Recent research studies show that in 2019, the number of smartphones surpassed five billion worldwide. The majority of owners use mobile devices to make direct peer-to-peer (P2P) payments. The popularity of such platforms is growing every day due to the simplicity, convenience, and high-speed operations processing.

In the United States alone, analysts predict that 52.5 percent of smartphones will have at least one monetary operation per month by 2022. People in other countries are also switching to P2P payments and need an appropriate mobile/web environment. Therefore, by offering such products, you occupy an interesting niche and have a chance to gain a substantial income prospect by helping customers with their daily tasks.

Let’s figure out what you have to know about mobile money transferring and how to build a P2P payment app.

Let’s Take a Look at the Fintech Market

The number of mobile payments is increasing, and a striking example of this area’s growth is the United States. In 2014, the volume of P2P transactions stood at the level ofUS$13 billion, and had already reached the level of US$150 billion in 2019. Direct payments are expected to beUS$336 billion in the last months of 2021. In China, another large marketplace, more than a million P2P-schemed transfers are processed daily without banking participation.

By the end of 2020, the transaction value of global digital remittances reached almost US$1 billion, and the average annual payment value per person is about US$10,300. Moreover, predictions included the following:

- The global growth of bank-free online payments would be 15.6 percent annually;

- Over 62 percent of the young audience would prefer mobile direct payments; and

- The number of consumers in the online money–transferring segment is projected to reach 14.5 million by 2024.

The pandemic has accelerated the growth of non-cash direct payments, so we can expect that the most daring predictions about peer-to-peer app development will come true.

Why Do You Need to Develop a P2P Payment App?

When it comes to getting motivated to build a P2P payment app, the primary thing is the advantages the product can bring to users. You will offer a convenient payment method with necessary and maybe even unique features to help users better manage personal finances.

There are many other reasons for peer-to-peer app development. Digital wallets are a highly demanded fintech area. They allow the owner to receive an intermediary commission and achieve monetization of the product fairly.

Read also: How to develop a money-saving application

Read more

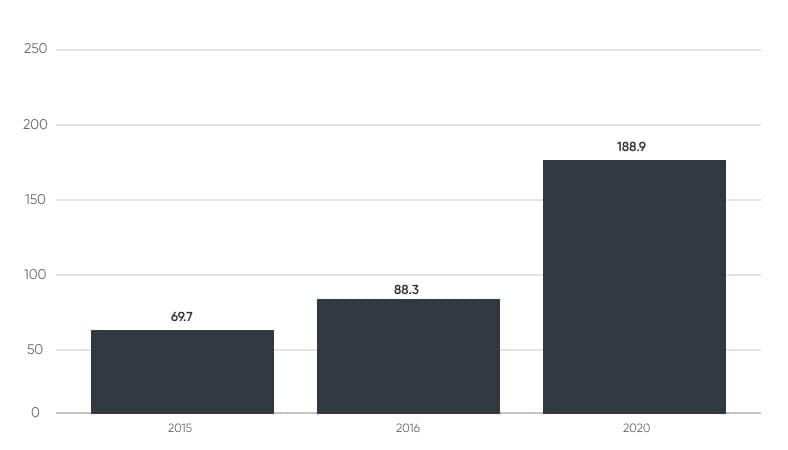

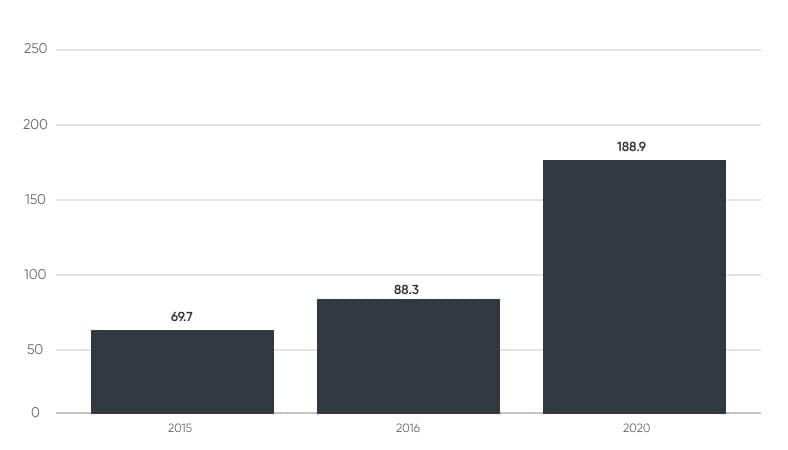

The demand is on the way up, and the app industry’s revenue demonstrates more than 200 percent growth over the last decade. Statista research proves that there is a big monetization perspective:

There are various spheres in which P2P payment app development could be profitable:

- Retail and B2C services. The applications help users settle accounts with builders, buy goods in a store or an e-commerce shop, etc.

