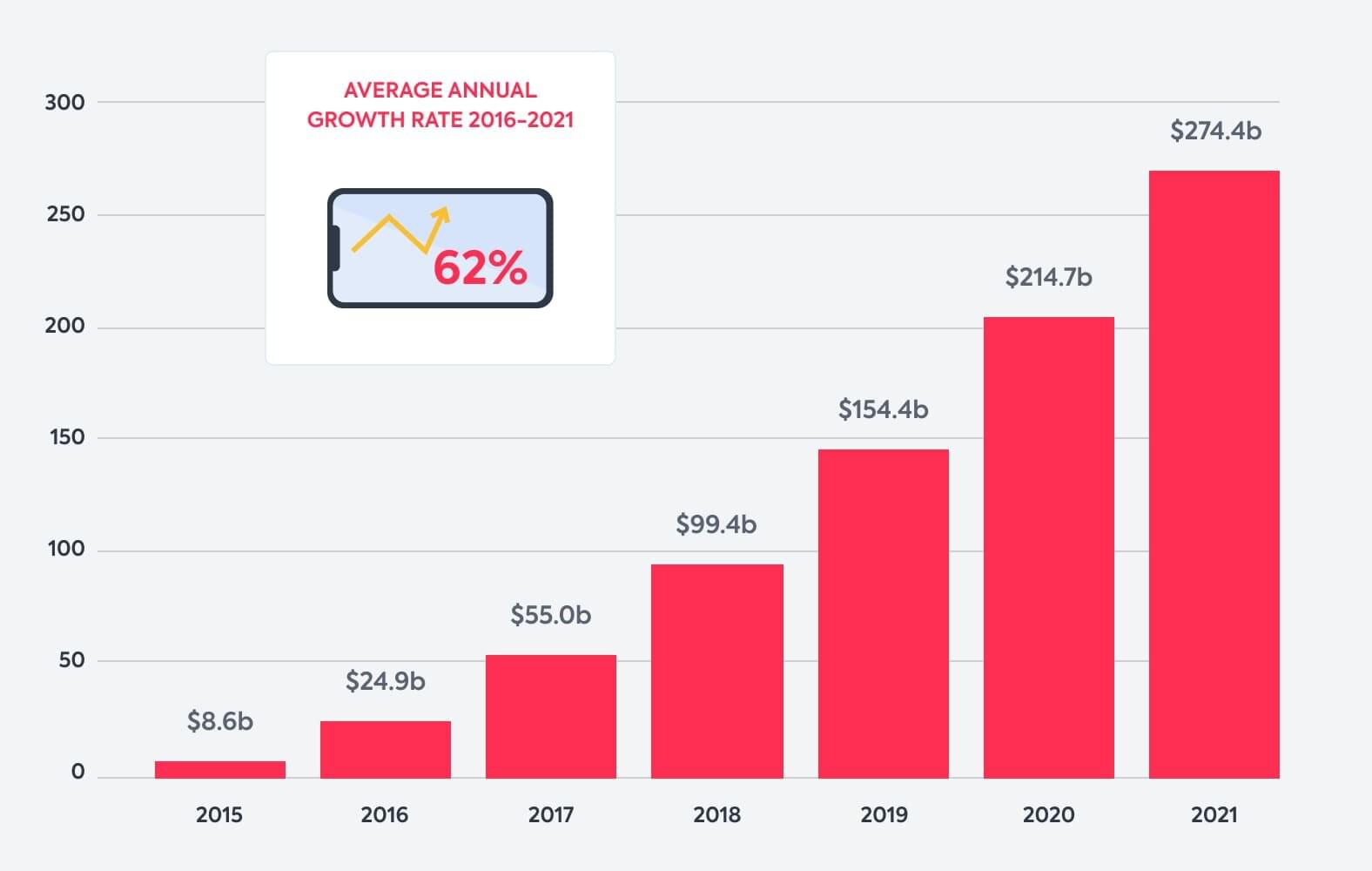

The overall mobile payment transaction volume is also growing. If in 2016, according to Statista, it was US$25 billion, then by 2021, its size reached almost US$275 billion with an average annual growth rate of 62 percent, which is noted on the graph:

Today’s shops are integrating mobile apps in their workflows. Mordor Intelligence notes that the mobile e-payment market size is valued at US$1139.43 billion in 2019 and is expected to be US$4690.65 billion by 2025. The projected 2020–2025 CAGR is 26.93 percent.

On regional markets, the United States maintains its leadership. Contactless payment technologies are ubiquitous and are projected to generate over US$220 billion in transaction value by 2023. But the Asia-Pacific region (APAC) is actively approaching the United States, and e–payments are being actively introduced there. The average annual growth rate in 2020–2027 is projected to be 30.5 percent. India, Japan, and Australia also provide an excellent ecosystem for electronic payments.

The market growth is expected to skyrocket during the pandemic. Most people now prefer e-payments and remote transactions to avoid physical contact. Therefore, mobile wallet app development is becoming a promising business niche.

What Is a Mobile Wallet Application?