- Financial establishments. Companies can offer users various cards or create internal payment systems (and a bank is not needed).

- Telecommunication, logistics, and tech companies. They act as neutral participants in the financial segment. With a custom-made mobile wallet, enterprises can integrate cards from various banks in one environment.

- Private payments. People use e-wallets to send money to credit/debit cards; lend to someone; financially help parents, students, or children; etc.

- Other areas. Such apps are handy for non-commercial fundraising for charity, anonymous transferring, etc.

Decided to create a mobile payment app? Get advice on your solution from industry experts.

Contact us

Benefits of Peer-to-Peer Payment

The main reason for the popularity of this payment method is the ability to send and receive money with one touch of your smartphone. You don’t need any intermediaries; all transfers are carried out directly to the recipient. Therefore, excess fees are reduced or absent, and the operational costs become low.

Other benefits are:

- Transparency and security: financial software typically has multiple protections to ensure money safety;

- Acceleration and streamlining of all types of mobile payments, such as sending money or managing expenses;

- The ability to conduct monetary operations through various devices, and transfer payments anywhere with an Internet connection presence;

- The minimal amount of recipient data needed by the system;

- The ability to transfer money to any card in various banks;

- Availability 24/7; and

- Simplified access to user history.

How Does a Peer-to-Peer System Work?

Peer-to-peer platforms transfer money between external and internal accounts or bank cards. Operations are carried out using a web or mobile app that acts as an intermediary and provides access to an easy-to-understand environment for transactions and money management.

The user registers in the system and links their bank account or card. Receivers can be found by email, phone number, name, etc. To perform a payment, you have to select the recipient, enter the sum, and push the “Send” button.

Depending on the platform’s type, the client can:

- Withdraw sums to a personal bank account;

- Pay for various services, send money for renting an apartment, or buy in installments;

- Split the bill amongst several people (e.g., expenses for lunch or travel payment); and

- Send money beyond the geo–boundaries —some P2P applications aim to make such transfers with fewer commissions.

Apps can operate on fiat currency only or allow the transfer of crypto-money, too. Systems of the second kind, like Breadwallet or DropBit, are becoming more popular each year. In fact, the entirety of blockchain-oriented currency apps is created with P2P payment and crypto–wallets in mind.

Types of P2P Payment Apps

If you create a money transfer app, it can belong to one of the following types:

Standalone services. Companies like PayPal have an independent digital wallet. Standalone apps assist a user in performing card payments and keep money before withdrawal or sending.

Bank–centric services. A lot of banks are building P2P platforms or using apps to transfer money via partners. Systems like Dwolla or Zelle involve a bank as one of the parties and can work with merchants’ hardware such as point-of-sale (PoS) terminals.

Read also: How to integrate a payment gateway into the app

Read more

Social media–centric services. Google, Facebook, and other media corporations develop their own P2P apps or attach a payment feature in their messengers. Mobile wallets allow transferring funds from bank cards within the platform and sending sums directly to receivers.

Mobile OS–centric systems. Solutions like Android Pay or Apple Pay are not exactly apps, but features of a mobile device. Contactless payments are possible only on gadgets with NFC, which is often a problem for the customer. But theP2P method allows transferring money to Android/Apple Pay users and buying goods at stores with NFC PoS terminals.

Need a smart solution for your P2P payment app development? We are here to help!

Contact us

How to Monetize a Mobile Payment App

Selecting the monetization model is often a problem in the money transfer app development planning stage. Making the right choices helps you achieve good revenue faster while maintaining customer loyalty.

Premium service approach

This method is also called the Freemium model. The main functionality is accessible and free. Customers can avail themselves of the primary features like money transfers, transaction history, etc. But high–end functionality, such as a chatbot, cryptocurrency transactions, or currency rates, is available only in the paid plans. The app’s owner allows the premium users to subscribe and charges them for it.

To improve monetization within this model, an owner can turn to transaction fees and take a percentage from every transfer. For instance, Cash App, which belongs to Square, Inc., collects income by charging a commission:

- Businesses pay a 2.75 percent fee per transaction if a customer purchases goods/services via the app;

- ATMs have a US$2 fee per each money withdrawal; and

- Sending sums from credit cards costs a 3 percent fee.

The reports prove that this model is effective. The numbers in Square’s Q3 2019 Shareholder Letter show that the app’s net revenue in autumn 2019 reached US$307 million.

Affiliate Marketing Approach

You can place banners and allocate advertising space on the user interface (UI) and earn by charging advertisers for each ad show or click. You can also provide your app to banks or similar institutions to display their services.

The affiliate marketing approach is user-friendly enough, and the “cost per click” is a widely used earning method that allows the regular generation of income. Customers can pay only for products that are consumed “on-demand.”

An excellent example of this approach is Facebook. Users don’t pay the platform directly, but the company leverages a vast amount of data to sell highly targeted ads. This monetization strategy has proven its effectiveness. According to a Statista report, in 2021, Facebook is projected to generate US$94.69 billion in ad revenue.

Alternative approaches:

- Micro-payments and set up in-app purchases. Micro-payments are transactions that involve lower money amounts and usually occur via digital applications. In-app purchases allow users to pay for additional services or buy financial and similar products, so it is recommended to include them when you make a money transfer app.

- Membership. This approach involves users subscribing to get unlimited access to products or services. There are recurring fees for membership, and members get inclusion in an exclusive group or other benefits.

- Sale of source codes and APIs. If you build a mobile money transfer system on your own, you can allow technical services as a separate product. For instance, Dwolla’s robust API is used worldwide, and it’s a significant source of the company’s income.

Best Examples of Payment Applications

Probably the most famous online P2P system is PayPal, topping the charts and used in over 200 countries. PayPal’s number of total active users exceeded 250 million by the end of 2020, and buyers and merchants can send and receive sums in over 100 currencies.

The app works as a merchant account or a payment gateway, and provides users the following benefits:

- ConductingP2P transactions;

- Linking customers’ cards or bank accounts;

- Sending money worldwide;

- Easy access via Android/iOS and web applications, etc.

The app offers robust security tools, including encryption and fraud detection. The system has no setup or cancellation refund, but there are service and transaction fees that generate the primary income. Another disadvantage is the user data sharing with third parties, and clients can’t prevent it.

Venmo has pioneered the P2P applications industry. The system appeared in 2009 and soon became the primary money transaction tool for millennials. Braintree, the PayPal–affiliated company, purchased Venmo for approximately US$26 million. The app’s total payment volume reached US$37 billion in the second half of 2020, from US$17 billion in 2018.

Venmo combines payment and social network features and allows users to:

- Chat and share money with loved ones;

- Pay for services and shop using Venmo Mastercard;

- Pay for taxis and meals through Uber services with money on Venmo accounts; and

- Enhance the user experience via a continuous feed and transactions list.

Venmo is easy to use, quick, and pretty fun. It’s clear focus and strong performance make it one of the most exciting systems in its category. But there are some disadvantages: for instance, there’s no ability to perform payments on the desktop site. Not everyone likes Venmo’s communication style, either—they use emoticons instead of words.

This service developed by Square, Inc. started in 2015 as a free app. Now it has more than 7 million active users. The app’s market capitalization has reached US$86 billion due to the combined Freemium monetization method.

A notable feature is a focus on cryptocurrency transactions. The service is in demand: the platform generated US$1.63 billion in bitcoin revenue during the third quarter of 2020. Users can deposit cryptocurrency from external sources to an app bitcoin address, and:

- Request and send money via the app or email;

- Deposit paychecks, tax returns, or unemployment benefits into the balance;

- Order a Visa Cash Card that allows payment at ATMs or transfer them to any local bank account; and

- Buy or sell stocks with no commission.

Square, Inc. doesn’t charge service fees and allows transferring money at no cost, but there is a fee imposed by the SEC.

Dwolla was founded in 2008 to make money transfers affordable, easy, and fast. The company began with Veridian Credit Union, and Iowa Credit Union League processed the transactions. Unlike PayPal or Cash App, Dwolla is not a third–party processor or merchant account provider.

Now the platform works with all U.S. banks and credit unions as an agent. Its main features are:

- Funds management;

- Payments for purchases and monetary donations;

- On-demand funds exchange between individuals;

- Custom limits setup and instant bank check.

By the second half of 2020, Dwolla had reachedUS$10.2 million in revenue. The platform has an intuitive and dynamic dashboard as well as flexible features for API integration. The transparent pricing approach allows transactions for free. However, additional functions are paid, according to the Freemium model.

What Do You Need to Know in Advance?

To implement a successful project in payment application development, you must consider many essential things beforehand.

First, make sure the system supports all the primary online payment methods: P2P within the network, e-commerce, on-the-spot transactions at retailers, etc. To reach an edge, incorporate the various use cases. It can be paying a taxi bill, a borrowing limit setting, or withdrawing a set amount at various intervals.

When you make a payment app, it is also crucial to ensure that the system is versatile, multifunctional, and easily scalable. Choose technologies so that even at high loads, the application doesn’t crash. For instance, you can opt for a cluster solution or provide cloud-based capacities to help increase performance. If you work with e-commerce sites, it is better to stay with a native app. It enables the ability to pay for goods without delays. In general, native apps usually load e-commerce sites 10–20 percent quicker than others.