A mobile or digital wallet (m-wallet, m-money transfer, e-wallet) is a financial tool that allows users to operate money via smartphones or similar gadgets. This model is used by merchants, banks, enterprises, and individuals.

Today, the e-wallet is an excellent environment for all who use money online. Such platforms allow easy access to payments, convenient m-money storage, and support:

- Transparent money transfers to/from bank cards via a PC or phone;

- Simple virtual money conversion into bank assets by transfer to an account or card;

- Purchases in retail stores, ticket booking, discount coupons redemption, multiple card details storage, digital money (e.g., bitcoin) transactions, etc.

Want to know more about digital wallet app development? Get a quick initial expert consultation for free.

Contact us

Digital Wallet Benefits

E-wallet app development is a field with much potential due to the pronounced interest in such platforms and their benefits for individuals:

- Accessibility and simple payment process. Users can pay for purchases easily. The access is as simple as logging into a social media account.

- Convenience and functionality. Users can perform various operations with fiat or/and non-fiat currencies. An e-wallet is also an excellent solution for online work with clients.

- Fast transactions. Bank operations take hours or even days. An m-wallet’s transaction performs in seconds, and clients can perform operations anywhere and anytime.

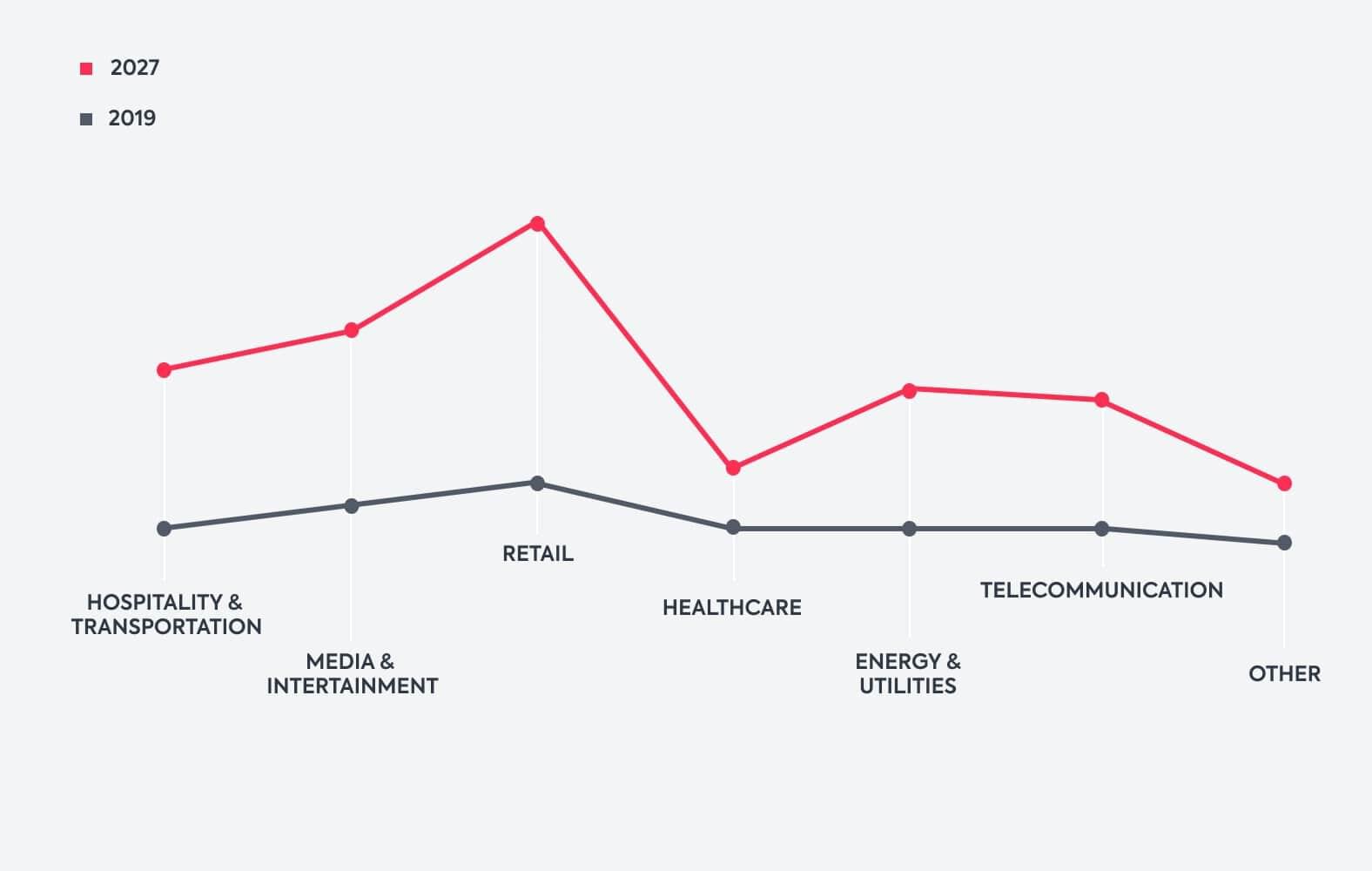

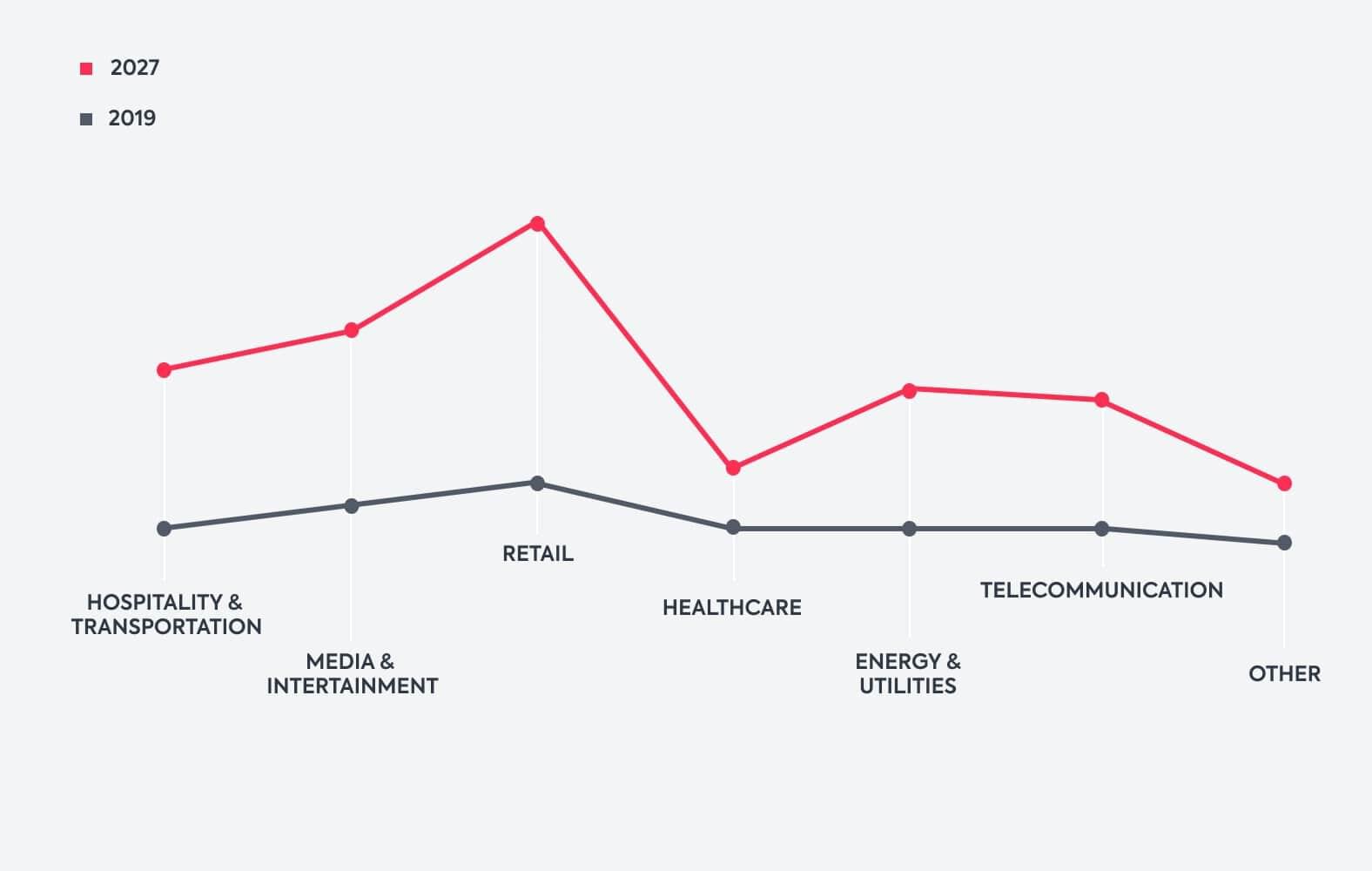