It is worth thinking about the following in advance:

- Geo–limitations. Regulations differ between jurisdictions, and an app cannot match all fintech standards everywhere at once. Consider geographical restrictions before the payment app development.

- Disputes settlement. In some cases, when a user sends money, the receiver doesn’t receive it. Therefore, the application must be supported to sort out troubles, settle the dispute to return lost funds, or report the money’s whereabouts.

- Currency conversion. P2P systems must always face this challenge. There are more than 180 different currencies globally, and we recommend thinking about conversions in real-time.

Security, Privacy, and Legal Issues

When you build a money transfer app, remember that, as any fintech product, the P2P system should meet the financial regulations of the region:

- In the United States, more than eight federal agencies are engaged in regulatory compliance, and there are 50 states, each of which has its own set of rules. Thus, you need to consider this if your market is the United States.

- In Canada, the fintech area is regulated by the 2019 Bank Act, which opens up various online payment opportunities.

- The UK fintech market is regulated by the Financial Conduct Authority (FCA). It protects consumers, keeps the industry stable, and promotes healthy competition between providers.

- European Union regulations are described in Directive (EU) 2015/2366. Payment platforms that process EU citizens’ data must comply with GDPR principles: transparency and legitimacy, data minimization, accuracy, confidentiality, etc.

- An app developed for China has to get approval from the fintech committee under the People’s Bank of China (PBOC).

- If the target market is Korea, you should follow the fintech center rules under the Financial Services Commission (FSC).

- Apps for Australia need to meet the Australian Securities and Investments Commission (ASIC) requirements.

With the large amount of confidential data stored, P2P system providers must ensure secure data record management. Therefore, make absolutely sure that the app complies with all 12 requirements of the PCI-DSS standard and doesn’t expose the credit card number during a transaction. While paying at retailers, the clients will use their phones.

You also need fingerprint identification to authorize transactions, data encryption, and two-factor authentication. Foresee the protection against DoS attacks and storage flooding, such as favorite users’ selection via their reputation or access restriction.

To get a detailed consultation on payment application security, contact us

Contact us

Main Features for Payment Applications

The How to Make a Peer-to-Peer Payment App guide would be incomplete without a list of features every P2P payment app needs. The main ones include:

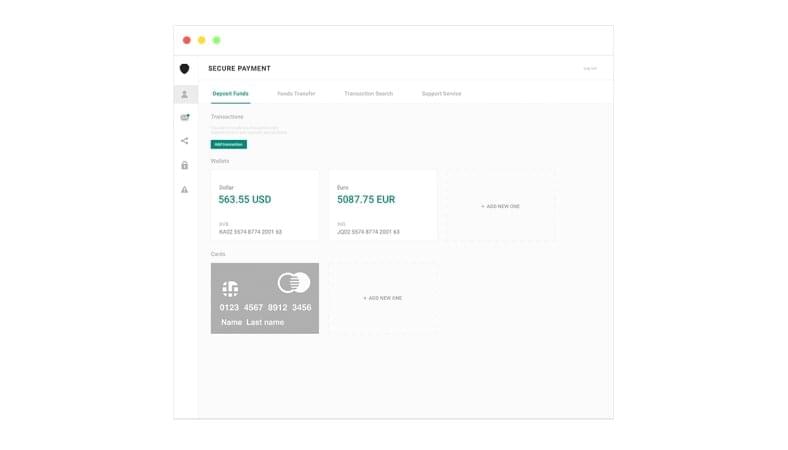

User and admin space for managing features

App admin (the owner) needs a panel to manage the functions, edit, remove options, etc. For the user, the primary operation space is a digital wallet. The customer will keep money and card data, perform transactions, and store info about special offers, discounts, and other financial details.

All the funds’ movements must be secured; therefore, you have to add a unique ID/OTP (one-time password) feature. This verification will protect transactions that the user makes in a digital wallet. ID and OTP prevent unwanted or occasional operations and are critical to ensure secured P2P mobile apps. To increase security, you can provide OTP requests whenever the app opens and/or transaction confirmation with fingerprint scanning (Touch ID) or face recognition.

To implement the feature, you may need third–party SDKs like Firebase, Twilio, etc.

Money transfer and management

This feature of payment apps allows users to send money and pull it from the account, request the required sum from other users, manage funds, and withdraw funds from the system. Users must be able to see transaction history: payments, dates, and correct time. This feature generates added value for customers as they can check the historical data for all their operations.

It is also recommended to:

- Implement money transfers to a bank account or card: this option is liked by most users and allows the app owner to earn a commission;

- Provide filters that let users select the transaction date range and keep a check on payments and receivables;

- Add the capability to use the phone camera to scan bills and send them to receivers; and

- Generate and submit transaction invoices for the sender or the receiver.

To implement the feature, you may need Rest APIs, Dwolla, ACH, and invoices like Bamboo.

Transaction notifications

Notifications about everything that happens to the money in the app are among the main functions for increasing customer loyalty. Therefore, your payment service should include pop-ups, pushes, and other messages that report to customers about received funds, updates in their account or wallet, upcoming bill due dates, special offers, etc.

To implement the feature, you may need Rest APIs, Chrome notifications, Firebase (Google) Cloud messaging, Apple’s APNS, or similar notification services.

Chat/chatbot

The chat feature allows users to clarify specific payment details directly in the P2P app and reduce possible mistakes. It is also recommended to implement a chatbot to address queries that arise while transacting, wrong deductions from a wallet, and internet connection loss.

To implement the feature, you may need third–party SDKs like Zendesk, Chatfuel, Microsoft Bot Framework, Amazon Lex, LUIS, Wit.ai, Api.ai, etc.

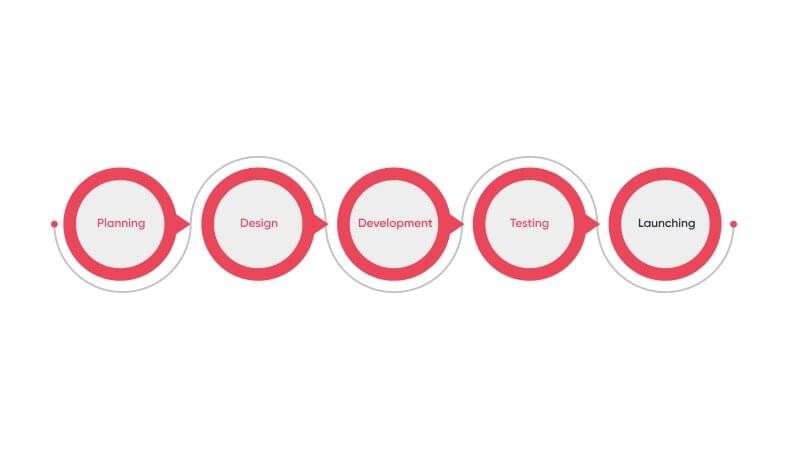

The Most Crucial Steps in Building a P2P Payment App

Mobile payment app development is a real challenge. Each step’s laboriousness and a massive number of non-obvious details make the task practically impossible without experience and a deep understanding of the internal processes. By turning to a professional developer, you will resolve the difficulties with the choice of technology, quickly license, launch the app, and scale it.

Building a payment app includes several mandatory steps:

App platform prioritization

When you’re thinking about how to create a mobile payment app, the primary thing to figure out is the tech stack. It depends on the kind of solution you’ve chosen: native, cross-platform, or hybrid.

A native application is the right decision if you need the fastest development and loading of e-commerce sites and the effective combination of UI/UX specialist and programmer, ensuring product preparation quality and speed. To develop an iOS app, you need the Objective-c or Swift languages within the Apple XCode/Intelli App code. For Android products, programmers use Java or Kotlin, Android Studio/Eclipse, and other tools.

Unlike a native app, a cross-platform app allows you to compile the source code for several platforms with minimal effort. Many Objective-c or Java developers have a negative opinion of frameworks like Xamarin, Telerik Platform, Unity, Qt, and Appcelerator Titanium. Still, a cross-platform approach can be more beneficial for business. You don’t need a lot of narrow specialists, most of the code can be written by one person, and it is relatively easy to control the correspondence between versions under different mobile operating systems.

PhoneGap and other hybrid frameworks are also popular. Almost any mobile operating system can handle the web browser function, so an app running under one system can quickly run on another.

At CHI Software, we always choose an approach individually. We discuss how to build a P2P payment app with our clients, considering their business needs, the required development speed, and the product specificity. Therefore, our customers receive a bespoke solution that suits them exactly.

Talk to our experts to get valuable insights

Contact us

A development approach and features

You can use several techniques to make a mobile payment app:

- Platform as a Service (PaaS) and Mobile Backend as a Service (MBaaS) platforms to develop the apps;

- SDKs and APIs for payment integration, ID verification, CRM, pushups, or similar features; and

- Integrated Development Environments (IDES) and frameworks to speed up the project.

If you are planning to expand to different jurisdictions in the future, use app internationalization, and customize the code to make it ready for localization, modification, and release in multiple languages.

Concerning SDKs and third–party APIs, it is worth using them wherever possible if you want to speed up and simplify development and access the core online features. For instance:

- Synapse API provides a variety of financial products like payment, deposit, card issuance, and compliance management;

- Dwolla API allows for multiple transfer options, such as activity managing and monitoring, and the platform’s connection to the U.S. banking system; and

- Kleynbank blockchain solution for banking integration ensures transparent operations.