Benefits for B2B or B2C businesses are also numerous. Mobile platforms are primarily useful for retail and e-commerce. Digital wallets allow users to make payments with coupons or bonuses, engage new buyers, and enhance clients’ loyalty, so companies use them actively. According to forecasts, by 2027, the amount of m-wallet transactions in retail will be significantly higher than in other sectors. Over the past years, these indicators in different industries were approximately equal.

The following graph demonstrates this trend:

Businesses benefit in other areas too:

- Financial establishments can benefit from cardless payments because they store the bank or loyalty card data;

- Transportation and logistics can integrate bank cards and financial services into the m–wallet, provide secured payments, and track funds movement in real–time;

- Telecommunication companies can offer customers convenient bill repayment and balance refill methods;

- Grocery and event-based companies use features like paying for movie tickets, ordering food, or shopping through NFC (near-field communication) technology; and

- Healthcare receives a convenient tool for hospital bill payments and purchasing in chemist shops when patients run out of cash.

The Most Popular E-Wallet Apps

Before planning how to create a wallet app, it is recommended that you examine the technology’s success stories. Here are a few of them:

This service is an innovative private e-wallet app for online and “physical” purchases. The application uses NFC technology to enable payments by tapping a phone to an NFC-enabled terminal. To transfer money, you just need an email or phone number (and a few minutes).

The app:

- Allows planning, splitting, and making group payments from a smartphone;

- Provides safety due to PINs and data encryption;

- Allows people to find friends and send money directly from the card, bank account, or app’s balance.

The Apple Pay system from Apple Inc. allows users to pay for purchases via NFC and conduct secure transactions with payment confirmation by Touch ID or Face ID. The e-wallet runs across various Apple devices, including smartwatches.

The app:

- Doesn’t transfer bank card data to the merchant;

- Allows users to select cards for payment in the wallet app and transfer money right in Messages; and

- Supports pay–per–subscription to Apple services (Music, News+, etc.) and iCloud storage upgrade.

The Samsung Electronics app differs from many other m-wallets. Not only NFC payments are supported, but also payments using MST (electromagnetic transmission). This technology allows phones, wearables, and other Samsung gadgets to connect with terminals that only work with magnetic stripe cards.

The app:

- Allows storing bank, gift, rewards, and membership cards with a barcode on mobile devices;

- Uses the device camera to add Visa, MasterCard, or American Express cards issued by 1,000+ partner organizations; and

- Supports security using a robust token instead of sensitive user information, ARM TrustZone secure storage, and Samsung Knox technologies for vulnerabilities searching.

An online service founded by Amazon, this app focuses on giving customers an option to pay with their Amazon accounts on external websites. Entrepreneurs can add a wallet to their e-commerce store via the Amazon Payments SDK, control the payment methods available to customers, place orders across multiple channels, and use a checkout counter trusted by people worldwide.

The app:

- Allows users to place orders without card details (amazon.com credentials are enough);

- Stores personal cards data safely — end merchants do not receive it, so users are protected from unscrupulous sellers; and

- Allows users to buy or donate with a user’s voice, pay a phone bill or utilities, purchase music service subscriptions, etc.

An app created by Alibaba, the transcontinental merchant giant, this Chinese e-wallet app is one of the largest payment systems worldwide. AliPay is the leading third-party payment solution, operating in 70 countries. The wallet is convenient for online stores that cater to overseas customers.

The app:

- Allows users to make purchases (including AliExpress), purchase tours or train tickets, order a taxi, and book a table in a restaurant;

- Replenishes the balance of a virtual wallet using Western Union, WebMoney, and similar services; and

- Works as a social network where you can create a chat with friends, subscribe to their posts, or split a restaurant bill.

There are also popular applications for peer-to-peer transactions, like PayPal, Venmo, or CashApp. You can find out more about them in our How to Build a Payment App for Money Transfer article.

Types of Mobile Wallets

When you think about how to build a mobile wallet app, you must begin with the type you are comfortable with because their payment processes differ. Platforms may use a mobile provider that helps with transactions. Another way for m-wallet to work is by offering a discount from the bank account or card via SMS with an OTP or similar code. If the system provides web payments, users can transfer money via the app.

Read also: How to start a money-saving mobile app

Read more

There are other types to choose from if you want to create an e-wallet app:

- Closed m-wallets are created for individual purposes, and the system can be accessed only by a specific company’s clients;

- Semi-closed wallets are accessible online and offline, and you can use them to pay other parties (businesses or individuals), but the coverage sphere is relatively limited; and

- Open m-wallets work in partnership with banks, and can be freely used for purchases, money withdrawal, and ATM transactions.

If you need a custom solution for wallet app development, contact us

Contact us

How E-Wallet Apps Work

E-wallets store money transaction records, not physical currency. The software app’s part ensures the safety and data encryption of transfers; user info like the name is stored in a database. Users can link their card or banking account to perform the financial operations.

There are several scenarios when e-wallets work:

- Online commerce payments allow individuals to perform online shopping, pay for goods/services, and get payment receipts;

- Point of sale (POS) payments allow users to pay via mobile/contactless technologies; and

- Customers can transfer money directly through their gadgets and perform transactions between bank accounts.

How to Create a Mobile Wallet App

Features

To develop an e-wallet app properly, you have to think over the core features in advance and provide customers with:

Unique user ID across all payment channels. This feature simplifies customers’ identification, transaction info storage, and the payment process. A unique ID also improves data privacy and risk prevention.

Bank account linking. This crucial feature allows users to make transactions and add information such as CVV number. Users can easily connect cards to the wallet, select between various accounts, and manage the operations in one environment.

Money transactions. Provide users with the ability to:

- Add, transfer, or receive money by typing in the addresser number, scanning the QR code, or applying NFC or beacon technology;

- Send money to bank accounts from the application and vice versa, or transfer them back to the bank if the user doesn’t intend to keep too much cash on the app’s balance; and

- Set a limit for transaction numbers or the total money sum for the period.

POS and gateways integration. The more payment options your system will support, the better. It is important to proactively utilize POS integration to widen the use of e-wallets even for offline stores.

Payment for goods and services. If you want your clients to use their m-wallet regularly, it must support payment for:

- Electricity, TV, and other essential utility bills;

- Insurance premiums, income tax, and sales tax;

- Tickets, hotels, or other reservations; and

- Various products in stores, such as groceries, apparel, electronics, appliances, etc.