You can easily integrate databases and APIs with the help of a PaaS platform and DevOps tools, which are important for Agile projects. And don’t forget about cloud services platforms. They help to avoid excessive upfront investment in IT infrastructure.

We at CHI Software successfully use all the capabilities of cloud platforms such as Azure (we are a Microsoft Gold Certified Partner), AWS, and Google Cloud.

UI/UX design and development

The user interface (UI) design of your app should be attractive, intuitive, minimalistic, and straightforward. For iOS apps, you can use guidelines like Apple’s Human Interface, while for Android, consult Material design (and there are component descriptions for iOS, web, and Flutter, too). Tools like Coolors, Canva Color Palette Generator, and Adobe Color CC will help you select the right color scheme.

When you have selected the platforms, tools, and design, it’s time to write code using the selected language and integrate the database recourses, SDKs/APIs, and a payment gateway into the app. You can use ready-made SDKs with support for iOS and Android (such as Stripe or PayPal).

You also have to test the app. For instance, you can use Espresso to write concise and reliable Android UI tests (Java and Kotlin) and XCTest for the iOS systems. This is just a particular example of quality-assurance tools. Our ISTQB-certified engineers use manual and automated testing and check the test techniques to meet the objectives.

After developing a minimum viable product (MVP) and a full-fledged application based on it, fixing all bugs and errors, you can publish the app to the Apple AppStore and Google Play.

Estimation

The cost of developing an application depends on various factors: the size of the development team, the technical stack, and the location of the mobile developers. To estimate the sums, answer a few questions to decide the cost of app development:

- Which platform does your target audience prefer: native or cross–platform?

- What features should support your monetization model?

- What devices should you integrate to make the app more responsive?

The costs of creating solutions are directly affected by the hourly rates of the developers. They vary regionally:

| Company location |

Hourly rates, US$ |

| The US and Canada |

50–250 |

| Australia |

50–150 |

| Western Europe and the UK |

35–170 |

| Eastern Europe |

20–97 |

| Eastern Europe |

20-150 |

| India and Southeast Asia |

10-80 |

The average time for design and development varies between 300 and 1,000 hours. The simple apps can take up to 600 hours, while complicated, highly advanced solutions take up to 800 hours and more. The total development price ranges from US$20,000 to US$140,000 and higher.

CHI Software’s Case Studies

We have accumulated extensive and successful experience in smart payments and money transfers. Here are just a few samples of our apps:

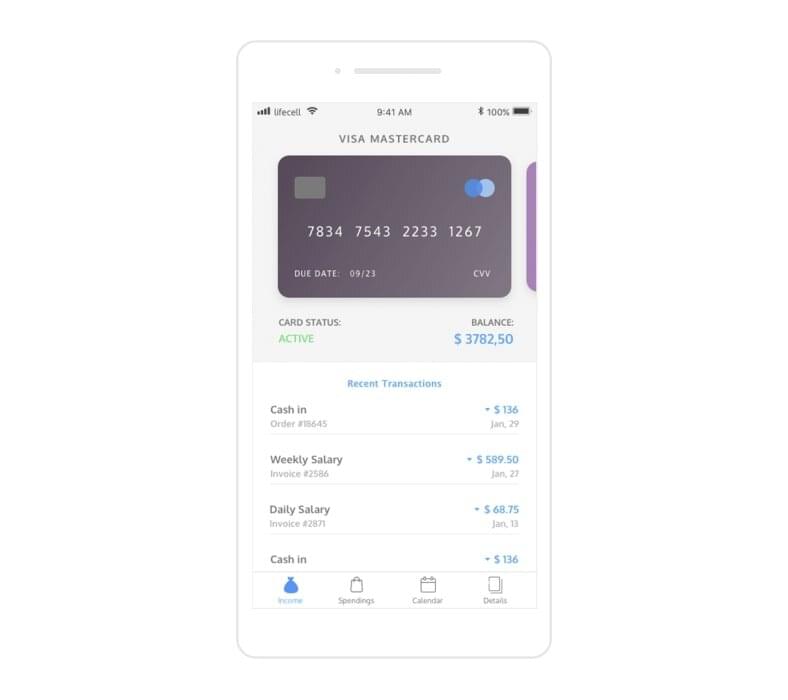

Payment system with Face ID

Technologies: MXNet, Python, AWS, Neural Networks, React-Native, HTML, Redux, Angular.js, TypeScript, SASS/SCSS, Karma, Jasmine, Docker, Git/GitLab

We developed a mobile app and backend of a payment platform with Face ID access to the available balance. The result was an easy-to-use virtual wallet with one-touch payments that works with a vast network of banks and financial institutions. It is certified with PCI DSS Level 1, which ensures full protection of customers’ wallet data. The implemented solution grew into a fintech system with cashback on transactions.