Transaction tracking. It is crucial to reflect user transactions in the wallet’s account and add the ability to monitor them. You can also set filters for an order tracking.

Settings selection. Users should be able to choose the preferred type of data that displays in an app, features of receiving notifications, etc. The app must support multiple languages to serve customers with different geographic locations.

24/7 support. If your customers face any payment or technical problem, then you must offer help immediately. It is also recommended to include different methods of contacting support: email, messages in the app, chatbot, etc.

Read also: How to add a payment gateway in an app

Read more

Additional features. The following options help to offer customers the best service:

- Loyalty cards, membership discounts, and gift vouchers;

- Exclusive offers: rewards, cashback, and others;

- ‘Refer a friend’ promotional feature to lure more customers;

- Back-up facility to restore user settings and save the data;

- Digital receipts that are sent to email, the app, or the user’s phone after the transaction;

- Ratings and reviews to improve services and demonstrate customer focus; and

- Integration with cloud, wearables, etc.

Need more advanced features? Consult our mobile wallet app developers

Contact us

Security

When you create a digital wallet app, safety comes first:

- Passwords are the core protection outpost. It’s recommended to provide several codes that are to be entered at various stages of working with the account and add a rejection feature if the customer enters a short or too–simple combination.

- Point-to-point encryption (P2PE) is an advanced tool. It ensures end-to-end protection and encrypts the whole transaction when an owner swipes the phone over a PoS terminal.

- Tokenization is a robust crypto protection technology. It allows the app to secure e-wallet payments using data encryption. A token is a combination of symbols that don’t contain financial info and are useless for fraudsters. The user data is stored in an encrypted cloud database.

- Biometric protection is an innovative technology. It is better to proactively utilize authorization by fingerprint or face recognition by phone camera. If the user’s device supports Touch ID or Face ID, the app converts information about unique physical features into digital code and stores it.

- Files of keys are additional multi-layered protection. The user receives it during registration in the system. The file stores the keys to a wallet, and without them, the criminal won’t be able to steal the money, even with the right password.

- Account blocking is a protection method that applies if other security tools provided can’t ensure safety. The owner can block the wallet by call, message, or in another way.

Technology Stack

POS Payments

To make an e-wallet app with a full set of functions and capabilities, you will have to work on the technology stack and, first of all, on POS payment. You can empower POS payment by using the NFC, Bluetooth and iBeacon services, QR (Quick Response) codes, or payment applications, which we discussed in this article.

Near-field communication. NFC wireless technology functions at a distance up to 10 cm and provides secure and contactless remote payments between smartphones and PoS devices. Connection setup time is shorter than in similar Bluetooth technology: NFC takes less than a second. The technology also supports transferring funds by touching a smartphone to a smartphone.

The holders have their cards stored in a digital form in an e-wallet. For this, the Host Card Emulation (HCE) technology is used. HCE is backed by Google for Android devices. Building an iOS app will require EMVCo payment standards or tokenization.

Bluetooth and iBeacons. Bluetooth is supported on the most modern gadgets, so m-wallet apps can use it for receiving signals sent by outside BLE-transmitters called beacons. This technology makes it possible to broadcast and receive data within a specific range of distance (up to 70 meters on average).

iBeacon technology is Apple’s version of Bluetooth. It is compatible with devices equipped with Bluetooth 4.0 or higher, whether it is iOS or Android. An iBeacon-empowered POS can quickly “read” the details, and info is automatically visible in the terminal. The technology provides contactless data exchange with minimal power consumption.