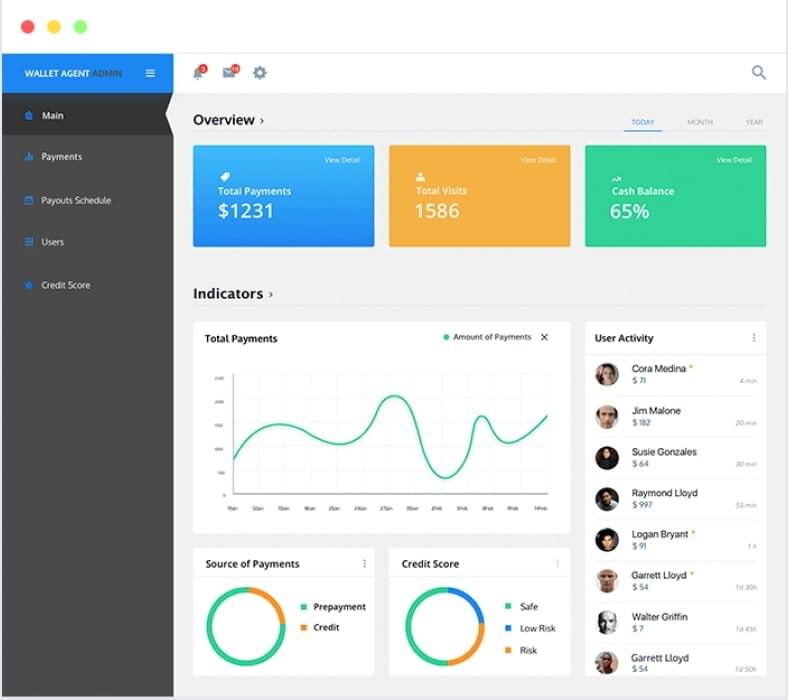

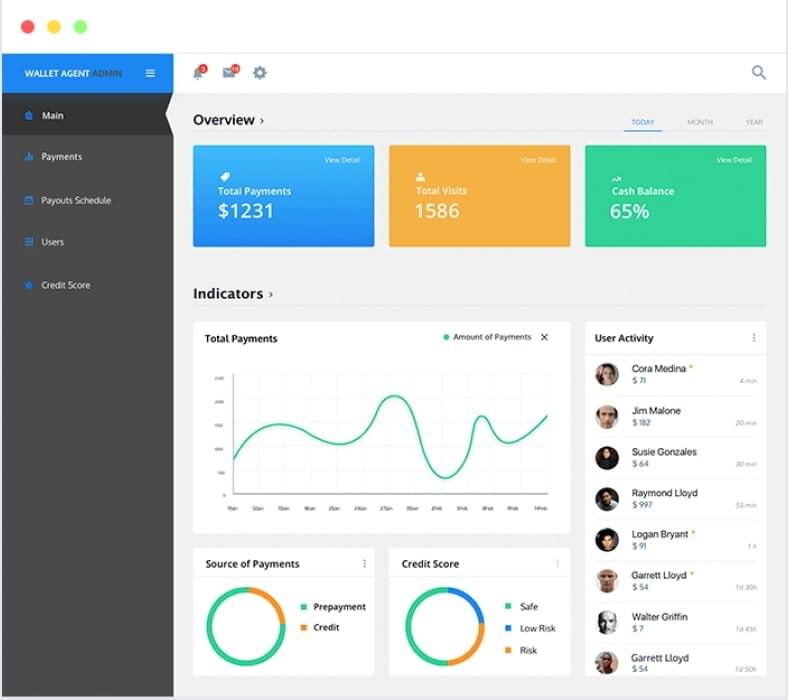

Personal wallet agent

Technologies: Python (2.7.x), Flask, PostgreSQL, AWS Lambda, AWS DynamoDB, Codeship, Mambu API, CallCreit API, Gulp, Angular JS

CHI Software developers were part of the distributed team for a next-generation fintech customer agent. The wallet:

- Helps users receive salary advances without having to wait for the calendar payday;

- Allows scheduled payouts — daily, weekly, or on an on–demand basis;

- Allows admins to verify users, check their credit score, and determine potential risks via third–party API.