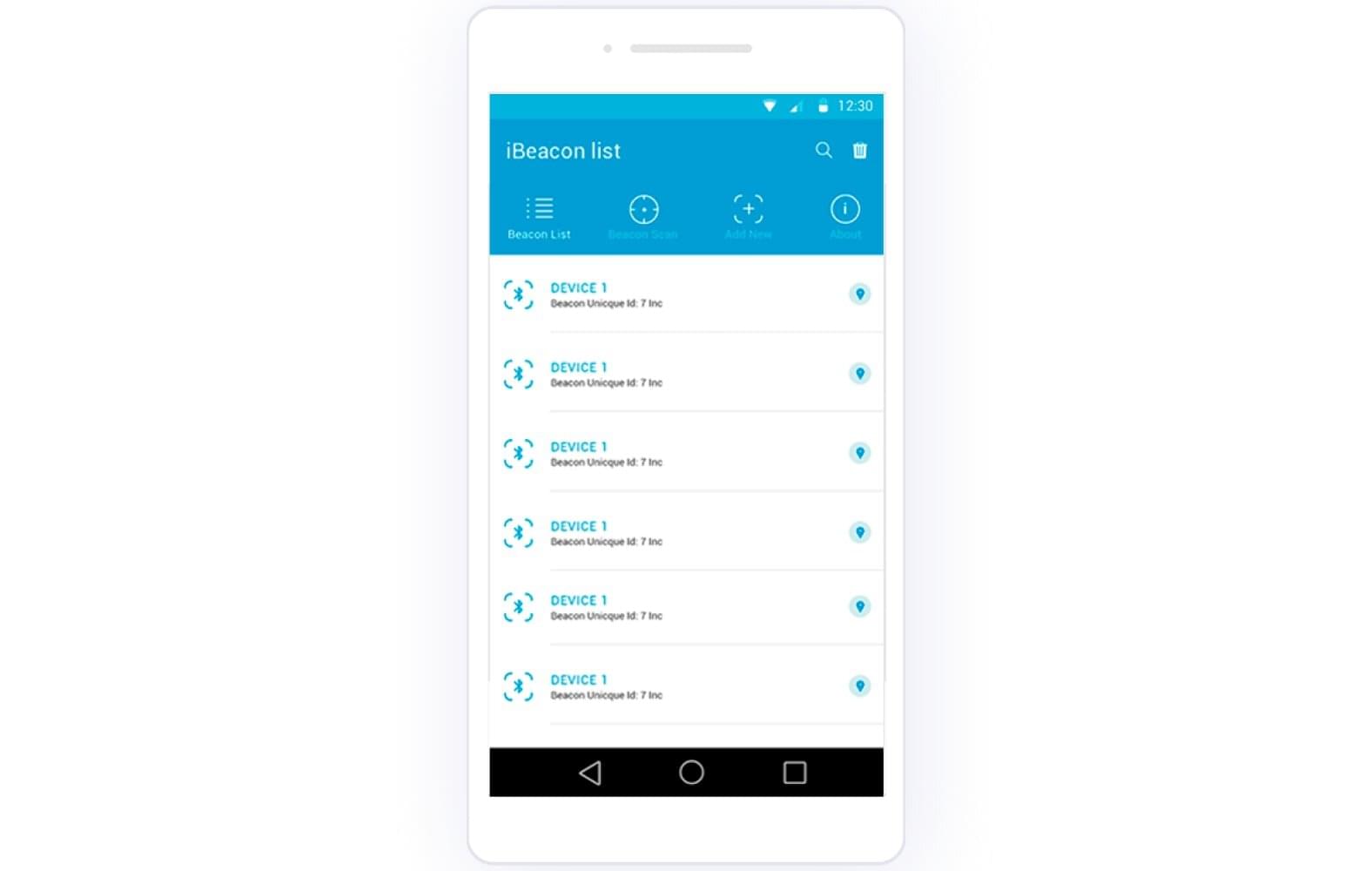

See how it works in our case study of a Bluetooth beacons app:

We were tasked to create a wallet app for iOS and Android users to work with any Bluetooth beacons. Our developers decided to use the following technologies:

- For iOS: Parse.corn, CoreBluetooth, QuartzCore, AFNetworking, Kontakt SDK, Cocoa Touch, iBeaconsScanner, and Core Location; and

- For Android: iBeacon, BLE, Parse, Material design, Canvas, Altbeacon, and Butterknife.

Our app supports both BeaconCatcher and iBeacon Scanner versions and can work with any Bluetooth beacons. The application receives the signal and displays the location of the detected devices within a three-meter radius. Users can name each beacon, find out its specific characteristics, set a password for it, and add a description or image.

Optical or QR code. A cloud-based technology uses QR codes generated by a client’s gadget or merchant’s store. Customers can make purchases and payments through a mobile gadget almost everywhere, online and offline. The method requires:

- Mobile device’s camera to scan the code;

- Bluetooth for data transmission;

- GPS for positioning;

- Touch ID for user’s authentication; and

- Internet connection for working in real-time mode.

APIs and SDKs

Third-party integration helps to create an e-wallet app with a lower investment of time and money. Therefore, developers widely use various frameworks, APIs (application programming interfaces), cloud solutions, and SDKs (software development kits). The ready–made tools and third-party codes simplify the project’s work and allow you to get a high-quality application in a short time.

To successfully integrate payment mode, you need APIs like Stripe, PayUMoney, or Braintree (the product of a PayPal–affiliated company). Implementation of social media tools requires APIs from Instagram, Twitter, Facebook, etc. Layer or Actor can provide you with real-time chats. Amazon SNS and Twilio help with push notifications. To implement SMS, voice, and phone verification, you can use Nexmo or a similar API.

SDKs help to simplify the work on applications, too. For m-wallet development, you can use:

- MasterCard Mobile Payment SDK for Android apps, which includes a development tools library and testing simulator;

- PayPal Mobile SDKs, which allow building Android and iOS apps;

- QuickPay SDKs, which offer kits for Android and iOS, a free test account, and a paid plan to process transactions and access to integrations, fraud filters, and virtual terminals.

MBaaS and Cloud Services

An MBaaS (mobile-service–as–a-backend) provider is the standard and rational choice to host the app’s mobile backend. This solution saves your effort and reduces time to develop and market. You optimize the backend building process and focus on business logic, features, and front-end UI/UX (user interface and user experience) when you decide how to create a mobile wallet app.

Ready-made cloud infrastructure enables access to storage, APIs, and other backend resources. CHI Software is a certified Cloud Consulting Partner with deep technical expertise. We will help you make the best of AWS, Azure, Salesforce, and Google Cloud for your business and will ensure:

- High performance: the load balancing and scaling tools for your infrastructure help to scale up or down based on demand;

- Strong security: data center and network architecture allow creators to meet the requirements of the most security-sensitive customers;

- Reliability: we will help you to take advantage of a scalable, robust, and safe global computing infrastructure;

- Efficiency: with DevOps services, you’ll build a scalable system that quickly adjusts to the fast-changing environment and business requirements.

Mobile Wallet App Development Process

Requirements Parsing

When you think over how to create a wallet app, you have to begin with analysis. Do thorough research; learn clients’ expectations, demands, and the prevailing market trends. Understanding the business and user requirements helps you to meet customer needs, highlight your offer’s uniqueness, quickly create an action plan, and form a team of experts.

An Action Plan

In the case of payment wallets, it is highly recommended to contact a software development company with experience in this area. Qualified experts will ensure the e-wallet offers data security for users, compliance with the legislation, and risk prevention.

To understand how many specialists you need, estimate the app’s complexity and delivery schedule. You need to hire:

- A project manager;

- Business analysts;

- UI/UX designers;

- Android/iOS and backend developers; and

- QA engineers.

Mobile apps are SoEs (systems of engagement), and Agile is a standard methodology for such development. Function prioritizing is comfortable with the Scrum approach. You build a product backlog (the list of features you need in an m-wallet app). Then you do sprint planning by estimating the options requested in the product backlog. This way, you can determine the features included in each sprint.

Need an action plan now? We will assemble a team of experts in the shortest time

Contact us

Designing the User Interface

For online payment apps, the top priority is engagement, readability, catchiness, and memorable icons. Every swipe, touch, and click should be valuable, rational, and convenient.

While making the UI/UX, you should:

- Follow the data unification rules to make lists, cards, and other forms of data presentation look similar;

- Consider high aspect ratio (18:9) and other parameters of modern smartphones when displaying financial information and statistics;

- Provide the possibility of one-handed navigation and a thumb-friendly layout;

- Think over filters, lists’ drop-down by click, lightboxes of settings, pop-ups, notifications, etc.

Examples of technologies you may need: Photoshop, Sketch, After Effects, InVision, Illustrator, Flinto, etc.

Development of the Digital Wallet

This phase includes coding — the development itself. Here you add all the features to your minimum viable product (MVP), test it, and implement additional functionality of the product with improvements. Developers integrate all the third-parties and databases, and bring the digital wallet to life.

Examples of technologies you may need:

- Mobile: Objective C, Swift, Java, Kotlin, XCode;

- Web: HTML 5, Backbone.JS, Angular.JS, Vue.JS, React.JS, Node.JS;

- Backend: Node.JS, Angular.JS, Ruby, Python, PHP, Django, MongoDB;

- Database: MongoDB, Apache Cassandra, HBase, Postgres, MySQL.