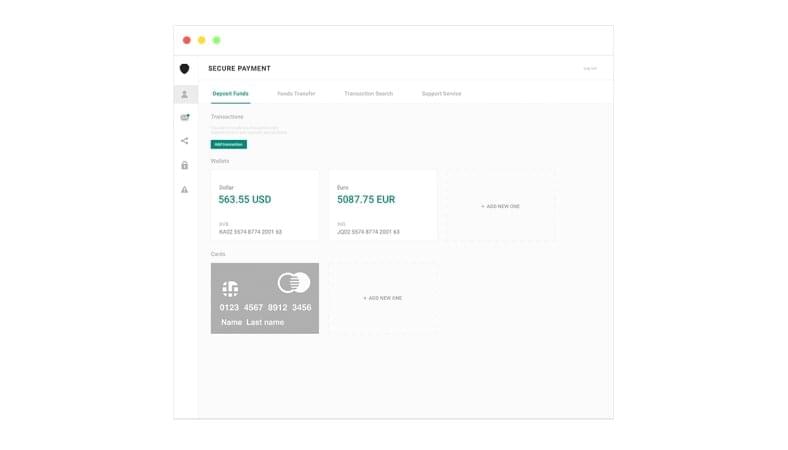

Secure online payment service

Technologies: Apache CXF, Apache Tomcat 7.0, Hibernate, J2EE, JSF 2.0, MySQL, PostgreSQL, RichFaces 3.x, 4.x, Spring 3.x, Amazon Web Services EC2 and S3

We have designed a speedy and flexible online e-payment system to ensure secure money transfers and protected shopping worldwide. The system has many funds withdrawal methods, compares different currency exchange services, offers the ones with the most agreeable rates, and supports all international wire/SWIFT bank transfers.

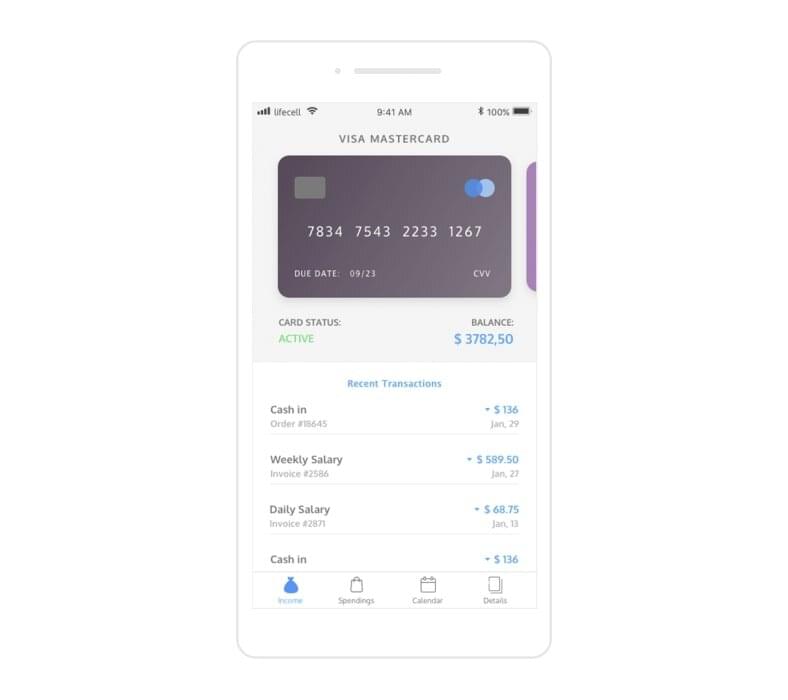

Fast-payment app

Technologies: Kotlin, Clean, MVVM, AndroidX, Lifecycle, Сoroutines, RxJava, Retrofit, GSON, Dagger, Okhttp, Glide, UiKit (own private library), Multidex, Timber, Stetho, Scarlet (Websocket), LeakCanary, PlayServices

This user-friendly application and credit module delivered by CHI Software provide fast payments, money transfers, and personal finances management. Payments from a mobile phone account, a wallet account, and any attached bank cards are allowed. The user can:

- Pay for mobile communications, home Internet and TV, utilities, games, social networks, transport, and loan payments;

- Transfer money to wallets by phone number, from card to card, or to a mobile phone account;

- Make hundreds of other necessary purchases.

Conclusion

When you first ask yourself how to build a payment app, it may seem to you that the road is long, winding, and there are too many competitors. However, by seeking help from professionals in the payment development industry, the complexities can be overcome.

At the end of the journey, you’ll find a significant reward. People worldwide are migrating from physical to digital money, which perhaps is the future of payments. P2P apps are still a niche segment that will undergo massive transformation soon, and you can be the first to adapt to new conditions and skim all of the cream.

Bringing people onto a platform with robust and legally compliant peer-to-peer solutions will also simplify routine financial transactions for your users, so it’s a win-win strategy. Therefore, today is the best time to start and create a money transfer app.

Develop a P2P payment app and get featured in the best P2P platforms list of 2021

Contact us