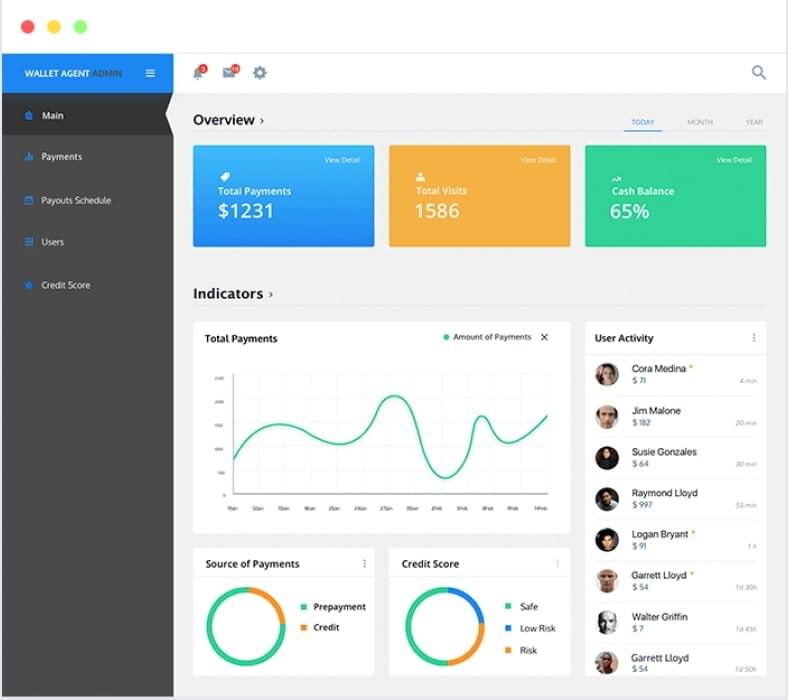

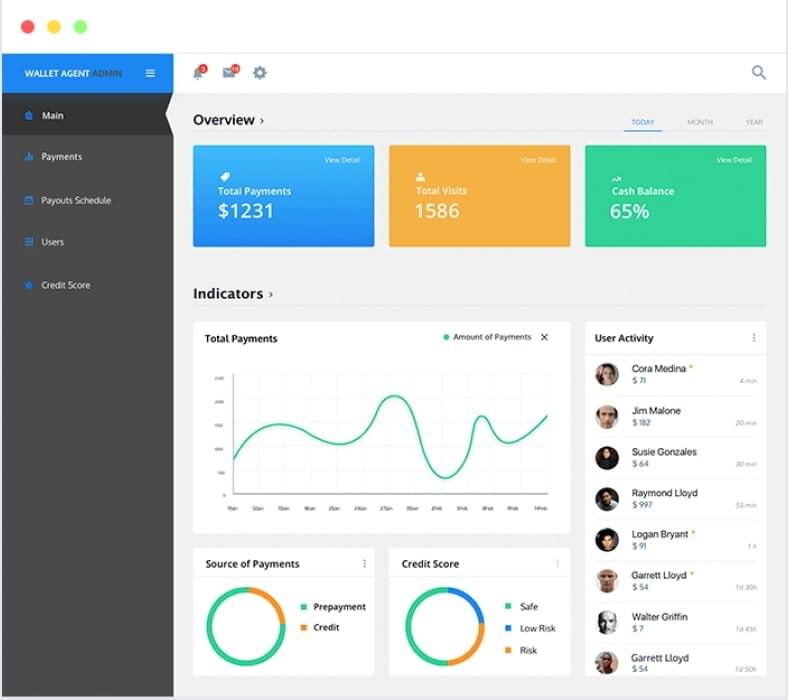

In our personal wallet agent case study, you can see how development technologies are used:

At CHI Software, we have developed a next-generation fintech solution. The wallet agent helps users control personal finances, regularize monthly cash flow, and receive salary advances without waiting for the calendar payday.

Technologies used: Python (2.7.x), Flask, PostgreSQL, AWS Lambda, AWS DynamoDB, Codeship, Mambu API, CallCreit API, Gulp, Angular JS.

We have implemented the third-party APIs, allowing admins to verify users, check their credit score, and determine the risks and potential benefits of working with the particular person. The customer can schedule payouts daily, weekly, or on an on-demand basis. The app also allows admins to mediate between companies (startups) and their employers.

QA and Testing

Bugs and technical issues appear in every app, and the QA team is on the lookout to fix them. At CHI Software, we apply testing services for mobile apps, covering the entire life cycle or joining at any stage. Our QA engineers use a wide range of test design techniques, from manual testing to automated tools and writing scripts. We do:

- Functional testing that evaluates the compliance of a component or system with functional requirements;

- Interoperability testing to determine the compatibility of an app;

- Loophole testing to ensure that there are no loopholes, deficiencies, or security flaws that could be exploited;

- Penetration testing to protect the app against outside attacks and find any weak points; and

- Non-functional, change–related, structural, and other types of testing.

Examples of technologies you may need: Test Rails, TestLink, Zephyr, Redmine, JMeter, SoapUI, Fiddler, Appium, Wireshark.

Launch, Support, and Maintenance

When your app is successfully developed and tested, it’s time for delivery and launch. You need to place the mobile wallet in the app stores and collect early user reviews for product analysis.

After release, you have to provide customers with professional maintenance to ensure the best possible interaction between app and user. Technical support can cover various services, such as general system updates, program code correction, or security management.

Android and iOS get updated regularly. The app should answer this challenge, so you have to release new system versions on time. Your e-wallet should work correctly across devices and platforms, support the latest OS versions, and continually improve the user experience.

Cost of E-Wallet Mobile App Development

The development cost depends on the solution’s complexity, the number of supported functions, and the design. Micro–animations, custom elements, and other non-standard solutions will increase the total cost by 20–50 percent.

Development costs also depend on the target platform where you will host the wallet. In general, Android app creation takes longer than iOS because many devices are working on Android. You have to test the wallet on them, and QA services will increase the overall price. IOS app development usually takes 780–1,055 working hours, and Android, 890–1,220 working hours. You will need the backend, too, so be ready to spend 1,100–1,550 working hours on it.

An important factor in pricing is the specialists’ hourly rate. It depends on the region of presence. Analytics shows that rates vary a lot:

| Region |

Average hourly rates, US$ |

| North America |

150–170 |

| South America |

35-45 |

| Western Europe |

70-125 |

| Eastern Europe |

35-85 |

| Australia and New Zealand |

100-110 |

| Southeast Asia and India |

25-35 |

In general, to get a ready-made app with primary features, you have to spend at least US$20,000. If you want a feature-rich, sophisticated product like AliPay, it can cost anywhere from US$90,000 to US$150,000. An average estimate is around US$80,000 for iOS and $85,000 for Android.

Conclusion

Now that you know how to build a wallet app, it’s time to take a step forward. Today, more and more people prefer mobile-app payment methods for all financial transactions, and e-commerce business depends significantly on such apps. So, the future of digital wallets seems bright.

In such a competitive industry, your B2B/B2C business or startup has to think hard about the product to make it more functional, secure, and user-friendly than others. But high-level expertise and support from experienced developers who will create a wallet app could help you cope with the task, make managing client finances convenient, and bring your business to success.

Schedule a meeting with our experts and get a detailed development cost estimate

Contact us

Rate this article

22 ratings, average: 4.5 out of 5